In brief:

- Macroeconomic uncertainty, ongoing labor shortages, and increased comfort levels with remote work have made CFOs more receptive to leveraging third-party providers for their finance and accounting function.

- Outsourcing is helping accelerate AI and automation adoption for F&A organizations, bringing the talent and expertise to identify and prioritize use cases and achieve sustainable success.

- Advancing data analytics tools stand as the biggest tech priority for both finance and shared services leaders, offering previously unavailable capabilities.

- Nearshore finance outsourcing is on the rise as CFOs look to Latin America to solve their operational challenges without the headaches of Asia-based solutions.

Outsourcing is a proven way to meet the growing needs of finance organizations as they look to address a shifting set of key priorities for 2025. CFOs are looking for practical solutions to help them elevate their progress in automation and AI, address talent shortages, serve as strategic advisors, incorporate advanced data analytics, and more.

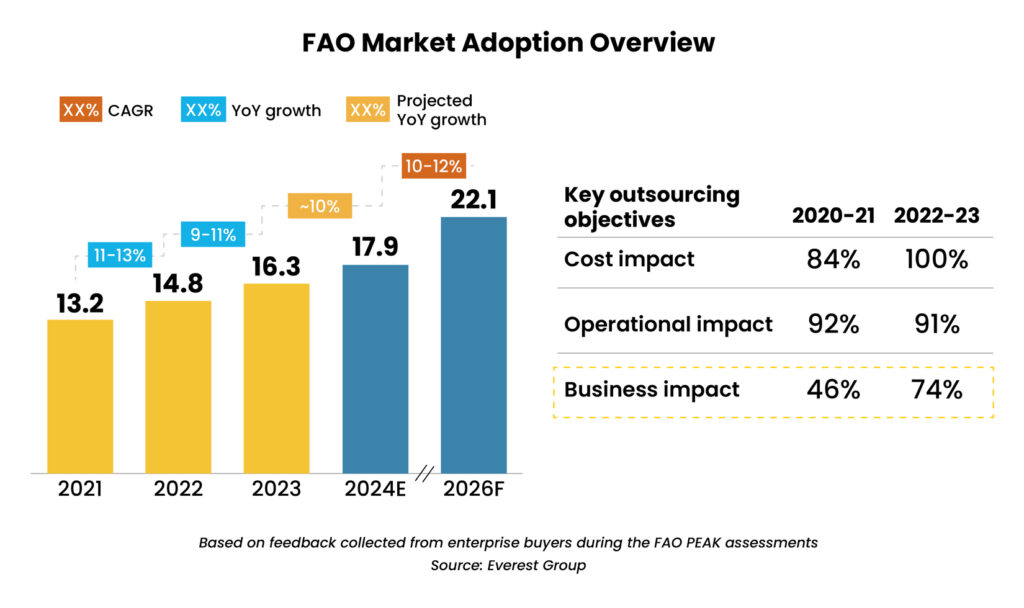

Despite uncertain economic conditions, the Finance & Accounting Outsourcing (FAO) market has demonstrated remarkable resilience, with robust growth in 2024 (~10%) and a double-digit growth forecast (10-12%) through 2026, demonstrating sustained expansion in the coming years, according to an Everest Group market overview compiled from data in its 2024 FAO PEAK Matrix report.

This growth goes beyond the mature North American market. Geographies such as Latin America (LATAM) and industry segments such as retail, CPG, healthcare, and travel and logistics are witnessing a recent surge in FAO demand, indicating increasing openness to leveraging third-party support for finance and accounting (F&A) operations, Everest Group reports.

In its market overview, Everest predicts FAO demand in Latin America will surge by 17% through 2026 as talent shortages, accelerating digital transformation, and persistent macroeconomic uncertainty prompt finance leaders to look beyond the lowest cost to ensure the highest efficiency and performance for their operations. As a result, more companies are realizing greater value from nearshoring to Latin America to help address their key priorities for 2025.

FAO trends: How tech-enabled nearshoring is changing the game

Here’s an overview of three of the five finance and accounting trends expected to shape the FAO landscape in 2025. Read on to uncover opportunities to fill gaps in your existing operations and create more efficiency, productivity, and value.

1. F&A labor shortages continue – demanding new talent pipelines

The accounting shortage is not only continuing, it’s worsening, according to the Robert Half 2025 Finance and Accounting Salary Guide. Professionals are overtasked, and many leave accounting for careers with a better work-life balance.

Additionally, as seasoned professionals retire, there is a dearth of younger talent equipped with both digital proficiency and a deep understanding of financial practices. As a result, operational costs are surging as the dwindling number of accounting professionals demand increasingly higher salaries.

- A severe shortage of skilled accountants is putting immense strain on CFOs and finance teams. The deficit, estimated to potentially reach 3.5 million by 2025 according to industry analysts, threatens to disrupt financial reporting and compliance processes across sectors.

- 51% of finance and accounting managers say hiring quickly enough to land top talent is one of their top recruiting challenges, according to Robert Half’s Salary Guide.

- Locating skilled professionals for jobs in the following F&A areas is particularly difficult, Robert Half found:

- Financial planning & analysis (FP&A) (46% of respondents)

- Accounts payable, accounts receivable, and bookkeeping (43%)

- Financial reporting (37%)

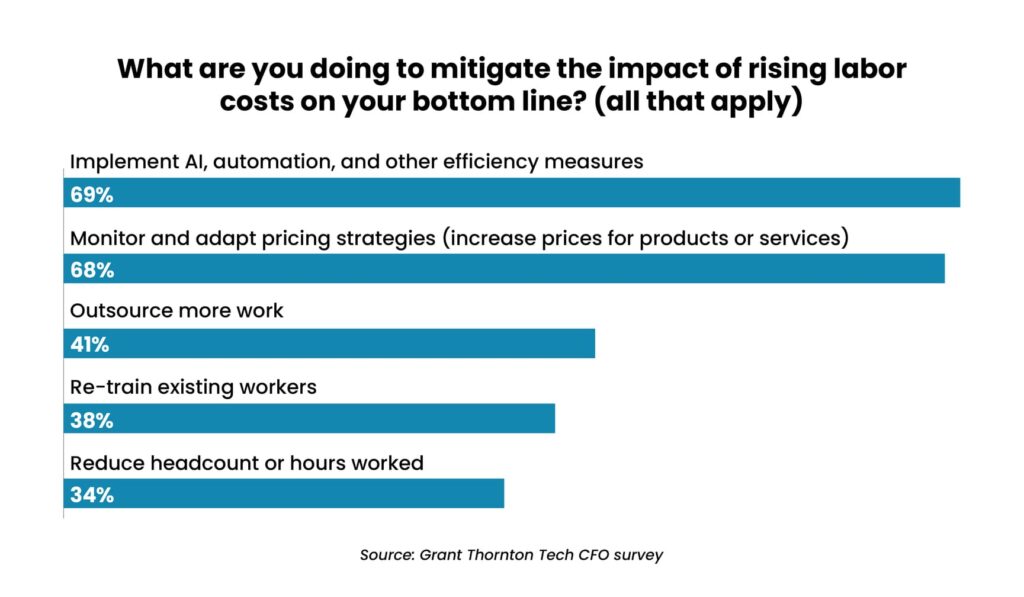

As a result, even businesses that never considered outsourcing before are now exploring opportunities to meet the challenges of a continued labor shortage by taking their spreadsheets on the road while at the same time learning how to increase efficiency and savings with automation. Amid rising labor costs, more than 40% of CFOs surveyed by Grant Thornton in 2024 indicated “outsource more work” as a key cost optimization strategy.

Instead of the headache of finding and training people in the U.S. amid the shrinking labor supply, many finance leaders are looking to outsourcing partners in regions like Latin America, which have an ample supply of finance professionals trained to U.S. GAAP and IFRS accounting standards working in the same time zone, culturally aligned, and with strong English proficiency.

Gain more insights into F&A labor trends in our report, “F&A Outsourcing Trends: How Tech-Enabled Nearshoring is Changing the Game in 2025.”

2. Tech-enabled finance outsourcing is accelerating AI and automation

When you combine the overall talent shortage in Finance & Accounting with the skills gaps in emerging technologies, CFOs are experiencing a talent “double whammy:” challenges just getting your basic work done plus the inability to improve productivity and performance through technology enablement! As a result, greater leveraging of AI and automation has emerged as a top CFO priority for 2025.

- The Grant Thornton survey found that “AI, automation, and other efficiency measures” was the most-cited tactic (68%) CFOs are using to mitigate the impact of rising costs on their bottom line.

- But while organizations want AI and automation, many feel hampered by a lack of available or skilled talent within their organization. More than half of CFOs plan to hire in critical areas like data analysis and forecasting this year, for example, but many are struggling to find finance talent with the necessary AI skills to help guide the enterprise through uncertainty (PwC “What’s Important to the CFO in 2024?”)

- CFOs are struggling to quantify AI investments and expected ROI, with most AI cost estimates underrepresented by a staggering 500% to 1,000%, states the Gartner Top 25 Finance Priorities report.

As a result, many are prioritizing the real-time collaboration, highly skilled tech talent, and proven track record of success available in top nearshore markets to drive their transformation journeys – with Intelligent Automation functions performed by 59% of LATAM shared services organizations (SSOs), compared to 28% of SSOs globally, according to a new report by SSON Research & Analytics and Auxis, “2024 State of the GBS & Outsourcing Industry in Latin America.”

Finance leaders are looking to strategic outsourcing partners to implement emerging tech with a long-term strategy aligned to business goals, relying on the outsourcer’s ability to identify opportunities that drive efficiency and savings in addition to labor arbitrage.

Learn more about how companies are leveraging the benefits of nearshoring to accelerate AI and automation adoption by downloading our report, “F&A Outsourcing Trends: How Tech-Enabled Nearshoring is Changing the Game in 2025.”

3. Nearshoring emerges as a premier finance and accounting outsourcing solution

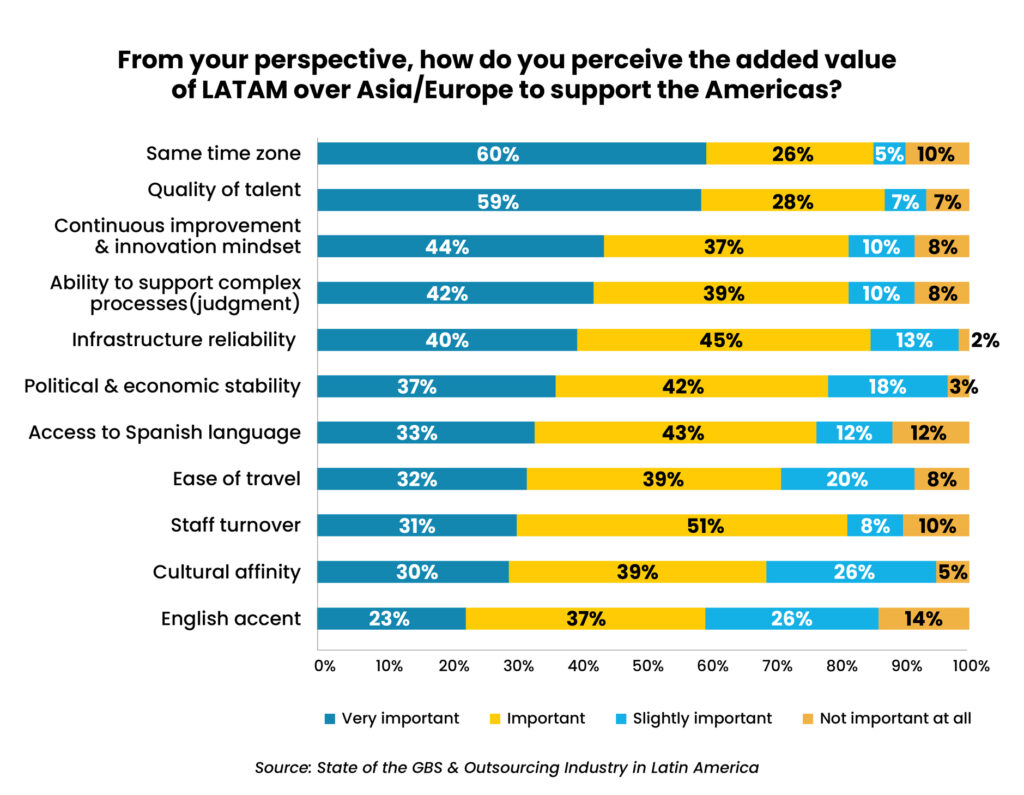

As organizations become acutely aware of the complexities of Asia-based outsourcing models, nearshoring to Latin America is emerging as a formidable alternative for CFOs. While cost savings in Latin America are generally positioned between Asia and Europe, LATAM’s labor arbitrage is still substantial – and the region’s ability to offer plenty of talent and drive continuous process improvement provides a compelling value proposition.

- More than 60% of respondents to the Auxis/SSON survey ranked all the factors on the chart below as important or very important to LATAM’s value-add over Asia and Europe:

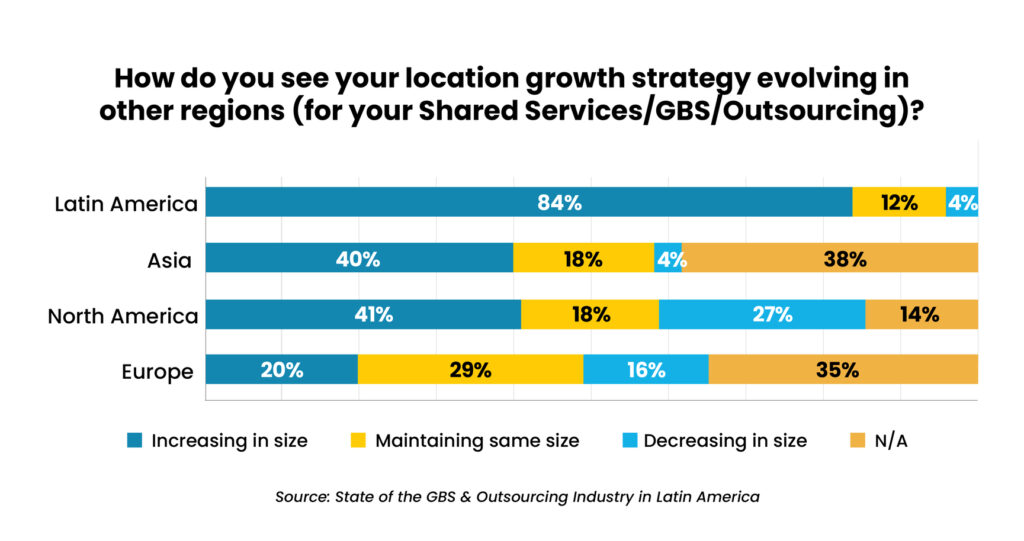

- LATAM’s shared services and outsourcing industry is growing significantly faster than other regions, with the Auxis/SSON report finding that 84% of Latin American SSOs are planning to expand their level of service.

At Auxis, we’ve seen many new clients seeking nearshore partners as they shift their focus from offshore markets to reduce operational challenges. We are also seeing an increasing number of organizations target LATAM to complement existing operations overseas – diversifying their outsourcing portfolios to mitigate risk and accessing talent capable of performing higher-value work that has proven difficult to support from Asia.

When finance and accounting processes are more complex, the easier communication and collaboration of nearshore markets with highly educated populations makes the most sense.

Beyond cost savings, learn why nearshoring is a top trend for CFOs in 2025 by downloading our report, “2024 State of the GBS & Outsourcing Industry in Latin America.”

Get the full 2025 F&A Outsourcing Trends report

How is the finance and accounting outsourcing landscape changing as the current business environment prompts CFOs to seek new solutions for cost reduction and digital transformation? Download the full FAO report to dig deeper into the trends above and explore other trends like advancing analytics and changing service delivery to maximize the value of your finance outsourcing journey in 2025.

You will learn how:

- Enterprises are addressing finance talent shortages at home by finding skilled talent in other regions

- Tech-enabled outsourcing is accelerating AI and automation

- Service delivery is expanding to more strategic and complex offerings

- FAO providers are using enhanced data analytics to move the F&A industry forward

- Nearshore locations are emerging as a premier outsourcing solution

Ready to learn more about the benefits of outsourcing finance and accounting services to Latin America for your organization? Schedule a consultation with our nearshore experts today! You can also visit our resource center for more finance and accounting outsourcing tips, strategies, and success stories.