Client Profile

Our client is a leading, high-growth specialty retailer headquartered on the West Coast. The private equity-backed business operates four e-commerce sites aimed at outdoor enthusiasts, competitive cyclists, and powersports enthusiasts, as well as a growing retail footprint in the U.S.

Business Challenge

High-growth retailer needed to automate invoice processing to protect supply chain

Similar to many e-commerce retailers and marketplaces like Amazon, the client’s online retail business operates with a dropshipping model, sending online orders it receives to third-party vendors that ship products directly to consumers. The client also competes against larger retailers and e-commerce sites by maintaining an “endless aisle,” providing shoppers at its brick-and-mortar stores the opportunity to order products online that are out-of-stock or not normally sold in-store.

As a result, maintaining strong relationships with a large, fragmented set of vendors is key to the retail client’s success – and timely vendor payments are vital to preventing supply chain disruptions and providing seamless shopping experiences to customers.

The client had previously outsourced accounts payable functions to Auxis after surging demand for online shopping and outdoor products during the pandemic overwhelmed its internal AP department. With vendors continuously putting the client’s account on hold due to late payments, Auxis was hired to optimize accounts payable processes, establish a scalable AP team, and help stabilize AP operations from its Global Delivery Center in Costa Rica – achieving an incredibly fast, four-week turnaround.

Read our AP outsourcing case study to learn more about how Auxis helped support the e-commerce client’s hyper-growth.

But the retailer faced another challenge: as invoice volumes continued to increase, more AP staff were needed to ensure timely payments, which increased operating costs. With a robust intelligent automation practice that supports its outsourcing solutions, Auxis identified an opportunity for the retailer to increase productivity without adding more staff – investing part of the labor savings derived from outsourcing into automating its high-volume, manual invoice process.

AP automation stands as the top digitization priority for CFOs – with 85% of AP teams realizing efficiency gains and 63% reporting faster, more timely payments from automation, according to the 2023 State of AP report.

Key challenges of the client’s manual AP invoice process included:

- Repetitive, time-consuming work. The retailer’s manual invoice process was tedious and time-draining, requiring staff to monitor a vendor email inbox, download attached vendor invoices from every email, verify details, and enter invoice data into the client’s NetSuite enterprise resource planning (ERP) system.

- Unnecessary steps triggered processing delays. The client’s process required busy AP supervisors to enter the vendor mailbox and manually assign invoices to staff, creating unnecessary dependencies and processing delays.

- Inconsistent invoice formats. A single vendor invoice might have dozens of pages while other vendors combined several invoices into a single PDF, complicating manual processing and increasing the likelihood of errors.

- High chance of errors and process exceptions. Manual AP processes are error-prone, increasing the risk of process exceptions that cause late payments.

Solution & Approach

Auxis transforms manual invoice processing with UiPath Intelligent Document Processing

Auxis identified UiPath’s Document Understanding tool, ranked the #1 Intelligent Document Processing (IDP) solution on Everest Group’s IDP Products PEAK Matrix Assessment 2024, as the right solution for automating the client’s invoice processing.

Intelligent Document Processing has gained rapid traction in recent years as organizations try to find more efficient ways to process high volumes of documents, particularly complex unstructured documents such as emails, images, and forms.

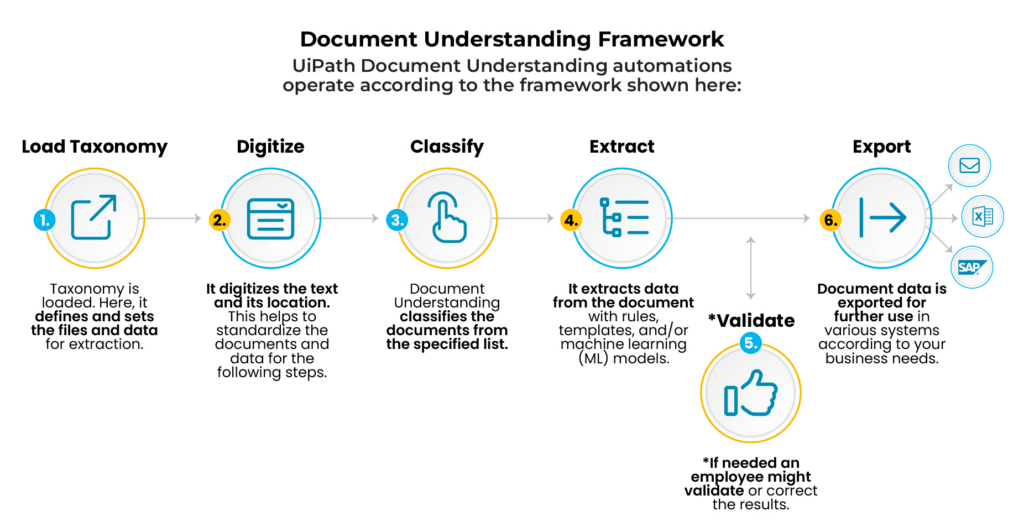

IDP automation software relies on technologies like optical character recognition (OCR) and natural language processing (NLP) to understand and process structured and unstructured data. It can also classify, extract, and validate that information from documents.

UiPath’s next-generation IDP solution, dubbed Document Understanding, combines Robotic Process Automation (RPA) and AI technologies like machine learning (ML) to process various types of documents and enhance the accuracy of document categorization and data extraction.

As a result, UiPath bots can handle entire workflows that previously required human intervention – standing out from other accounts payable process automation solutions that only automate specific parts of the invoice process.

Auxis built an IDP solution tailored to the retailer’s specific pain points, leveraging more than 25 years of finance transformation experience and in-depth knowledge of the client’s AP environment. As a UiPath Platinum Partner, the intelligent automation platform’s highest partnership level, Auxis also came to the table with an advanced AP automation team certified in the complexities of ML-powered Document Understanding.

Key AP invoice processing automation steps include:

- The automation monitors the vendor mailbox and identifies emails from specific vendors based on email address. It is trained to detect the presence of pre-defined keywords in the subject line to identify emails with invoice attachments and download them.

- Using Document Understanding, the automation extracts the following invoice information:

- Header-level information including invoice date, payment terms, and vendor names.

- Item-level information such as product number, item description, price, quantity, total quantity, and price discount.

- The automation tallies the extracted information against the corresponding purchase order (PO) in the client’s NetSuite ERP, including the quantity that was shipped, price per unit, and total price. The automation workflow can also help with processing invoices with no pre-existing POs, following different processing steps.

- The automation creates a new invoice in the ERP by entering the extracted information, uploads the PDF from the original invoice for reference, and saves the invoice it created for further processing.

The automation workflow pushes any invoices it cannot validate to Action Center, a UiPath feature which enables human intervention in long-running, unattended automation workflows. After resolving process exceptions, the accounts payable team moves invoices back to NetSuite so the automation can complete payment processing.

UiPath’s pre-existing NetSuite connector (a pre-built API integration that creates a secure connection to applications external to UiPath) helps the automation workflow interact seamlessly with the ERP platform.

The Auxis team trained the retailer’s automation to identify key details on invoices such as items and total quantity. Typically, training IDP models is a time-consuming process, requiring developers to spend hours labeling and mapping large amounts of data to familiarize the model with invoice formats and details that require extraction.

However, UiPath’s ML-powered solution includes invoice templates which are pre-trained to classify and extract commonly occurring data points. That helps accelerate the training process, achieving out-of-the-box accuracy rates of 90% even without training on specific data.

The Auxis team rapidly trained the UiPath Document Understanding model on specific invoice types sent by five of the client’s vendors, with the automation workflow up and running successfully within six weeks. Bots built on traditional IDP automation would have easily taken several more weeks of training to perform at an acceptable level of accuracy.

Auxis also trained the accounts payable department to familiarize staff with the technology and process of validating information pushed to the Action Center.

Results

Auxis’ automated invoice processing solution delivers scale with 40+% productivity improvement

Auxis’ automated invoice processing solutions allowed the client to reap the full benefits of tech-enabled outsourcing, increasing AP productivity without also increasing headcount and labor costs.

Key benefits include:

95% touchless invoice processing across 20 vendors

The Auxis automation workflow accurately processes 95% of invoices for 20 of the client’s largest vendors without human intervention, eliminating a significant burden for AP staff.

40+% greater productivity at a lower cost

Auxis’ automation solution delivered more than 40% greater invoice processing capacity with the same sized staff while lowering costs per invoice. This alleviated a major client pain point of having to continually grow its AP team and incur higher costs as invoice volumes increased.

100% automated work assignment

Zero manual effort is required to monitor the vendor mailbox and assign work. Instead, the Auxis automation workflow assigns invoices to itself and moves them to a completed folder when finished, freeing up AP team supervisors and personnel to focus on more strategic tasks.

Increased scalability

New vendors can be easily added to the Auxis IDP solution, as machine learning allows the automation to train on new invoice types without redoing the time-consuming data mapping process. That’s a key benefit for an e-commerce business that is constantly growing its supplier base.

Continuous learning reduces process exceptions

Machine learning constantly improves the accuracy of the automation’s data extraction, continuously learning from inputs made by client teams while resolving process exceptions in Action Center. This retraining can also be scheduled at regular intervals to increase accuracy over time, allowing the automation to constantly train itself to recognize new information from processed invoices.

Reduced errors, better financial control

By executing tasks according to defined and programmed rules, bots eliminate errors that humans are prone to make – supporting accurate and timely payments that strengthen vendor relationships. Accelerating invoice processing also improved the client’s cash flow management, delivering better insights into its accounts payable process.

Employees shifted to more proactive, high-level problem solving

Accounts payable process automation freed up the client’s team to focus on higher-level strategic work. AP turnover also typically decreases after automation due to the reduction in tedious, manual work and stress caused by overwhelming workloads.

As a result of this successful implementation, the client is exploring opportunities with Auxis to expand intelligent automation across its organization.

Want to learn about the benefits of AP automation or other automation opportunities at your company?

Schedule a consultation with our intelligent automation experts today!

Or, visit our resource center for intelligent automation tips, strategies, and success stories.