In brief:

- Forward-thinking AP leaders are focused on accounts payable process improvement to help their organizations navigate an unpredictable landscape.

- Important strategies have emerged, from accounts payable process automation to nearshoring, that are key to ensuring your organization stands ready for 2024.

- Focusing on these five areas now with the right accounts payable partner can help your organization get ahead of the game with a modernized, future-proof function.

If the 2020s have taught us anything, it is to expect the unexpected. Few departments know that better than the accounts payable (AP) team, which has been forced to adapt its way of work to confront modern challenges.

A severe finance & accounting (F&A) labor shortage, pressure to accelerate digital transformation efforts, and supply chain disruptions that make it more important than ever to pay bills on time have forward-thinking finance executives leading the organizational march toward transformative change.

Optimizing AP process strategies is also essential to increasing margins and freeing up working capital in today’s uncertain economic climate. Improving cash flow stands as the biggest priority for finance executives in 2023, found the Everest Group’s Global CFO Survey, which polled finance leaders about the priorities, challenges, and initiatives of modern finance functions.

As the BPO Account Manager at Auxis, I have helped migrate and optimize the accounts payable process for Fortune 1000 companies across multiple industries and countries. Recently, important accounts payable process improvement strategies have emerged that I see as critical to ensuring your AP department stands ready for 2024.

As we approach the last quarter of 2023 and start planning for next year, here are five areas AP leaders need to focus on now to get ahead of the game. And here’s my perspective on why the right accounts payable outsourcing partner is key to successful transformation.

AP automation is king

Automating back office processes like accounts payable to improve performance efficiency is the top digital investment priority in the C-suite, according to a Gartner survey of CFOs and CEOs. Business Insider reports that an automated AP system can lower costs by 81% and improve efficiency by 73%.

That’s because automating the accounts payable process elevates cash forecasting models. It also keeps goods and services flowing with analytics for tracking invoice status and identifying bottlenecks.

Automation infuses the AP process with efficiency: catching fraud, discrepancies, and duplicate invoices; reducing errors associated with manual data entry; standardizing workflows; and significantly decreasing time and expense. Powerful new AP automation capabilities like AI (artificial intelligence), machine learning, and OCR (optical character recognition) enable advancements like touchless payments, automated invoice approval workflows, and automated processing of paper invoices.

By taking over time-consuming, end-to-end accounts payable processes, automation helps your AP team do more with less headcount. For example, 97% of AP departments waste valuable time with manual processes for managing invoices – a labor-intensive chore that increases the risk of misplaced paper invoices and late or duplicate payments.

In a PYMNTS survey of 200+ executives, 98% of respondents expect automation to help avoid delinquent payments by reducing the time it takes to process invoices. Nearly 90% expect their AP automation solution to improve visibility, avoiding errors that prompt late payments, duplicate payments, or missed opportunities to take advantage of early payment discounts.

Automated vendor portals can also minimize distractions from core responsibilities in your accounts payable department. Vendor portals allow vendors to access all the information related to their accounts in a single place, with real-time status updates and messaging capabilities.

Currently, more than a quarter of AP teams spend 6-10 hours every month fielding vendor inquiries, according to the 2022 State of AP report.

Quality accounts payable partners can help you take full advantage of embedded AP automation capabilities in top-rated, cloud-based enterprise resource planning (ERP) systems like Oracle NetSuite or customize solutions through marketing-leading intelligent automation platforms like UiPath.

Your AP team becomes a strategic asset

Thanks to the increased use of automation, accounts payable organizations have the bandwidth to take on high-value work that transforms them into a strategic asset to the business.

The result: a streamlined, digital department where traditional AP clerks are replaced by AP analysts who can draw on their business administration/accounting knowledge to analyze data, ensure the right controls are in place, and identify growth opportunities.

For instance, applying AP automation to report creation enables accounts payable staff to shift into an advisory role. That can include analyzing real-time reports and proactively identifying challenges like AP process gaps, projected dips in available funds, and vendors failing to meet minimum requirements.

Strategic AP functions can also recommend improvements for cash flow and business health.

Finance leaders favor nearshore outsourcing

However, increasing accounts payable process efficiencies can also lead to increased costs. According to information collected from Robert Half’s finance and accounting salary guides, the ongoing F&A labor shortage increased the cost of a U.S. accounts payable clerk by an average of 20% between 2019-2022.

Retaining staff creates another challenge, with 54% of finance managers still seeing increased quits in the red-hot job market.

The impact is severe: Three-quarters of CFOs say the talent shortage impacts revenue, while about half also indicate constraints on full-capacity operations.

Not surprisingly, 51% of finance leaders are turning to outsourcing to combat the labor shortage, rising AP processing costs, and other challenges (Deloitte’s 2022 Global Outsourcing Survey).

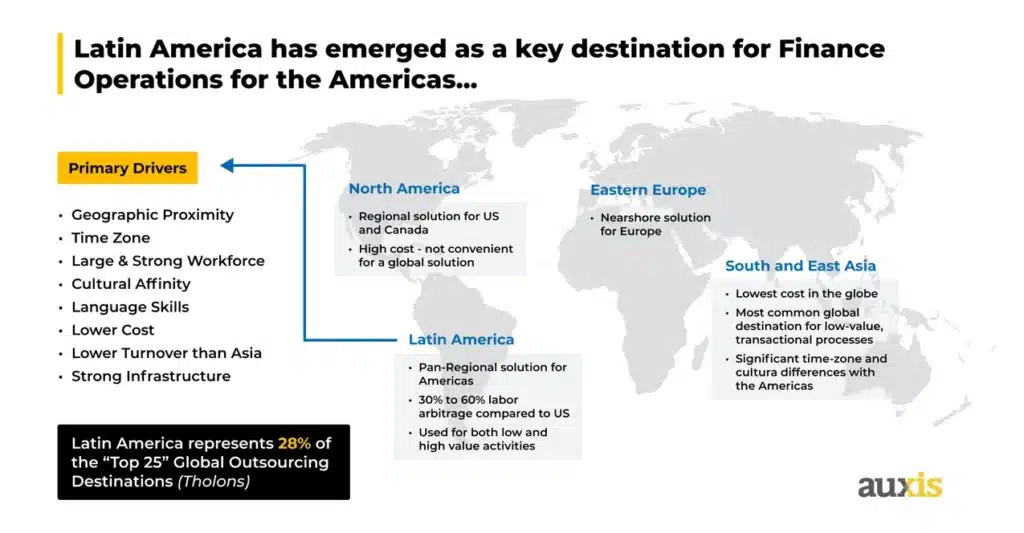

And increasingly, they favor the stronger communication and collaboration enabled by geographically close destinations, states ReportLinkr’s 2022 finance & accounting outsourcing report – driving the highest productivity and performance.

Latin American markets like Costa Rica and Colombia stand as leading destinations for North American finance operations, and the accounts payable process is often shifted first. These markets provide instant access to a deep pool of highly skilled talent at a labor arbitrage averaging 30-60%, according to Auxis’ latest finance & accounting labor savings report.

Nearshoring also avoids challenges that have many CFOs rethinking Asian-based outsourcing models, such as language and cultural barriers, difficulty doing business across faraway time zones, alarmingly high turnover, and more.

Strong English fluency and a highly educated workforce make Costa Rica the No. 1 shared services destination in Latin America, hosting 350+ multinational corporations.

Earning the top spot on the Offshore BPO Confidence Index in 2021 and 2022, Colombia is a prime location for F&A outsourcing as well. It boasts the third-largest labor force in Latin America, ranking among the top three nations in the region for availability of finance talent, according to the 2022 IMD World Talent Ranking.

Both Colombia and Costa Rica are well-suited to the increasingly analytical role of accounts payable, ranked by Tholons as Top Global Digital Nations.

Rising security risks demand stronger controls

Accounting fraud is a top-of-mind concern, with average losses exceeding $1.5 million. With access to payments and vendor master data, accounts payable presents high risk: Nearly 60% of F&A organizations report scams targeting their accounts payable process, according to the 2022 AFP Payments Fraud and Control report.

Danger lurks in multiple directions: cybercriminals posing as suppliers, real suppliers who seek duplicate payments by resubmitting the same invoice or charging for products/services not rendered, and internal staff who set up fraudulent schemes.

Strengthening internal controls is a vital accounts payable process improvement as you look toward 2024:

- Segregate AP process duties across multiple employees, decreasing opportunities for committing and hiding fraud while performing work.

- AI-infused automation can spot red flags and fraudulent patterns, prompting deeper review long before payments are made.

- Use electronic payment solutions like virtual cards and ACH (automated clearing house) transactions with built-in security controls like permissions and privileges, configurable business rules, complete audit trails, and parameters for approved payments.

- Implementing trend reviews for the accounts payable process helps catch fraudulent activity by regularly matching invoice data to vendor balances.

New metrics for accounts payable success

While traditional metrics remain important, digitization and macroeconomic conditions have created new priorities for measuring AP process success.

Right First Time (RFT) metrics are key to tracking the performance of an AP automation solution, proactively identifying ways to optimize invoice processing.

For example, paper invoices with no fixed format and unstructured data require advanced AI skills capable of responding to dynamic situations and unforeseen events.

Tracking RFT enhances the speed and accuracy of document processing by identifying new situations machine learning models need to learn by repeatedly encountering samples.

As intensity around increasing working capital escalates, Days Payable Outstanding (DPO) and Payment On Time (POT) metrics support strategic decisions about when to release cash.

Paying too early can be just as troubling as paying too late. Tracking DPO and POT metrics creates visibility that helps avoid cash flow problems, enabling your AP team to effectively use credit terms to increase margins and working capital without impacting credit standing or early payment discounts from suppliers.

These insights also help avoid late payments that damage vendor relationships and incur unnecessary late fees.

Why Auxis: chart a course through the challenges of 2023 and beyond

With disruption as the status quo, forward-thinking AP leaders are focused on tightening up the accounts payable process and leveraging emerging technology to help their organizations navigate an unpredictable landscape.

But many AP teams lack the time or expertise to make these changes effectively. Quality AP outsourcing providers like Auxis bring the talent, best practices, best-in-class automation tools, and deep experience optimizing accounts payable processes for a wealth of clients across industries.

Auxis has a proven track record of implementing digital technologies like intelligent automation and NetSuite for finance operations – removing risk at a time when at least 70% of digital transformation initiatives fail. Our clients consistently receive high-quality AP outsourcing outcomes that are focused on achieving expected cost savings and ROI.

Leaning into accounts payable process transformation with the right outsourcing partner can help you chart a course through the challenges of 2023 and beyond – optimizing working capital, embedding the accounts payable process with efficiency and resiliency, overcoming labor and supply chain challenges, and stepping into the strategic role that powers a future-ready organization.

Want to learn more about optimizing the accounts payable process through nearshoring and automation? Schedule a consultation today! You can also read our blog for more AP tips and strategies, or read our case studies for AP success stories.