In brief:

- The accountant shortage has reached crisis levels in 2024, with more than half of financial-related jobs unfilled and accounting graduates dropping by the largest single-year percentage in more than a decade.

- The lack of qualified talent is driving salaries sky high, impacting financial reporting, and forcing CPA firms to turn away work.

- Finance leaders must completely reimagine how they source talent as the traditional accounting pipeline falls apart.

- CFOs are increasingly turning to nearshore finance and accounting outsourcing to access deep pools of top-quality talent, solving the challenges of Asia-based solutions through time zone, cultural, and language compatibilities.

The accounting talent shortage has reached crisis levels – and it’s spilled over into financial reporting. Publicly traded Advance Auto Parts recently disclosed that turnover in key accounting positions created a material weakness in its financial reporting controls that stopped it from filing a 10-Q quarterly report on schedule.

As a key predictor of restatements, companies must disclose flaws in their internal control over financial reporting (ICFR) if there’s a reasonable chance a material misstatement could occur that they couldn’t prevent or detect in a timely manner. In its disclosure, Advance Auto said it was unable to attract and retain enough qualified people to fill its internal control responsibilities, requiring more time to assess the deficiency and remediation before filing.

Advance Auto’s struggles are far from unique. Through June 2023, nearly 600 U.S.-listed companies reported material weaknesses related to personnel predominantly in accounting or IT – an alarming 40.6% increase over 2019, according to a Wall Street Journal (WSJ) report.

The traditional accounting resource pipeline is crumbling in the U.S., forcing finance leaders to completely reimagine how they source talent. But confronting that challenge also creates an opportunity to reinvent outdated operating models and innovate a better way of working.

By leveraging the top-tier talent, labor arbitrage, and compatibilities of top Latin American markets with the digital capabilities and optimized operations of top nearshore finance and accounting outsourcing (FAO) partners, CFOs are transforming their organizations into the modern finance department the business demands while tapping into a deep new pool of certified accounting professionals.

The accounting talent shortage: Surging salaries and a dwindling pipeline

The statistics aren’t pretty. More than 300,000 U.S. accountants and auditors left their jobs within two years—a sharp 17% decline in talent from the profession’s peak in 2019—and the talent pipeline to replenish them is dwindling as the number of people seeking an accounting degree dropped by the largest single-year percentage since 1995.

In response, entry-level pay for accountants and auditors rose at its quickest pace in recent years – surging 21% in the first quarter of 2023, 13% in 2022, and 4% in 2021, according to a WSJ report.

Retaining talent is of equal concern as short-staffed teams burn out. In the first quarter of 2023, compensation climbed 9% for accounting-related roles across five seniority levels – nearly three times 2023’s annual inflation rate.

That doesn’t account for hefty signing bonuses and other pricey perks companies are dangling to lure and retain talent. In the red-hot job market, many finance managers feel forced to relax experience requirements as well, settling for entry-level workers who can learn on the job, states Robert Half’s 2024 Finance and Accounting Salaries & Hiring Trends report.

But assigning less-experienced people to critical accounting tasks brings significant risk: increasing the likelihood of errors, ICFR shortfalls, and fraud.

Why is the accounting talent pipeline breaking?

While for a spell, we were comfortable with the uncomfortable, pointing to the pandemic as the impetus for the labor shortage, the reasons for the nation’s yawning talent gaps are changing.

What started as The Great Resignation has morphed into The Great Reshuffle. A record 50.6 million U.S. workers quit their jobs in 2022 – the highest level in the history of the U.S. Bureau of Labor Statistics’ (BLS) Job Openings and Labor Turnover (JOLT) Survey, which started in 2001.

But while the labor force participation rate plummeted during COVID, it returned to pre-pandemic levels in Q2-23. Instead of resigning from work altogether, workers are now leaving their jobs in search of something better.

Unfortunately, that trend has far-reaching implications for the accounting profession, which struggles with an image problem. Traditionally, a steady pipeline developed corporate finance leaders: top accounting students honed their expertise in the Big Four before transitioning to top corporate roles.

But now, even Big Four accounting firms are struggling to fill once-coveted jobs. CFO Dive reports that the CPA shortage is forcing some accounting firms to turn away work – and 77% say they are considering, planning, or already employing accountants working remotely from other countries to fill gaps.

More than half of financial-related jobs remain unfilled – the highest of any industry, according to a 2023 U.S. Chamber of Commerce analysis. But where are all the accountants going?

Experienced accountants are leaving the profession in droves to pursue better-paid, higher-valued jobs in tech, investment banking, and private equity. Others are choosing something they consider more fulfilling or better equipped for work-life balance like contract work or starting a business.

Making matters worse, the American Institute of Certified Public Accountants (AICPA) estimated that a whopping 75% of its members reached retirement age by 2020. And there simply are not enough college graduates in the pipeline to replace them, as the profession’s reputation for long hours, mundane tasks, less meaningful work, and high academic hurdles has the CFOs of tomorrow opting for other careers.

The 150 credit-hour requirement for CPA licensure – on top of an intimidating 40-60% pass rate for each section of the CPA exam – has long been recognized as a significant barrier to the U.S. accounting pipeline, forcing time and expense that equates to an additional year of school than most careers.

Automation and outsourcing to fight the accounting talent shortage

Digitization and automation can ease the burden of the accounting shortage, but they can’t completely fill the gap. The urgent need to tap into a new talent pipeline is combining with cost pressures to move the pendulum in favor of nearshore outsourcing.

More than half of CFOs currently outsource finance and accounting processes (Deloitte Global Outsourcing Survey), and Everest Group expects the FAO market to experience steady 11–13% growth over the next three years.

But not all outsourcing solutions are created equal. Everest Group’s Finance and Accounting (FAO) Peak Matrix® Assessment 2023 notes that enterprises are increasingly seeking outsourcing partners with the top-tier talent, flexibility, and experience to move beyond transactional processing to support strategic areas like designing and executing digital strategies, driving process excellence, and providing actionable insights.

Labor shortages and comfort levels with remote work also have CFOs starting to outsource more complex processes like financial planning and analysis. But the bottom-of-the-barrel pricing and overnight shifts needed to align with U.S. business hours in offshore locations like India and the Philippines leaves many providers struggling to attract higher-level resources who can support judgment-intensive activities.

The Asian-based offshore market also brings quality concerns stemming from cultural and language barriers, the difficulty of doing business across faraway time zones, high turnover that impacts performance consistency, and more. India’s business processing outsourcing (BPO) industry is chipping away at offshore cost savings with 10% median salary increases in 2023 to combat 24% attrition – the highest increase in the country, according to WTW’s 2023 Salary Budget Planning report.

Top nearshore locations solve Asian-based outsourcing challenges

A growing number of CFOs are rethinking Asian-based outsourcing models as they look beyond the lowest cost to ensure the highest performance. Gartner predicts that outdated pricing models that don’t drive process improvement and digitization will stop a whopping 60% of finance leaders from renewing their current BPO contracts by 2025.

Amid the search for a new pipeline of quality accounting talent, outsourcing within the same region allows you to successfully implement a hybrid operating model where your provider functions as a true extension of your team. Cultural, time zone and language similarities solve offshore challenges – providing agile, real-time communication and collaboration.

Nearshoring to Latin America also creates significant cost savings without sacrificing quality, offering highly educated talent with the critical-thinking skills and strong English proficiency needed to successfully deliver finance processes across the value chain.

It accelerates digital transformation as well, providing access to capabilities that can be difficult or expensive to hire in the U.S. like intelligent automation, analytics, and cybersecurity.

Latin America: A top-quality accounting pipeline at a significantly lower cost

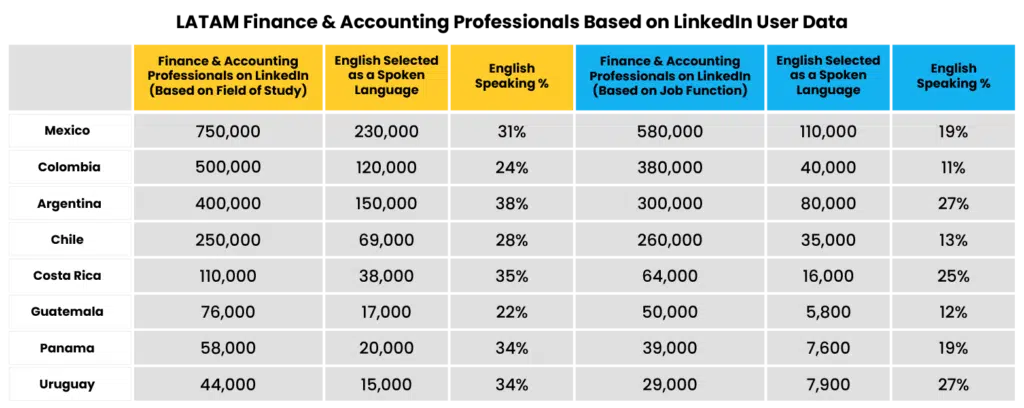

But it’s the quality of LATAM’s accounting talent that makes it the strategic destination of choice for CFOs. Top nearshore locations like Costa Rica, Colombia, and Mexico offer deep pools of certified accountants trained to U.S. GAAP and IFRS standards, mitigating the errors and backlogs that plague short-staffed U.S. teams.

Ranked #1 on the Offshore BPO Confidence Index, Colombia also ranked #1 in LATAM for skilled talent availability on the 2023 IMD World Talent Ranking. The number of graduates earning finance-related bachelor’s, master’s, or other degrees in Colombia expands by an average 13% annually – more than any educational area, according to Invest in Bogotá data.

Not surprisingly, a wealth of multinationals are already performing finance operations for North America from Colombia, including Johnson & Johnson, Diageo, Medtronic, UPS, Stanley Black & Decker, Schlumberger, Delta Airlines, and many others.

On the other hand, Costa Rica offers finance teams the most mature shared services destination in Latin America. It provides one of the highest English proficiencies in the region and deep familiarity with North American business practices stemming from 350 multinational organizations with business services operations in the country.

The table below provides the estimated number of finance and accounting professionals in different countries in Latin America, based on LinkedIn user data. Given their geographic proximity to the U.S., the countries with the highest level of experience supporting North America are Colombia, Costa Rica, and Mexico, with Guatemala and Panama as additional options in Central America on a smaller scale.

Many Latin American governments are deeply committed to fueling the region’s steady accounting pipeline. Government-sponsored accounting programs incorporating internships start at the high school level in Costa Rica, for example, guiding large numbers of highly experienced workers to graduate with accounting degrees.

In addition, these roles are still considered prestigious careers in LATAM, particularly when working for the shared services operations of large multinational companies. And resources take pride in performing accounting tasks that American Millennial/Gen Z workers often consider beneath them, driving consistency, performance, and less turnover.

PEAK Matrix® for Finance & Accounting Outsourcing (FAO) Services 2023 Assessment

Why Auxis: Innovate a better way of work

The severe lack of accountants continues to keep finance leaders up at night, impacting reporting, full-capacity operations, and new initiatives.

A “new normal” is emerging as forward-thinking executives increasingly turn to quality nearshore accounting providers like Auxis to cost-effectively alleviate the labor shortage while transitioning to a modernized hybrid operating model that boosts efficiency and results.

Auxis was recently recognized as a Major Contender and Nearshore Leader in Everest Group’s 2023 FAO PEAK Matrix® Assessment, widely considered the #1 source for evaluating top finance and accounting outsourcing companies. Combining its pioneer status in the nearshore space with robust digital capabilities, more than 25 years of finance transformation experience and a uniquely customized and flexible outsourcing approach, Auxis brings the innovative solutions CFOs need to solve their operational challenges.

Ready to learn more about finance and accounting outsourcing? Schedule a consultation with our FAO team today! Or, download a complimentary copy of Everest Group’s PEAK Matrix® for Finance & Accounting Outsourcing (FAO) Services 2023 Assessment to learn why Auxis was recognized as a Major Contender and Nearshore Leader. You can also visit our resource center for finance and accounting outsourcing tips, strategies, and success stories.