In brief:

- As CFOs grapple with talent shortages, cost pressures, and rapidly accelerating technology, demand for finance shared services is rising – with finance being the most common function performed by shared services worldwide.

- Organizations rank digital enablement and process efficiency as their top shared services objectives.

- An effective finance shared services model is about more than centralization, requiring the right structure, scope, location strategy, technology, and partner to scale efficiently and drive long-term transformation.

- Latin America is emerging as the preferred destination for U.S. finance organizations because it combines real-time collaboration, scalable cost efficiency, and strong alignment with U.S. business culture and accounting standards.

Finance teams face growing pressure to facilitate cost reduction, improve agility, and support enterprise-wide transformation efforts. At the same time, the accounting talent shortage has reached historic levels – more than 300,000 U.S. accountants and auditors exited the profession in the past two years, and CPA candidates are down 27% over the past decade. As a result, finance leaders are struggling to fill roles, manage reporting requirements, and sustain performance in an increasingly complex environment.

Once seen as a back-office cost lever, finance shared services (FSS) models have evolved into strategic enablers of efficiency, automation, and high-quality service delivery across the finance function.

Today, enterprises cite digital enablement and process efficiency as their top shared services objectives (Deloitte 2025 Global Business Services (GBS) Survey). With finance now the top business function performed – delivered by 90% of shared services globally – FSS has become a proven path to unlocking specialized talent, reducing execution risk, and accelerating transformation for finance teams.

Still, building a high-performing finance shared services model takes more than centralization. It requires the right structure, digital capabilities, delivery, and governance framework. In this article, we break down five essentials for designing or optimizing a finance shared services model that delivers scalable, sustainable value.

What is shared services in finance?

Finance shared services is a centralized operating model that consolidates core financial functions such as accounts payable, accounts receivable, and general accounting processes into a dedicated service center that can support multiple business units or regions. By centralizing and standardizing these financial processes, organizations reduce duplication, streamline operations, boost accuracy, and improve cost efficiency.

For example, LATAM shared services deliver average labor savings of 30-50% compared to the U.S., with another 10-20% savings added by productivity and efficiency gains. These shared services organizations (SSOs) are strategic hubs for automation, real-time analytics, and continuous improvement, enabling finance teams to move beyond transactional tasks into business enablement.

Modern FSS organizations operate as internal service providers governed by service-level agreements (SLAs) to deliver measurable value through finance transformation, performance transparency, and alignment with strategic goals. Labor savings can be used to self-fund digital investments, speeding AI and automation adoption and benefits.

The result is a finance function that’s faster, smarter, and better equipped to drive decision-making across the enterprise.

Challenges in finance shared services

While finance and accounting shared services deliver significant benefits, they also present obstacles that organizations must overcome to achieve success.

The most common challenges include:

- High setup costs

Building a captive finance shared services center requires upfront investment in technology, infrastructure, and staffing. - Process standardization complexity

Aligning workflows across regions and teams can be difficult and demands careful planning and strong governance. - Talent shortages

Attracting and retaining finance professionals with specialized skills and emerging tech expertise remains a top concern. - Employee resistance

Business units may push back against centralization and loss of local control. - Technology integration issues

Many organizations struggle to merge multiple finance systems and ensure data accuracy and integrity. - Complex regulatory compliance

Centralizing financial functions can make it challenging to stay compliant with local and international regulations.

From good to great: Finance shared services best practices

Leverage these finance shared services best practices to build or enhance your FSS.

1. Define the scope of your finance shared services model.

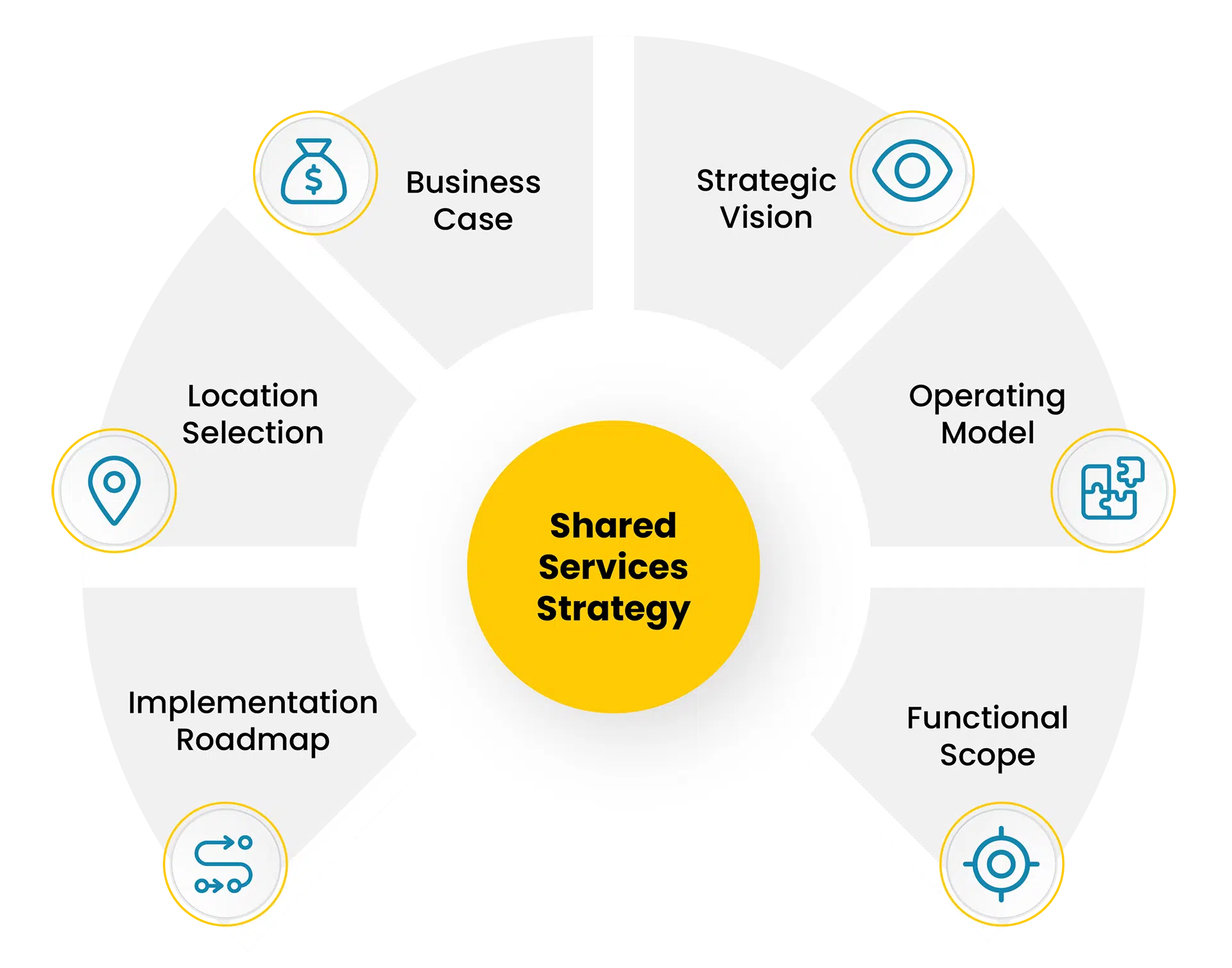

A finance shared services model delivers more value when built on a clearly defined vision, scope, and operating structure. That means aligning your intended organization to enterprise goals, identifying the right processes to centralize, and embedding governance mechanisms like SLAs, KPIs, and escalation paths from day one.

Most organizations begin by offloading high-volume transactional finance activities to their SSOs. That often includes:

- Accounts Payable (AP)

Invoice processing, vendor payments, travel and expense reporting - Accounts Receivable (AR)

Billing, collections, cash application, dispute resolution - General Ledger (GL)

Journal entries, reconciliations, month-end close - Financial Reporting

Internal and statutory reporting, consolidation, dashboarding - Fixed Assets Accounting

Capitalization, depreciation, asset retirement, leases, and capital project accounting - Tax Support

Indirect tax filings, 1099s, audit documentation - Treasury Operations

Cash positioning, bank account management, payment execution - Master Data Management

Vendor and customer master, chart of accounts - Compliance & Controls

SOX documentation, audit support, risk reporting

However, the scope of shared services for finance & accounting is broadening as talent shortages in the U.S. and greater comfort levels with remote work drive CFOs to offload more complex activities. According to Everest Group, more than 40% of finance leaders are adding functions like financial planning & analysis (FP&A) support, internal controls, and data visualization to their shared services models in 2025.

2. Determine the right type of finance shared services model for your business.

There’s no one-size-fits-all approach to structuring finance shared services. Organizations typically choose from three primary delivery models: captive (in-house), fully outsourced, or a hybrid of both – based on their size, operating complexity, transformation goals, and available resources.

Each model brings distinct benefits and trade-offs and understanding them is key to designing a finance operation that’s scalable, efficient, and future-ready.

Captive FSS model (in-house)

In a captive model, the business owns and operates its shared services organization, hiring talent, managing infrastructure, and overseeing service delivery. This model offers complete control but comes with significant upfront costs and slower time to value.

Captive models often require 50+ FTEs to make a payback compared to long-term run costs and ROI, which may take 4+ years to materialize. Finance shared services implementation (establishing physical facilities, obtaining local business licenses, hiring and training staff, etc.) is also no easy task – and lacking the right expertise can cause benefits to erode quickly.

It’s also important to keep in mind that captive solutions are a long-term investment: once they are built, it’s pricey and difficult to reverse course.

Captive models typically suit large enterprises with deep transformation experience, mature governance, the ability to achieve economies of scale, and the capital to build for the long term.

Fully outsourced model (third-party provider)

A fully outsourced model transfers shared services operations to an external partner. This model eliminates the need to build in-house capabilities and provides immediate access to skilled finance talent, prebuilt automation frameworks, and a mature delivery infrastructure.

In a heated war for talent, captives struggle to compete with outsourcers, who typically have better career progression paths that make it easier to attract and retain the best resources.

Fully outsourced delivery can reduce execution risk as well through defined SLAs, built-in process maturity, and the flexibility to scale quickly without internal ramp-up. After building a business case for outsourcing vs. implementing shared services, an Auxis client discovered that the payback period of insourcing was more than double (>4 years) the positive cash impact of outsourcing (<2 years).

Some 54% of finance organizations currently outsource processes to a third-party provider (Deloitte 2024 Global Outsourcing Survey).

Hybrid model (captive + outsourced)

The hybrid model – now the most popular FSS structure – combines internal teams focused on strategic and high-value roles (e.g., FP&A, business partnering) with outsourced partners managing more transactional, automation-ready processes like AP, AR, and GL. This approach delivers the best of both worlds: control and institutional knowledge retention from the captive side, paired with cost reduction, scalability, best practices, and innovation from outsourcing.

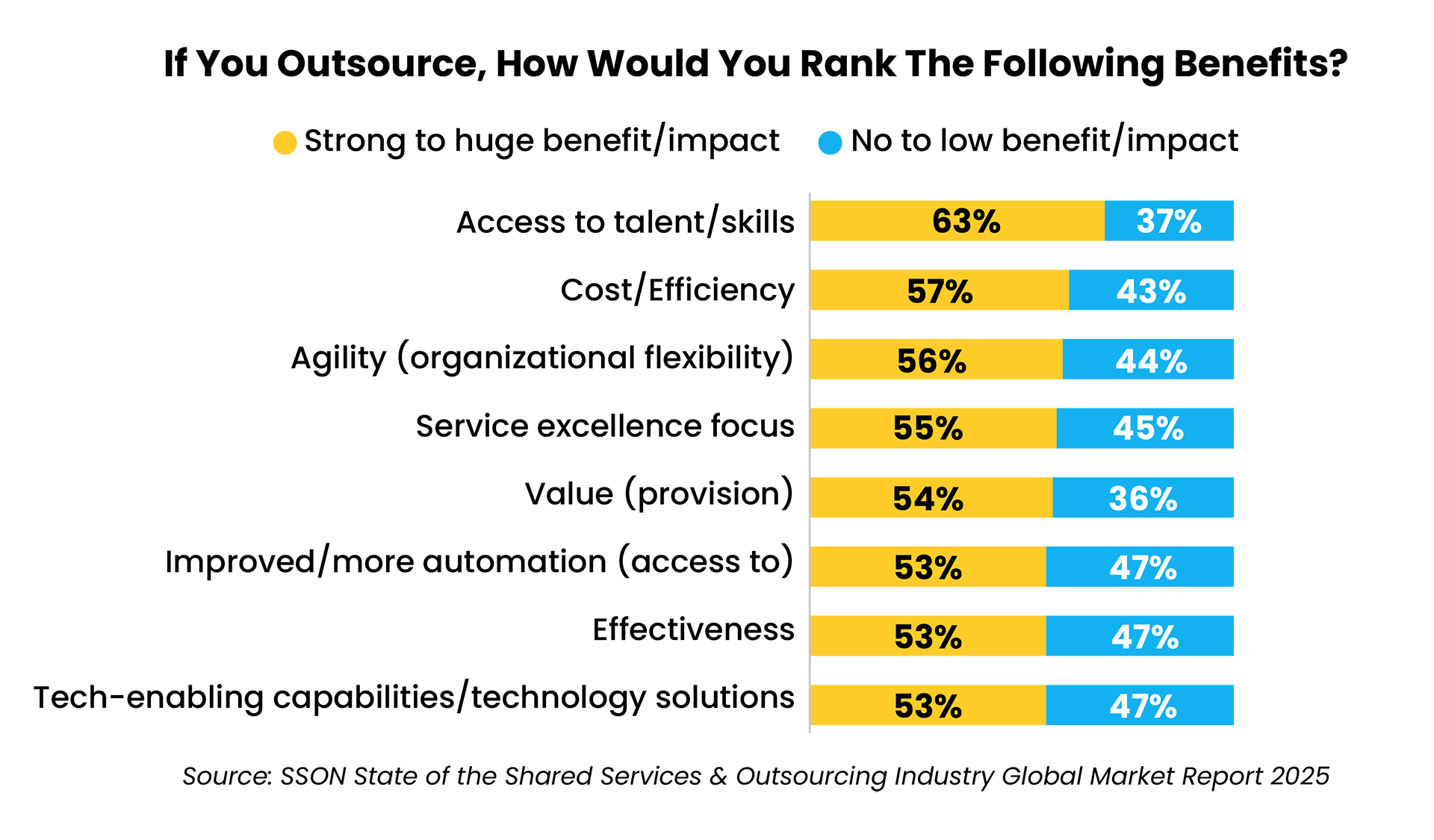

In today’s tight labor markets, outsourcing also helps overcome local labor shortages. Shared services leaders rank “access to talent/skills” as the #1 outsourcing driver – trumping “cost/efficiency” for the first time since the pandemic on SSON’s State of the Shared Services and Outsourcing Industry Global Market Report 2025.

Other top reasons for outsourcing include greater agility, service excellence focus, access to automation, tech-enabling capabilities, and accessing new geographies to mitigate risk.

More than 50% of SSOs already leverage outsourcing, and 22% plan to increase outsourced volume this year, the SSON report found – signaling growing preference for hybrid, value-driven models.

3. Conduct a thorough location assessment.

Your finance shared services location strategy is one of the most critical, and often underestimated decisions you’ll make. Where you choose to centralize financial operations will directly affect your ability to scale, attract qualified talent, maintain compliance, and deliver high-quality service to stakeholders.

Organizations generally choose from three delivery models:

- Onshore (U.S.) shared services centers offer close alignment with U.S. business units, enabling real-time collaboration and easy integration. However, labor shortages and rising costs limit scalability – especially for transactional processes – leading many organizations to limit onshore delivery to niche or complex roles.

- Offshore (Asia-based) delivery (e.g., India, Philippines) has long been popular for low-cost processing. But growing challenges such as distant time zones, cultural gaps, language barriers, and high attrition are eroding its advantages, especially for more complex work. India now ranks 103rd out of 134 countries in talent competitiveness.

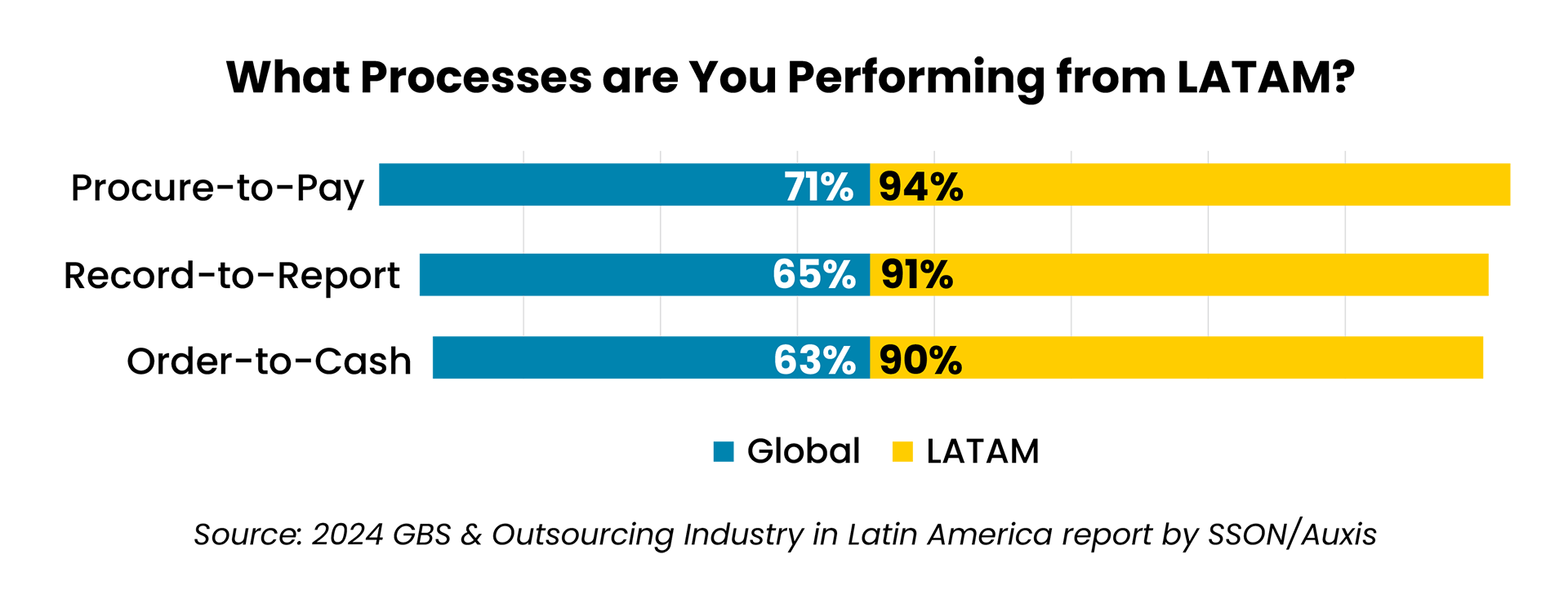

- Nearshore (Latin America) delivery, particularly the “Big Three” markets of Costa Rica, Colombia, and Mexico, have become the preferred destination for North American finance teams, with processes now performed on a greater scale vs. globally.

Nearshoring solves offshoring challenges with an ample supply of cost-effective finance professionals trained to U.S. GAAP and IFRS accounting standards working in the same time zone, culturally aligned, and with strong English proficiency. The result:

Enterprise and shared services leaders report higher satisfaction rates with LATAM SSOs (87%) vs. SSOs in North America (69%), Europe (64%), and Asia (53%)

Source: 2024 State of the GBS & Outsourcing Industry in Latin America report by SSON and Auxis.

4. Embed automation and emerging tech into your finance shared services model.

Automation is no longer optional – it’s the engine powering high-performing finance teams. From Robotic Process Automation (RPA) and Intelligent Document Processing (IDP) to Generative AI (GenAI) and Agentic, technology is transforming the finance function.

Some core use cases include:

- Invoice capture and matching (AP)

- Cash application and dispute resolution (AR)

- Journal entries and reconciliations (GL)

- Responding to vendor inquiries

- KPI reporting and variance analysis

Emerging technologies like Agentic AI and Generative AI are expanding the value even further, generating financial narratives, supporting audit response prep, enabling self-service tools for faster internal support, and supporting automation of end-to-end processes.

Shared services have become a core component of enterprise digital agendas, with developing next-gen digital capabilities/accelerating digital transformation ranking as the top priority for shared services leaders in 2025.

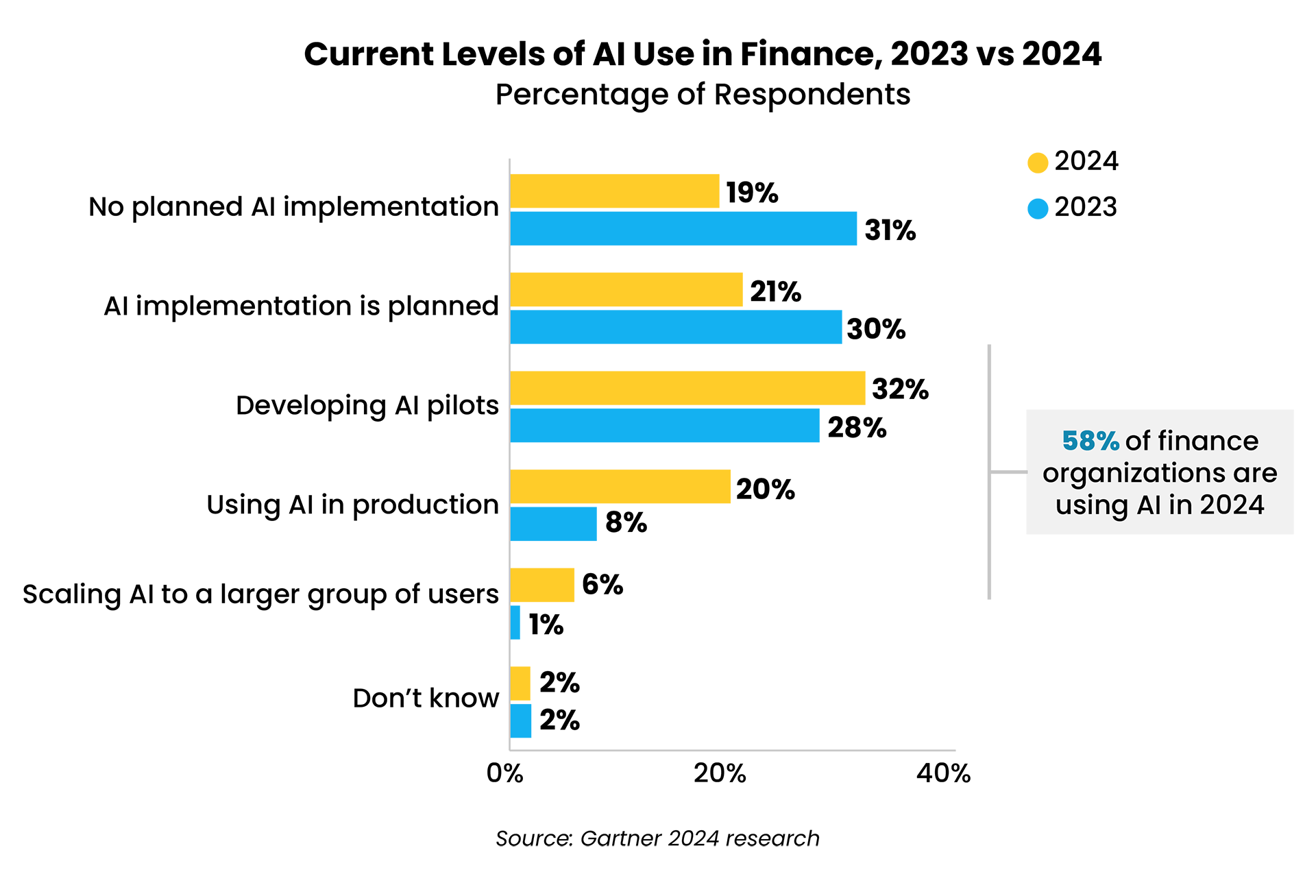

However, despite surging interest, many finance teams still struggle to unlock full value from technology use: 58% of CFOs used AI in 2024, but most cited poor ROI due to limited automation maturity, data integrity challenges, and talent gaps in emerging tech.

For organizations without in-house automation expertise, outsourced shared services provide a faster, lower-risk path forward. It enables automation at scale without a big upfront investment, adding built-in process discipline, high-volume workflows, and expert personnel. Deloitte’s 2024 Global Outsourcing Survey reports that 81% of finance leaders plan to adopt AI-driven tools as part of their outsourced shared services strategy in 2025 as they look to access the talent, technology, and expertise they lack in-house.

LATAM leads the way in automation maturity. Shared services in the region have achieved 9% higher adoption across critical emerging technology solutions than the global average (2024 State of the GBS & Outsourcing Industry in LATAM Report). Nearly half report productivity improvements exceeding 20% from their efforts, positioning LATAM shared services as not just cost-effective, but innovation-forward.

See how Auxis’ tech-enabled outsourcing solution in LATAM helped a major e-commerce retailer achieve 95% touchless invoice processing, resulting in a 40% boost in AP productivity.

5. Partner with a top-quality finance shared services provider.

Whether you’re outsourcing, building or optimizing a captive center, or deploying a hybrid approach, the right partner will help you navigate the challenges and complexities of your end-to-end shared services journey. They enable long-term performance improvement, drive finance digitization, unlock significant cost savings, and provide the scalability and guidance required to grow with confidence.

Everest Group’s 2024 Shared Services Market Study reports that 63% of organizations accelerated digital transformation in their finance processes after engaging a qualified external partner.

What should you expect from a top-tier finance shared services provider?

- U.S. standards expertise

Certifications and deep experience in U.S. GAAP, IFRS, SOX, and compliance requirements, with a strong track record across core functions like accounts payable, accounts receivable, accounting, and FP&A. - Easy access and collaboration

Flexible delivery models that provide real-time collaboration and strong cultural alignment with U.S. finance teams. - Built-in automation, transparency, and digital capabilities

Top FSS providers go beyond task automation to help you achieve full-scale process transformation through proven AI and automation frameworks. As most AI initiatives struggle to deliver expected value, quality partners bring a proven track record of identifying the best opportunities, prioritizing a roadmap, and achieving sustainable success. - Advanced analytics and reporting

Access to dashboards, variance analysis, and actionable insights that turn finance into a strategic business driver. - Robust performance management

Defined SLAs, KPIs, and escalation protocols that ensure accountability, transparency, and a focus on continuous improvement. - Enhanced security and controls

Robust governance and risk management practices ensure standardized and audit-ready processes, advanced technologies like AI and automation for real-time monitoring, and compliance with global regulatory frameworks.

The right FSS partner acts as an extension of your finance team, delivering the expertise, technology, and governance required to operate smarter, move faster, and build a future-ready finance function.

Why Auxis: Nearshore finance shared services that deliver results

As finance departments face mounting pressure to do more with less, more CFOs are turning to shared services to transform their financial operations. But true success in today’s environment isn’t about chasing the lowest cost. It includes settling upon an FSS model that drives quality, agility, and continuous improvement.

While some organizations have attempted captive models or offshoring to Asia, many are now re-evaluating those decisions in light of high attrition, challenges delivering more complex processes, and time zone misalignment. For North American finance teams, nearshoring finance and accounting processes has emerged as a strategic path forward, since it offers an attractive mix of labor cost savings, skilled talent, and time zone, language, and cultural affinity that supports service delivery across the value chain.

Auxis is a recognized leader in outsourced finance shared services, with nearshore delivery centers designed for real-time collaboration and high-quality execution. It’s ranked among the top global providers by Everest Group, ISG, and the International Association of Outsourcing Professionals (IAOP).

Auxis was also named UiPath’s Foundational Americas Partner of the Year, highlighting its leadership in AI and automation-driven transformation. Whether you need expert advice for standing up a new finance shared services model, optimizing an existing model, or want to outsource finance processes, Auxis provides the strategy, talent, and technology to move your finance function forward, faster.

Ready to transform your finance function? Schedule a consultation with our finance shared services experts today! Or, visit our Finance Outsourcing Resource Center to explore trends, best practices, and client success stories.

Frequently Asked Questions

What’s the difference between Shared Services Centers (SSC) and Global Business Services (GBS)?

What is AP shared services?

Why standardize finance processes before moving to shared services?

What should you expect from an FSS partner?