In brief:

- The shortage of accountants has reached crisis levels in 2025 — CPA candidates are down 27% over the past decade and more than 90% of finance leaders can’t find enough qualified accounting professionals.

- The lack of accountants is driving salaries sky high, impacting financial reporting and forcing CPA firms to turn away work.

- Finance leaders must completely reimagine how they source talent as the traditional accounting pipeline falls apart.

- CFOs are increasingly turning to nearshore finance and accounting services to access deep pools of top-quality talent, solving the challenges of Asia-based solutions through time zone, cultural, and language compatibilities.

The accounting labor shortage has reached crisis levels, spilling over into financial reporting.

Advance Auto Parts disclosed that turnover in key accounting positions created a material weakness in its financial reporting controls in 2023, delaying its 10-Q filing, according to a Wall Street Journal (WSJ) report. The company stated it couldn’t attract or retain enough qualified accounting professionals to fulfill its internal control responsibilities on time.

Tupperware Brands faced similar fallout in 2024, citing “significant attrition” in its finance and accounting team as the reason for delayed filings and misstated income across multiple years. Its auditor, PwC, resigned in October and its CFO resigned less than a year later, according to a 2024 WSJ report.

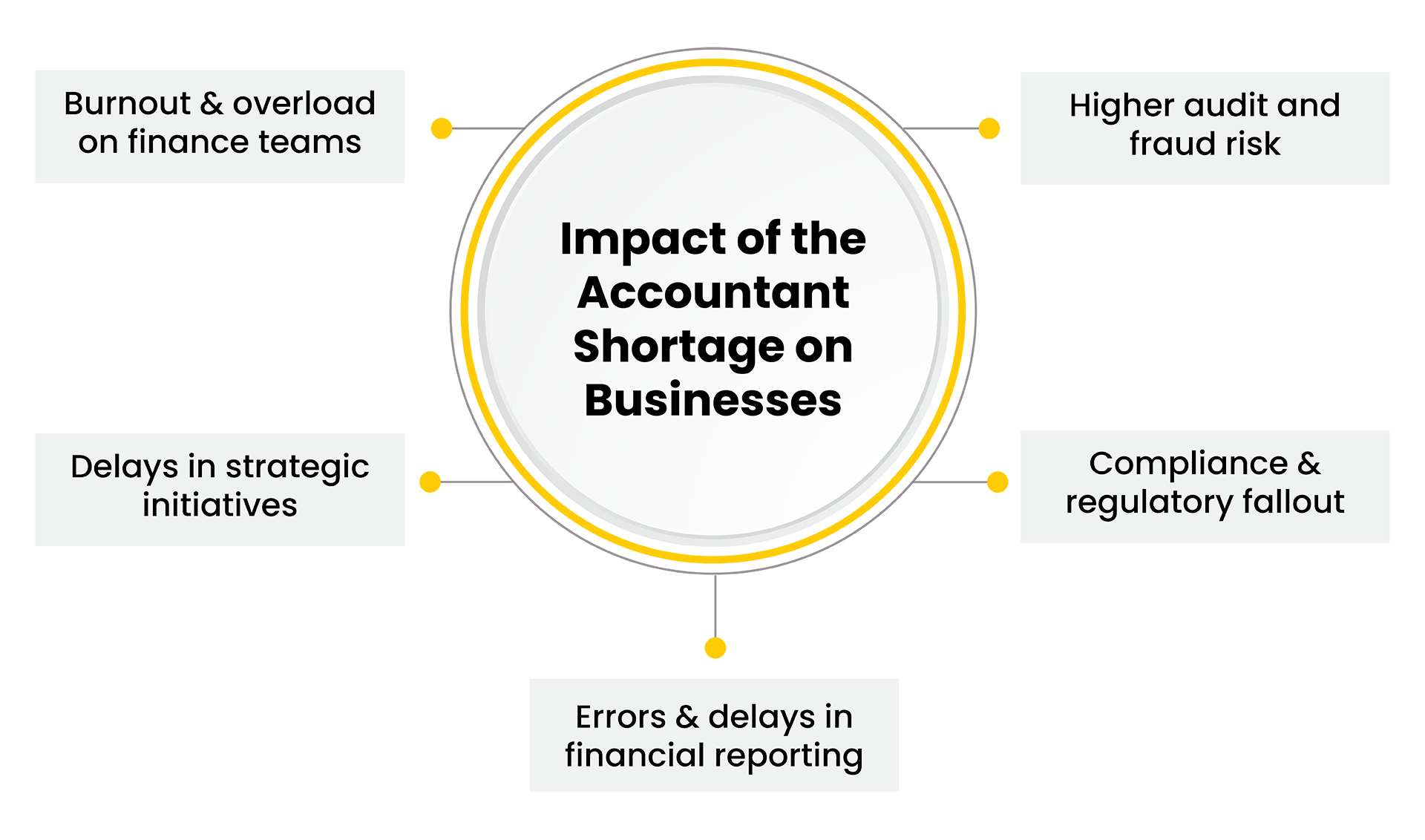

These cases highlight a critical truth: without qualified accounting talent, even well-established organizations face heightened regulatory, operational, and reputational risks.

And, unfortunately, their struggles are not isolated. Between July 2023 and June 2024, nearly 640 U.S.-listed companies reported material weaknesses tied to the accounting talent shortage, the 2024 WSJ report found. The share of companies with staffing-related internal control issues has steadily climbed from 30% in 2022 to 34.4% in 2024.

The traditional accounting resource pipeline is crumbling in the U.S., forcing finance leaders to completely reimagine how they source talent. But confronting that challenge also creates an opportunity to reinvent outdated operating models and innovate a better way of working.

Everest Group predicts finance and accounting outsourcing (FAO) demand in Latin America will surge by 17% through 2026 as CFOs turn to top-tier nearshore partners to tap into a deep new pool of certified accounting professionals — unlocking cost efficiencies, time zone alignment, and scalable digital operations to build the modern finance function their business demands.

The 2025 accountant shortage: Surging salaries and a dwindling pipeline

The statistics aren’t pretty. More than 300,000 U.S. accountants and auditors left their jobs within two years—a 17% drop from the profession’s peak in 2019.

The real concern goes deeper than attrition: there are fewer students pursuing accounting majors. According to the American Institute of CPAs, the number of candidates taking the CPA license exam has dropped by 27% over the past decade.

In response, accounting firms are aggressively increasing compensation, even starting salaries. EY announced a more than 10% salary hike for accountants in 2025 as part of a $1 billion, three-year investment aimed at reversing the accountant shortage. Starting salaries are climbing fastest in high-demand accounting roles like financial analysis, and that’s not including the signing bonuses and retention perks firms now regularly offer to stay competitive.

Many finance managers feel forced to relax experience requirements, settling for entry-level accountants expected to learn on the job, states Robert Half’s 2024 Finance and Accounting Salaries & Hiring Trends report. Yet, assigning less-experienced workers to critical accounting tasks brings significant risk: increasing the likelihood of errors, fraud, and shortfalls in internal controls over financial reporting.

Why is there a shortage of accountants?

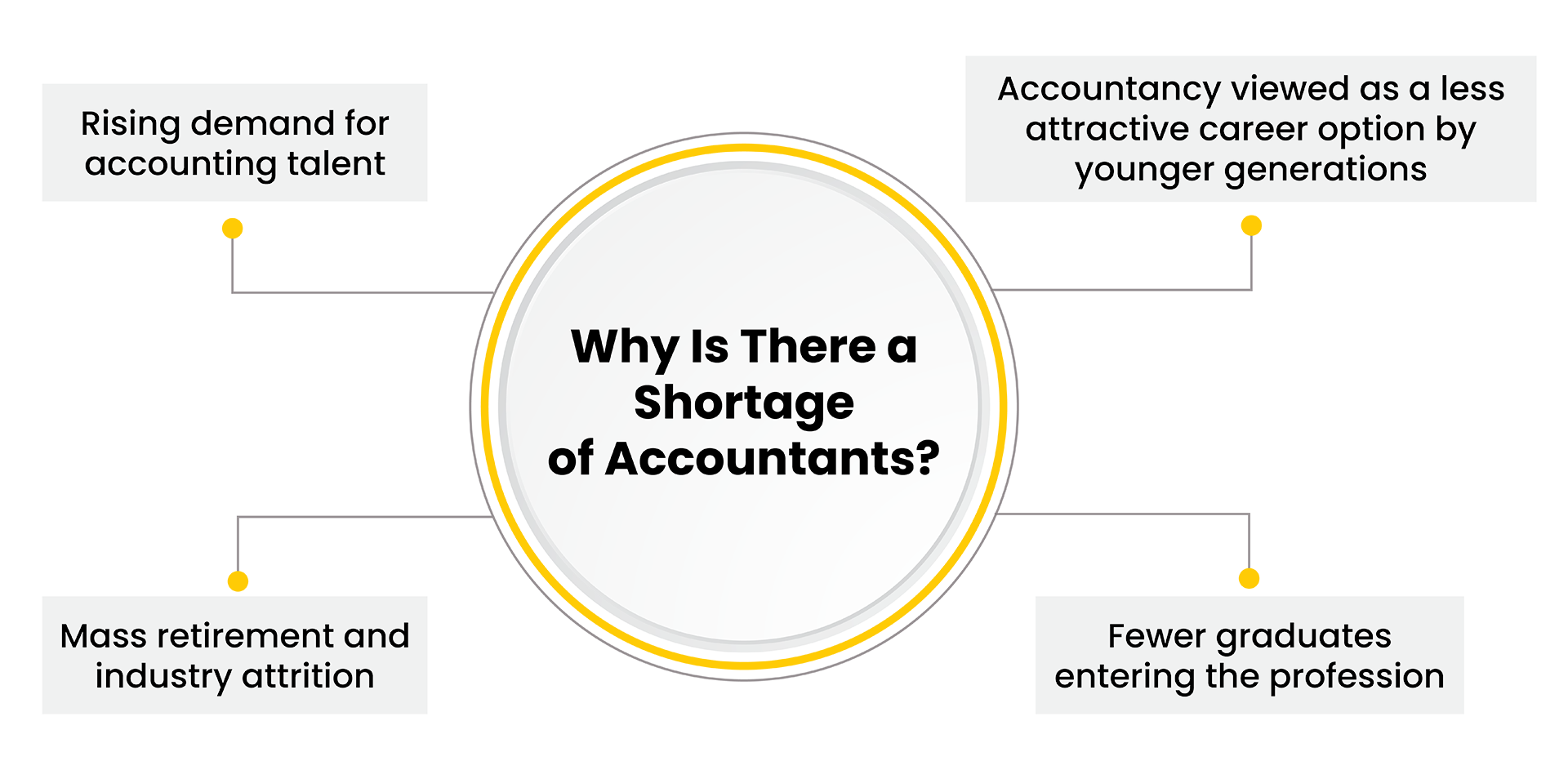

While the COVID-19 pandemic initially disrupted labor markets, the factors contributing to the accountant shortage run deeper. What started as The Great Resignation morphed into The Great Reshuffle as a record 50.6 million U.S. workers quit their jobs in 2022 – the highest level since the U.S. Bureau of Labor Statistics’ (BLS) Job Openings and Labor Turnover (JOLT) Survey began tracking in 2001.

Instead of leaving the job market entirely, workers are now leaving their jobs in search of something better.

Unfortunately, that trend has far-reaching implications for the accounting industry, which struggles with an image problem. Traditionally, a steady pipeline developed corporate finance leaders: top accounting graduates honed their expertise at Big Four firms before transitioning to corporate finance roles.

But recently, even these accounting firms struggle to fill their once-coveted jobs. CFO Dive reports that 77% of accounting firms are considering or already employing accountants working remotely from other countries to address the CPA shortage.

Over 90% of finance and accounting leaders report difficulty finding qualified professionals, according to Robert Half’s 2025 Talent Report. But where are all the accountants going?

Experienced accountants are leaving the profession in droves to pursue better-paid, higher-valued jobs in tech, investment banking, and private equity. Others are choosing contract work or starting their own businesses, considering these routes more fulfilling or a better path to work-life balance.

Making matters worse, the American Institute of Certified Public Accountants (AICPA) estimates that 75% of its members reached retirement age by 2020. There simply are not enough college accounting students in the pipeline to replace them, as the profession’s reputation for long hours, mundane tasks, less meaningful work, and high academic hurdles has the CFOs of tomorrow opting for other careers.

The 150 credit-hour requirement for CPA licensure – on top of an intimidating 40-60% pass rate for each section of the CPA exam – has long been recognized as a significant factor driving the shortage in the accountant industry, forcing time and expense that equates to an additional year of school than most careers.

Automation and outsourcing to fight the accounting shortage

While artificial intelligence (AI) and automation can ease the burden of the accountant shortage by streamlining routine accounting tasks, they can’t fully close the gap. The urgent need to tap into a new talent pipeline is combining with cost pressures to move the pendulum in favor of nearshore outsourcing.

Ninety percent of CFOs now outsource accounting functions, according to a 2024 CFO.com report. Everest Group’s PEAK Matrix® for Finance & Accounting Outsourcing (FAO) Services 2024 Assessment projects steady double-digit market growth (10-12%) through 2026, fueled by rising demand for specialized talent and cost efficiency.

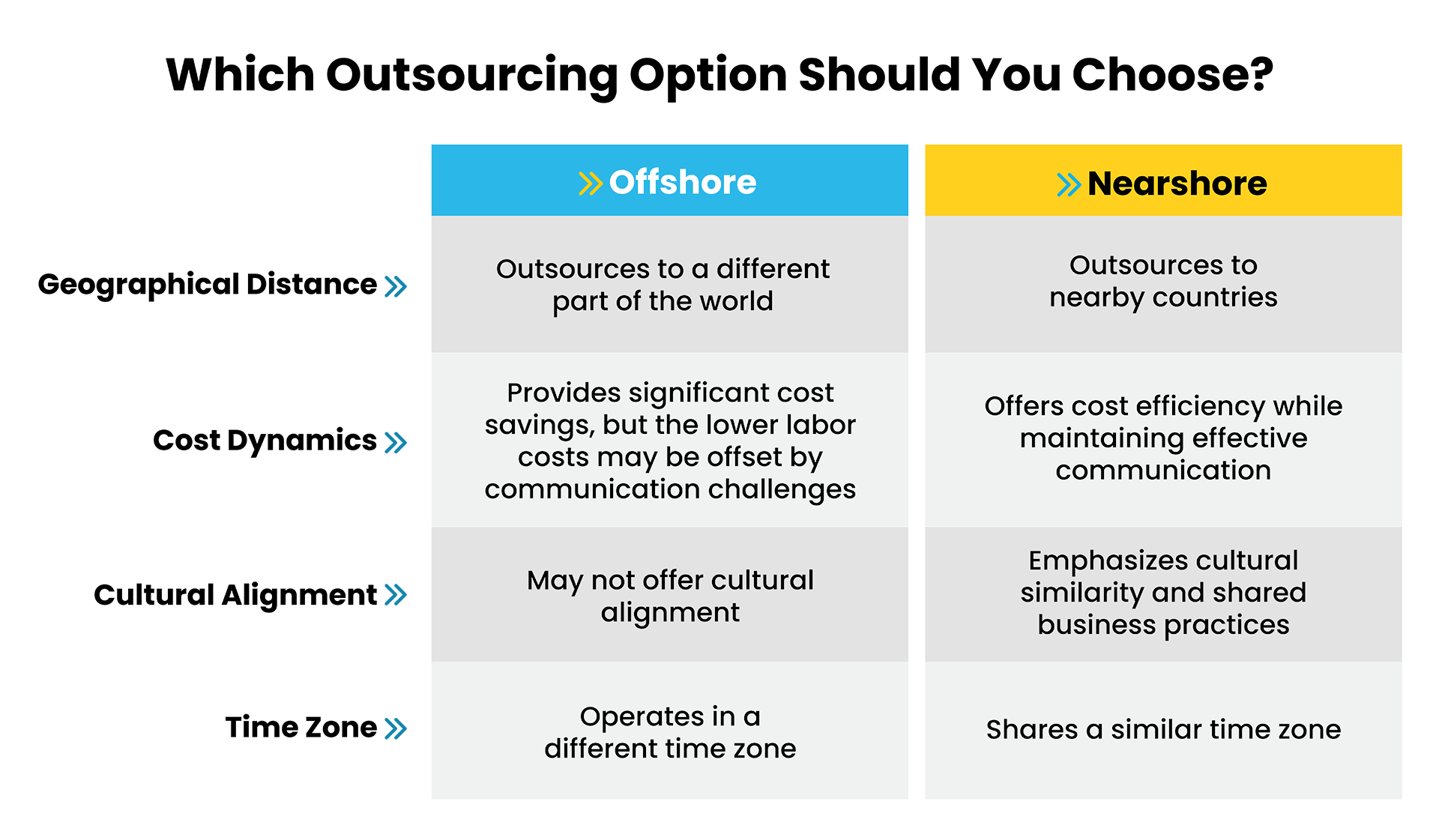

But not all outsourcing models are the same. Enterprises are increasingly seeking outsourcing partners that deliver beyond transactional processing. The 2024 FAO PEAK Matrix® Assessment highlights a shift toward providers who can support strategic initiatives, such as digital transformation, process improvement, and data-driven decision-making.

Accounting labor shortages and the normalization of remote work are also pushing CFOs to outsource more complex activities such as financial planning and analysis (FP&A). Yet, traditional offshore hubs like India and the Philippines face growing challenges. Bottom-tier pricing and the overnight shifts needed to align with U.S. business hours make it difficult to attract and retain the high-caliber talent needed for judgment-intensive roles.

The Asian-based offshore market further brings quality concerns, including cultural and language barriers, extreme time zone differences, and high employee turnover that impacts performance consistency.

These offshore locations also face high attrition rates and rising salaries. WTW’s 2024 Salary Budget Planning Report projects India’s BPO industry will continue its trend of increasing salaries annually by 9.5% in 2025 to combat its high turnover, chipping away at labor arbitrage.

Nearshoring solves Asian-based outsourcing challenges

As organizations seek more effective FAO solutions, a growing number of CFOs are rethinking Asian-based outsourcing models as they look beyond the lowest cost to ensure the highest performance. Gartner predicts that outdated pricing models that don’t drive process improvement and digitization will lead 60% of finance leaders to forgo renewing their current BPO contracts by the end of this year.

Amid the search for a new pipeline of quality accounting talent, outsourcing within the same region allows you to successfully implement a hybrid operating model where your provider functions as a true extension of your team. Nearshoring advantages in Latin America solve the challenges of outsourcing to Asia, providing time zone compatibility and cultural and language alignment while still achieving cost efficiency.

When finance and accounting processes are more complex, the easier communication and collaboration of nearshore markets with highly educated populations makes the most sense.

Finance teams in top nearshore markets also help accelerate modernization — bringing deep experience working with automation and AI for companies across industries. Leading nearshoring partners bring proven finance transformation expertise and certified talent in areas like cybersecurity and intelligent automation — capabilities often too costly or scarce in the U.S.

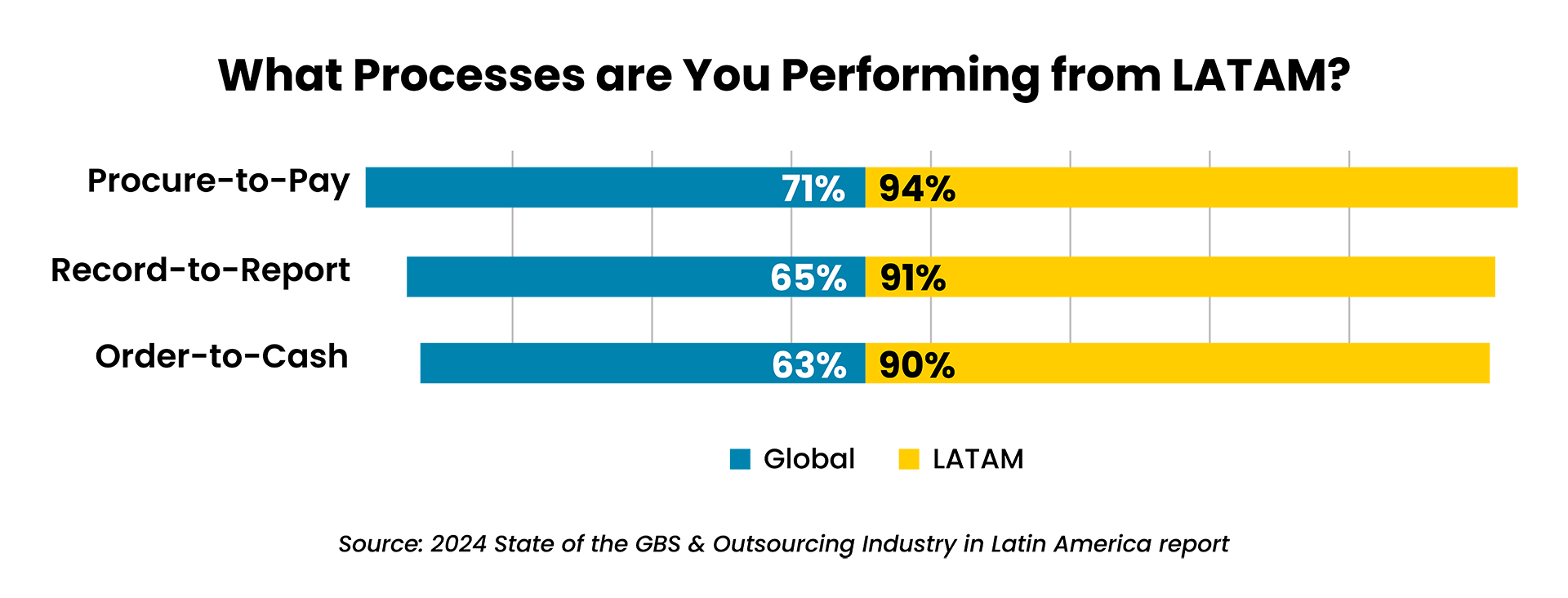

Consider these findings from the 2024 State of the GBS & Outsourcing Industry in Latin America report by SSON and Auxis:

- 90% of enterprise and global business services leaders are either operating in Latin America (LATAM) or plan to establish operations there within the next three years.

- Core finance functions are currently performed on a greater scale at Latin American shared services compared to global organizations (performed by 90+% of LATAM shared services vs. 63+% of global ones).

- Intelligent automation services are also delivered on a greater scale in Latin America compared to globally (performed by 59% of LATAM shared services vs. 28% of global ones), with LATAM shared services showing 9% higher adoption across critical technology than their global counterparts.

- LATAM shared services experience higher satisfaction rates (87%) compared to Asia (53%), Europe (64%), and even North America (69%).

Latin America: Solve the CPA shortage with top-quality talent at a lower cost

But it is the quality of LATAM’s accounting talent that makes it the preferred destination for CFOs. Top nearshore locations like Costa Rica, Colombia, and Mexico offer deep talent pools of certified accountants trained in U.S. GAAP and IFRS standards, minimizing the errors and reporting delays that plague short-staffed U.S. teams.

Latin America’s top destinations rank significantly ahead of Asia’s most popular markets on the World Economic Forum-endorsed Global Talent Competitiveness Index, as saturated labor markets cause India’s talent competitiveness score to decrease every year since 2020. While India and the Philippines scored 103rd and 84th on the latest Talent Index, Costa Rica, Colombia, and Mexico came in at 47, 72, and 74, respectively.

Mexico and Colombia also edged out the Philippines to rank among the top outsourcing destinations globally on Kearney’s latest Global Services Location Index, with Colombia standing out as the most financially attractive of the top nearshore markets. As the third-largest BPO market in LATAM, Colombia ranks second in the region for availability of skilled talent – offering five cities with more than 1 million inhabitants and 15 with more than 500,000.

It’s no surprise that leading multinationals – including Johnson & Johnson, Diageo, Medtronic, UPS, Stanley Black & Decker, Schlumberger, and Delta Airlines – have established finance hubs in Colombia to support North American operations.

Costa Rica is the most mature shared services destination in Latin America, ranked by Deloitte’s latest Global Shared Services and Outsourcing Survey among the top 10 shared services locations worldwide. It combines one of the region’s highest English proficiency rates and deep familiarity with North American business practices, thanks to more than 350 multinational organizations – including Procter & Gamble, Oracle, Pfizer, Citi, and Cencora – operating within the country.

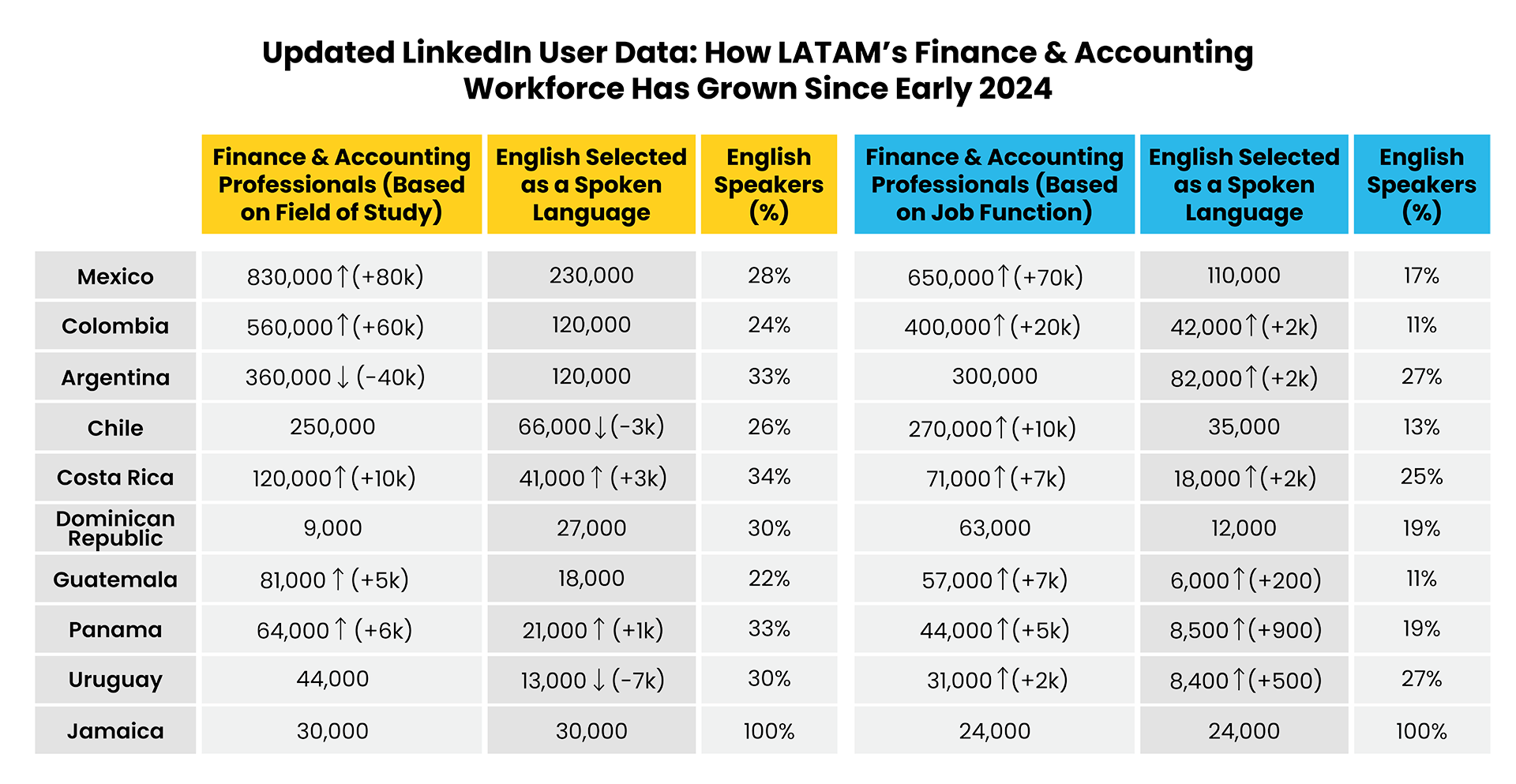

The table below highlights the estimated number of finance and accounting professionals across countries in Latin America and their English proficiency, based on updated LinkedIn user data. It includes professionals with academic backgrounds in finance and accounting and those actively working in the field.

Since our original LinkedIn-based analysis in January 2024, the region’s finance & accounting workforce has continued to gain strength. Updated LinkedIn user data shows:

- 5-8% average growth in F&A professionals across LATAM, with the highest growth coming from Colombia (+12%), Mexico (+11%), and Costa Rica (+9%).

- English proficiency levels remain strong, led by Costa Rica and Jamaica.

- While not included in the original analysis, Jamaica and the Dominican Republic expand the nearshore landscape with high bilingual readiness.

This growth reflects not only academic pipelines but also rising demand from multinationals operating finance hubs across Latin America. At the same time, many governments are proactively investing in the region’s finance workforce.

For example, in Costa Rica, government-sponsored accounting programs start with high school students and incorporate internships, resulting in a steady flow of experience and workforce-ready accounting graduates. Colombia is seeing a 13% annual increase in finance graduates – the highest growth rate across disciplines, according to a research study by Invest in Bogotá data.

In addition, accounting remains a coveted career path in LATAM, particularly when working for shared services organizations supporting or owned by multinational companies. Professionals value their accounting careers and take pride in performing accounting tasks that American Millennial/Gen Z workers often view as tedious or low value, leading to higher performance, lower turnover, and greater consistency.

Why Auxis: Innovate a better way of work

The severe lack of accountants continues to keep finance leaders up at night, disrupting reporting, delaying initiatives, and straining already-stretched finance departments.

In response, forward-thinking CFOs are embracing a “new normal,” partnering with high-quality nearshore accounting providers like Auxis to bridge talent gaps cost-effectively with a modernized, hybrid operating model that boosts efficiency and performance.

Auxis’ FAO solutions stand out for their ability to drive strategic value, not just cost savings. Named a top finance and accounting outsourcing company globally by leading research analysts like Everest Group and ISG, Auxis is consistently recognized for its world-class, tech-enabled nearshore delivery model that combines top-tier finance talent with process optimization and advanced digital capabilities.

In 2024, Auxis received UiPath’s Foundational Americas Partner of the Year award for its ability to place AI and automation at the foundation of business innovation and success.

With nearly three decades of finance transformation experience and a uniquely customized and flexible client-centric outsourcing approach, Auxis brings the innovative solutions CFOs need to confront modern operational challenges and plan for the next decade.

Ready to learn more about finance and accounting outsourcing? Schedule a consultation with our FAO team today! Or, download a complimentary copy of Everest Group’s PEAK Matrix® for Finance & Accounting Outsourcing (FAO) Services 2024 Assessment to learn why Auxis was recognized as a Star Performer, Major Contender, and Nearshore Leader. You can also visit our resource center for finance and accounting outsourcing tips, strategies, and success stories.

Frequently Asked Questions

Why are so many accountants leaving?

How are companies responding to the shortage of accountants in the USA?

What’s the difference between nearshore and offshore outsourcing?