Since the start of the pandemic in 2020, there have been transformational changes happening in back office operating models that have rapidly altered the daily existence of business operations. From video conferencing and other cloud-based collaboration tools to work-from-home to digital transformation, the ways companies operate today seem almost “Jetson-esque” compared to the halcyon days of 2019.

Many organizations are struggling to keep up with these changes and their operating costs, and the “war for talent” that erupted as a by-product has further complicated how companies are managing their day-to-day. These factors have led to another transformational change: the hybrid BPO operating model, with organizations integrating outsourcing into their company’s core business operations across a broader range of functions than ever before.

For more than 20 years, outsourcing has had its place in back office operations, but the focus was on highly transactional activities and the goal was primarily cost savings. As recently as 2019, cost reduction was cited as the number one objective of organizations for considering outsourcing (“Deloitte Global Outsourcing Survey 2020”), and by a large margin (70%).

Then, in 2021, as the pandemic impacted the way companies operated, other factors became more important. Adapting to customers’ needs and business models took over the top spot of business challenges in 2021, with “Cost Pressures” dropping to number three on the list.

By 2022, with the talent war raging, access to talent became the number one challenge for organizations while cost pressure moved up to number two, closely followed by concerns around adapting to customer needs. In 2023, with the inflationary pressures hitting companies’ bottom lines, all three topics have become closely intertwined into the issues impacting day-to-day operations (“Executive Insights –Finance & Accounting Outsourcing (FAO) Market,” Everest Group, July 2023).

At the same time, the business process outsourcing (BPO) market has continued to grow at an accelerated pace over the past three years. From 2020-2022, Finance and Accounting Outsourcing (FAO) grew year-over-year by 27.4%, according to the Everest report. And by 2024, it is expected to grow an additional 19.8%!

Let’s take a deeper dive into the drivers behind these trends to better understand what is happening in business operations and what hybrid outsourcing involves.

Understanding the Hybrid Outsourcing Model

In 2022, according to the Everest Group report, concerns about talent availability were cited by business executives as their number one challenge. This changed somewhat in 2023 when cost pressure was cited as the number one concern, driven by macroeconomic conditions and inflationary pressures impacting the economy. While rising wages slowed down somewhat, the availability of talent still concerned business executives.

The recent “State of the Global Workplace: 2023 Report” published by Gallup looks at how employees feel about their work and their lives, an “important predictor of organizational resilience and performance,” according to the study. Stress at work was reported at a record high, with 44% of those surveyed expressing they have “a lot” of stress regarding their jobs, and it was reported that 59% of employees are “quiet quitting,” mentally disengaging from their jobs, while another 18% reported that they were “loud quitting,” actively disengaging from their work. 53% of the employees surveyed said they’re actively searching for a new job, 8% higher than the prior year. Attracting and retaining talent, always a concern for organizations, has become a constant source of frustration for business executives, impacting their ability to get things done.

At the same time, labor costs have sky-rocketed, particularly in various back office and finance & accounting-related activities.

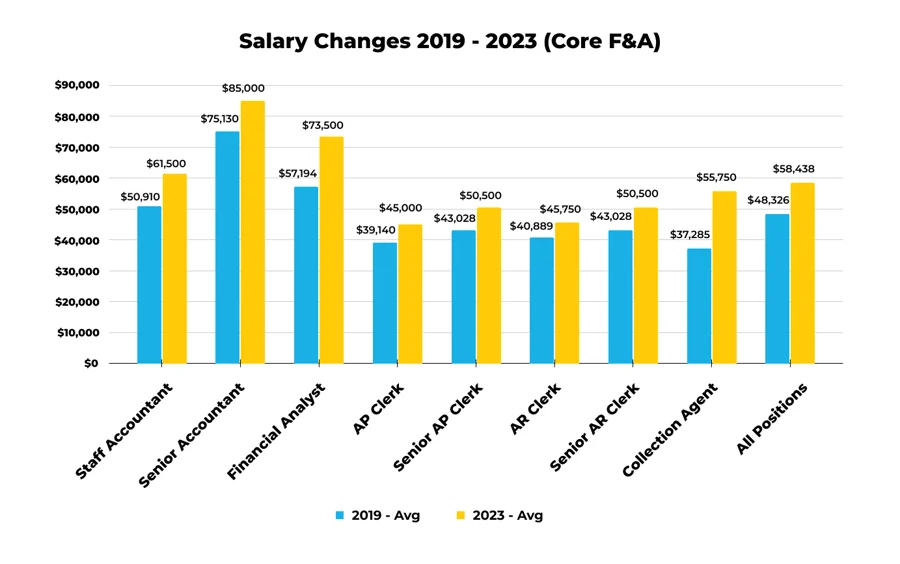

Comparing salaries from pre-pandemic 2019 to post-pandemic 2023, the changes are dramatic. Consider these 8 “core” finance & accounting roles (Staff Accountant, Senior Accountant, Financial Analyst, AP Clerk, Senior AP Clerk, AR Clerk, Senior AR Clerk, and Collections Agents.) Overall, the salaries for these positions increased by almost 21% for these 8 roles, from an average of $48,326 to $58,438, according to the Robert Half Salary Survey data for 2019 and 2023. This slightly outpaced the inflation rate during that same period, according to the U.S. Bureau of Labor Statistics.

And these numbers don’t take into account the fully loaded labor cost (adding in the cost of taxes, benefits, and other incentives), which generally amounts to another 20-25% on top of the salary.

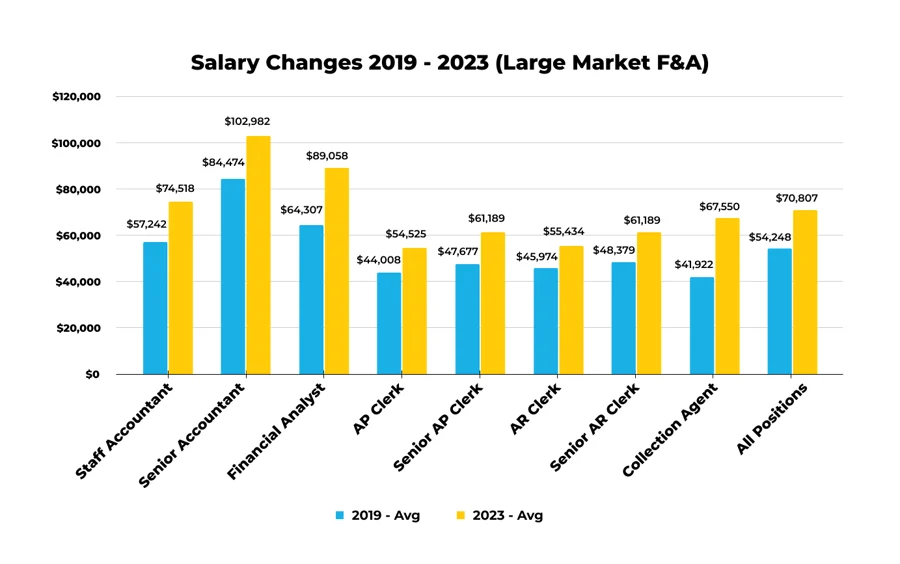

But the numbers get starker when considering some of the “larger” markets (New York, San Francisco, Los Angeles, Miami, Atlanta, Dallas, Denver, and Austin), where acquiring and retaining their in-house team has proven to be an even bigger challenge. According to the Robert Half Salary data for the same period, the salaries for these same 8 positions increased by almost 31% from an average of $54,248 to $70,807, not including the additional salary load:

And for certain positions, the competition is even more fierce. Financial Analyst salaries increased almost 40% (38.5%), and salaries for Collections Agents rose an astounding 61% as companies recognized the need to actively manage their outstanding cash positions with inflation on the rise.

Clearly, the talent war is still a “hot” one.

The “Democratization” of Digital Transformation

Using productivity data available from APQC, we have seen that there has been an increase in certain key performance measures within back office operations since 2019. The measures tell a story of 20%+ productivity gains on average.

Finance shared services centers that have implemented automation report lower staffing levels and operate at a greater cost advantage than organizations that are not utilizing automation. Without automation, SSCs report 50 FTEs per $1 billion revenue. With automation, they report about 38 FTEs, an improvement of 24%.

Looking at specific activities such as Accounts Payable, the number of invoices processed per FTE on average increased by 17% during this same period; the number of disbursements processed improved by 21%. And when you look at those organizations considered “bottom performers,” the numbers are even more pronounced: a 29% jump in the number of invoices processed for organizations at this level.

Interestingly, the organizations considered “top performers” saw virtually no change in their productivity measures during this period. This speaks to the “democratization” of digital transformation, as the technology was being employed by a broader range of organizations across the SMB spectrum and was no longer the “sole property of the big boys.”

But the allure of Digital Transformation, with its fast time to benefit and enticing ROIs, carries its own set of challenges. Many organizations still report that they are ill-equipped to identify and address the need for digital skills in finance, according to a recent report from Gartner.

And 70% of complex, large-scale digital transformation efforts are considered failures, according to a recent McKinsey study.

Given the rising labor cost, which in many cases is outstripping the productivity gains that are available, and the continuing challenges of attracting and retaining talent, failure is not an option for most organizations.

The Emergence of the “Hybrid” Outsourcing Model

As discussed, outsourcing has shown consistent growth over the past few years and organizations and sought to incorporate it into their operating models to solve some of the challenges they are facing. What has emerged is a “hybrid” approach to outsourcing operational areas.

A recent study by the Everest Group, “2022 Global CFO Survey,” is very informative on the direction that Finance organizations are taking:

- Almost 40% of CFOs are moving beyond transactional activities to transform judgment-intensive processes.

- Record-to-Report (R2R) is the top area (51%) where these transformational initiatives are occurring, and the leading area within R2R is Financial Planning & Analysis (FP&A) with 21%.

- 66% of Finance organizations are incorporating a hybrid operating model to make finance more agile and resilient.

- 68% have increased the adoption of digital technologies to enhance productivity, customer experience, and controls.

- More than 40% of organizations that are leveraging third-party support are driving organization-wide digital adoption compared to less than 30% of organizations that are not leveraging third-party support.

What should we take from this data?

Finance organizations are recognizing the need to change their operational approach from a reactive heavily transactional focus to one that provides actionable insights to help drive the business. In order to get there, they need to solve the talent and digital adoption challenges that they have been dealing with.

Organizations are recognizing that because processes are increasingly being redesigned to capitalize on digital technologies, companies can no longer outsource a single, fragmented slice of a process and hope to see much improvement in results. Instead, according to a recent article by McKinsey, for the highest impact, the outsourcing provider usually needs to own and transform the entire end-to-end process through optimization, digitization, automation, and the elimination of manual processes and work.

Nearshoring: Key Benefits of a Hybrid Outsourcing Model

As CFOs seek to outsource higher-level functions, they are recognizing the challenges inherent in an offshore outsourcing model, where the lowest cost often does not translate into the skilled labor and educated external resources to support more complex, judgment-led processes.

When processes are more complex, the ability to attract and retain better educated and experienced staff, combined with the improved collaboration and communication that these processes require, has opened the door to the nearshore market, with its benefits of time zone and geographic proximity, to become the destination for shared services and outsourcing of these business functions.

Though the lower-cost Asian destinations continue to dominate the offshoring market for transactional functions, many companies are looking towards nearshore markets as new destinations for many financial-oriented activities such as General Accounting, Accounts Payable, Accounts Receivable and Financial Planning & Analysis (FP&A).

Nearshoring is in the “eye of the beholder.” What is nearshore for Europe is not the same as what is nearshore for North America. The EMEA market considers Eastern Europe as nearshore. For the U.S., it is Latin America.

Besides the obvious benefits of working in similar time zones and the ability to easily travel to these markets, other key nearshore benefits include:

1. Cultural Alignment:

Latin America’s geographic proximity and common European roots creates close alignment with U.S. culture, work ethics, and overall values.

2. Work Experience:

With so many U.S. companies doing business in the region, the workforce in these markets is very familiar with western business practices and technical requirements (e.g., U.S. GAAP and regulatory requirements, etc.) communication styles and the general “pace” of business.

3. Language and Education:

Many countries in Latin America have highly-rated education systems and strong English language skills.

More and more, Finance organizations are leveraging the support of third-party outsourcing providers, expanding their roles to include more judgment-based activities, and demanding increased collaboration, innovation and productivity through the implementation of digital technologies that an outsourcing partner can deliver as part of their operating model.

In other words, “hybrid is the new normal.”

Resources Links: