In brief

- 2026 shared services trends reflect the model’s progression from a cost-control function into a value engine, with service quality, insight, and business outcomes now defining success alongside efficiency.

- Rising value expectations are pushing GBS beyond transactional work, expanding its role in analytics, decision support, and front-facing activities.

- Hybrid, multi-location operating models have become the standard, blending captives, outsourcing, and nearshore and offshore delivery to improve resilience and access scarce talent.

- Automation and Agentic AI are reshaping execution models, but most organizations still depend on partners to operationalize AI at scale.

- Talent constraints, not cost, are driving strategic decisions, influencing workforce models, location strategies, and outsourcing adoption across the shared services market.

The latest shared services trends reveal that shared services has moved well beyond being a vehicle for standardizing and centralizing transactional work. As organizations navigate persistent talent shortages, rising service expectations, and accelerating digital change, shared services and Global Business Services (GBS) models are being repositioned as core engines of enterprise execution.

In 2026, the focus is no longer on whether shared services can deliver operational efficiency, but on how effectively it can drive value, resilience, and scalable performance across business operations.

This shift is being shaped by several converging forces. Enterprises are demanding measurable business outcomes alongside cost discipline, pushing shared services deeper into analytics, decision support, and front-facing activities.

Hybrid operating models blending captive teams, outsourcing, nearshore and offshore delivery, and flexible work arrangements have also become the norm rather than the exception. At the same time, automation, advanced analytics, and emerging Agentic AI capabilities are raising expectations for how work is orchestrated and executed at scale.

Yet despite high ambition, execution gaps remain. Leaders are thus rethinking everything from delivery footprints and partner strategies to governance, talent models, and technology ownership. The 2026 agenda is therefore defined less by experimentation and more by operationalization — turning strategy, technology, and talent into consistent, enterprise-wide results.

This report explores the 10 defining shared services and GBS trends shaping 2026, drawing on shared services news and insights from the latest State of the Shared Services & Outsourcing Industry Global Market Report by Shared Services & Outsourcing Network (SSON) Research & Analytics, alongside complementary SSON surveys and regional research. Together, these trends provide a clear view into where the shared services market is headed and what organizations must do to remain relevant, resilient, and impactful.

1. Cost reduction remains foundational — but value expectations now define success

Cost efficiency continues to sit at the core of shared services and GBS operating models. In uncertain economic conditions, organizations still rely on shared services providers to control spend, improve productivity, and stabilize operations.

However, the 2026 SSON State of the Shared Services & Outsourcing Industry Global Market Report makes it clear that reducing operational costs alone is no longer sufficient to meet enterprise expectations.

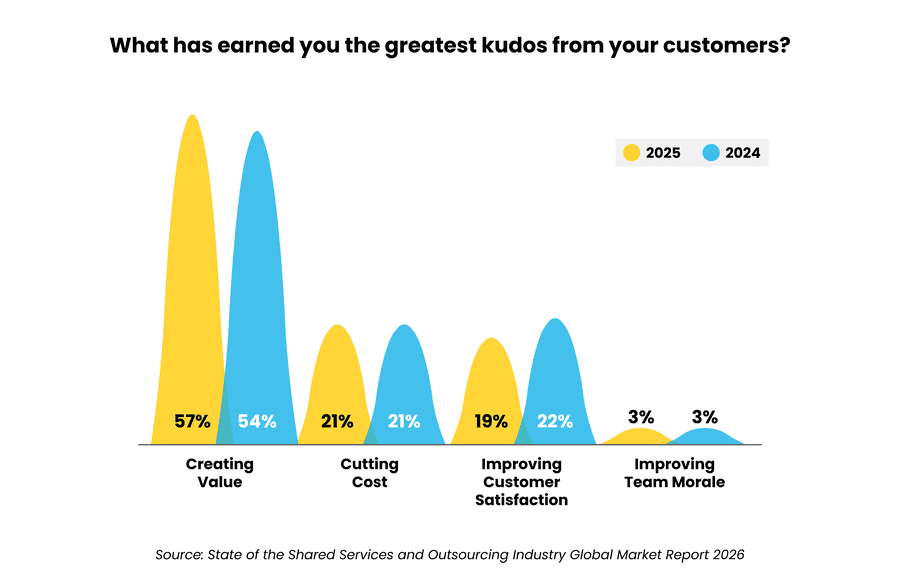

The clearest signal of this shift comes from the customer perspective. According to SSON, 57% of shared services leaders say the greatest recognition they receive from internal customers is for creating value, compared to just 21% for cutting costs. This marks a meaningful inflection point, reinforcing that shared services are increasingly judged by their contribution to business outcomes — not efficiency in isolation.

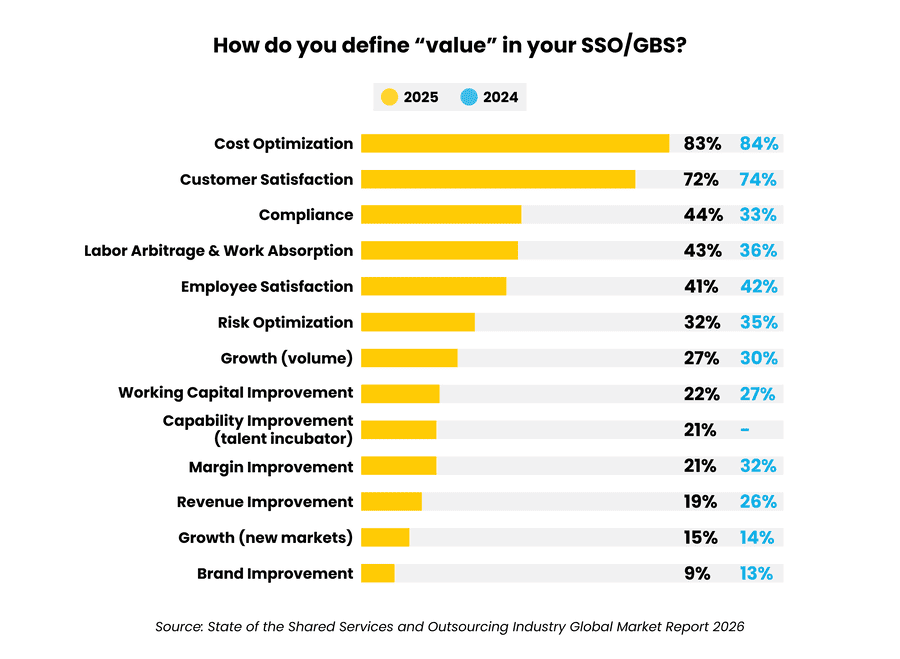

How organizations define “value” further reflects this evolution. While cost optimization remains foundational (83%), shared services leaders now associate value more broadly with customer satisfaction (72%), employee satisfaction (41%), and risk optimization, alongside traditional measures such as labor arbitrage and work absorption.

Value is no longer viewed as a by-product of savings, but as a multidimensional outcome tied to experience, reliability, and performance.

This shift is echoed beyond shared services. According to the latest Deloitte Global Outsourcing Survey, only 34% of organizations now cite cost reduction as a primary outsourcing driver, down sharply from 70% in 2020.

Instead, access to talent and the ability to meet growing business demands have overtaken cost as the leading decision factors — underscoring a broader market transition toward value-driven outcomes.

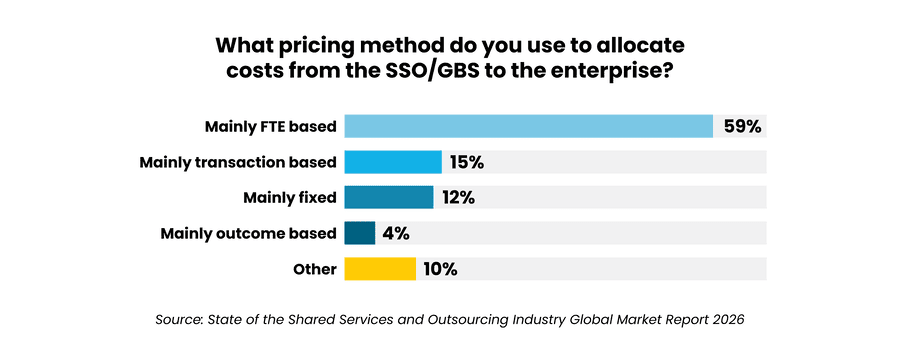

Despite rising expectations, operating models have not fully caught up. Traditional pricing approaches still dominate, with FTE-based and fixed pricing accounting for 71% of cost allocation models, while outcome-based pricing remains rare at just 4%.

This disconnect highlights a growing tension between legacy cost structures and the enterprise’s demand for measurable, value-driven results.

As shared services continues to mature, the message is clear: cost discipline is now table stakes. The organizations that differentiate themselves are those that can pair efficiency with service quality, insight, and demonstrable business impact — positioning shared services as a true value engine rather than a back-office function.

2. Emphasis on value pushes shared services beyond transactional work

As expectations continue to rise, shared services and GBS organizations are expanding well beyond traditional transactional execution and into more complex, value-driven work.

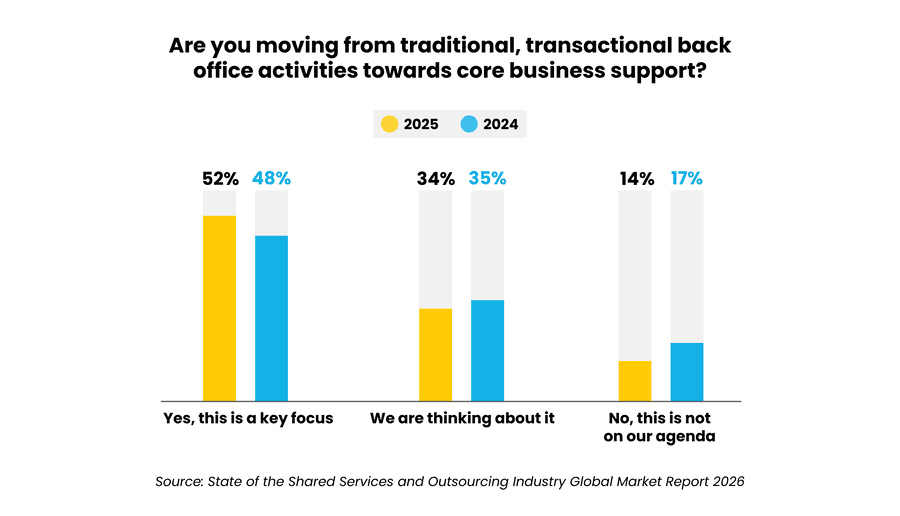

According to the 2026 SSON State of the Shared Services & Outsourcing Industry Global Market Report, 52% of organizations are already shifting from transactional back-office activities toward core business support (up from 48% in 2025), while 34% are actively considering this move. Only 14% say this evolution is not on their agenda, underscoring how widespread the shift has become.

For many organizations, this transition reflects a broader and more demanding definition of value, and it is materially reshaping the scope of work delivered by shared services.

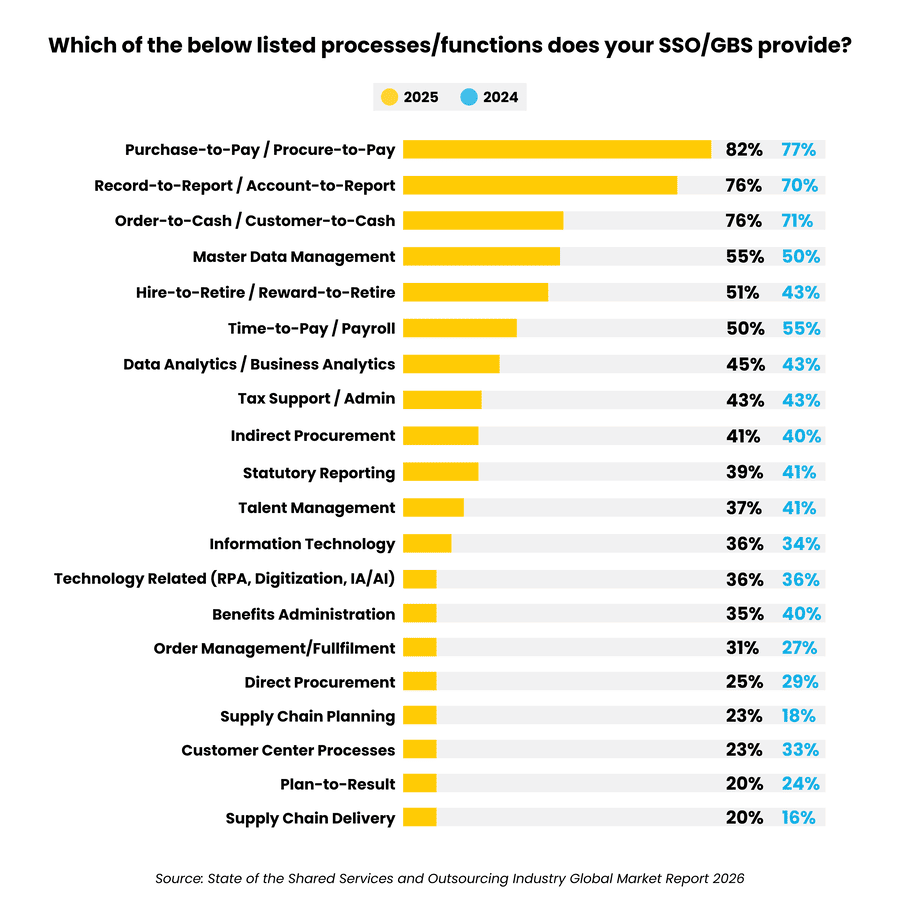

Today’s shared services/GBS organizations support a far wider range of activities that directly influence enterprise performance. SSON data shows growing delivery of data analytics and business analytics (45%), and master data management (55%), as well as expansion into consulting and advisory services (14%), marketing (16%), and sales support (12%).

Procurement activities have also been significantly increasing – entering the top 10 of services provided for the first time in 2025.

This expansion signals a clear move up the value chain — from execution to insight, enablement, and decision support. Rather than functioning solely as processing hubs, shared services organizations (SSOs) are embedded in activities that influence growth, customer experience, and strategic decision-making.

SSON underscores the implications of this shift: shared services organizations that remain confined to traditional back-office roles risk losing relevance. As enterprises demand faster insight, greater agility, and closer alignment with business priorities, transactional efficiency alone is no longer enough to justify the shared services model.

3. Global Business Services (GBS) cements its place as the preferred operating model

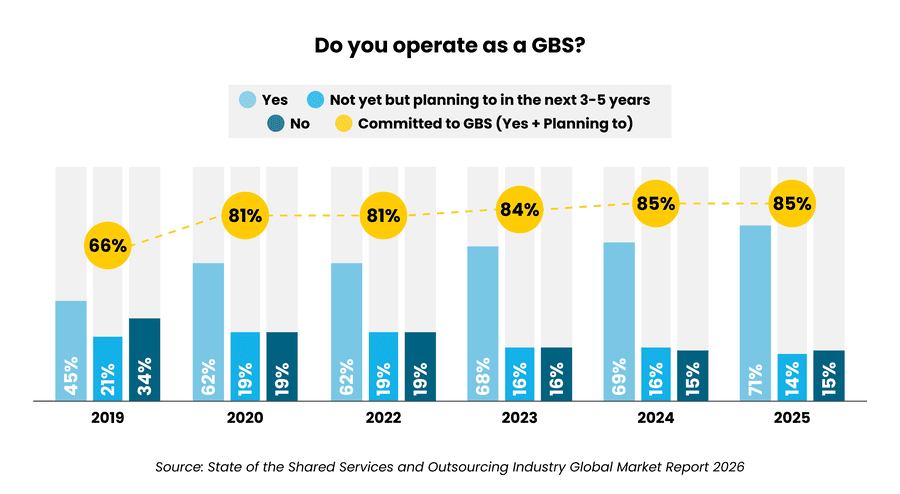

As shared services organizations expand their scope and move up the value chain, the consolidation of fragmented business units and function-specific models into more integrated Global Business Services (GBS) structures is accelerating. According to the 2026 SSON State of the Shared Services & Outsourcing Industry Global Market Report, 75% of organizations now operate multifunctional, multi-country shared services models — up from 69% a year ago — with the majority embracing GBS as their preferred operating framework.

Notably, just 15% of the market is not considering a GBS model, underscoring how firmly the approach has taken hold.

Momentum behind GBS adoption continues to build as enterprises seek operating models that can support scale, coordination, and value creation across complex environments. SSON data shows a steady year-over-year increase in organizations committing to enterprise-wide service models that span functions, geographies, and service lines — marking a clear departure from traditional shared service centers designed primarily for cost efficiency.

This shift toward GBS is also visible in how organizations position themselves internally and externally. Shared services are increasingly framed as enterprise platforms rather than standalone support functions — signaling a deliberate emphasis on integration, business alignment, and strategic relevance rather than cost reduction alone.

Structurally, GBS enables centralized governance while maintaining flexibility across regions and functions. By bringing business functions like finance, human resources, and information technology under a unified operating model, organizations are better positioned to standardize processes, deploy digital capabilities at scale, and share expertise across the enterprise. This integration supports more consistent service delivery, faster decision-making, and stronger alignment with business priorities.

The direction is clear. As expectations for value, agility, and insight continue to rise, GBS is no longer an aspirational future state. It is rapidly becoming the default operating model for shared services organizations seeking long-term relevance, scalability, and enterprise impact.

4. Scope expansion tops GBS agendas — reinforcing confidence in the model

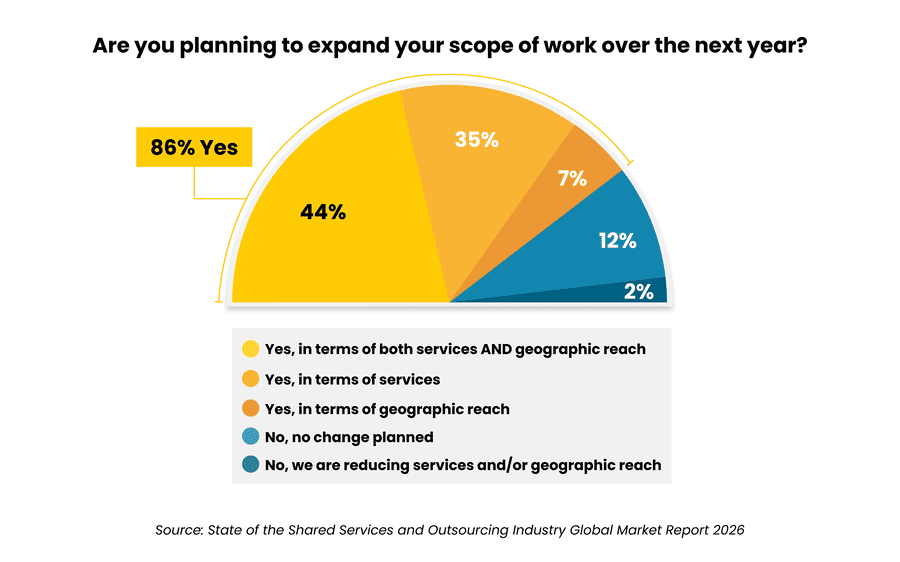

As Global Business Services models mature, organizations are expanding not just the scale of shared services, but the range and complexity of work delivered through them. According to the 2026 SSON Global Market Report, 86% of shared services organizations plan to expand the scope of services they deliver, either by adding new services, extending geographic reach, or both.

Only a small minority report no change or a reduction in scope.

That level of shared services market growth expansion sends a clear signal. Amid recurring industry debates about whether shared services continue to deliver strategic value, organizations are voting with their operating models.

If shared services were failing to deliver value, organizations would be shrinking scope — not broadening it. Instead, enterprises are committing more critical work to shared services as expectations for consistency, quality, and enterprise impact rise.

The traditional shared services “Big Three”— Finance, HR, and IT — continue to anchor most delivery models. Core financial operations remain dominant, with procure-to-pay (77%), order-to-cash (71%), and record-to-report (70%) still the most widely delivered processes across SSOs and GBS organizations.

However, organizations are increasingly offloading more complex processes within those functions. The expansion story is also increasingly visible in adjacent and specialized areas.

SSON data highlights a steady expansion into more complex, value-driven services such as master data management (55%), tax support and administration (43%), statutory reporting (39%), and technology-related services such as RPA, digitization, and AI (36%). Many organizations are also extending into customer-facing and front-office-adjacent activities, signaling greater trust in shared services to handle work that requires judgment, domain expertise, system integration, and closer interaction with the business.

Importantly, this expansion is not limited to incremental process additions. It represents consolidation of higher-value center-of-expertise activities such as analytics, reporting, governance support, and technology enablement within GBS structures built for scale and standardization.

For leading organizations, scope expansion has become a strategic lever. By broadening the work delivered through shared services, GBS leaders can extend service coverage, deepen functional expertise, and support business growth without fragmenting operations or sacrificing control.

As the scope and complexity of work increases, organizations are forced to confront a parallel question: Where can the right talent be found to support this expanded mandate at scale?

5. The search for best-available talent continues to drive multi-location models

Talent availability has become one of the most decisive factors shaping shared services and GBS operating models. Sustained workforce pressure such as persistent finance and accounting shortages combined with rising demand for analytics, judgment-intensive work, and closer business partnering are pushing organizations to rethink where and how work is delivered.

Rather than concentrating work in a single low-cost hub, organizations are distributing services across multiple regions to access broader talent pools, align skills with demand, and reduce exposure to local labor market constraints. Multi-location models also improve flexibility, supporting workload balancing, extended operating hours, and continuity amid geopolitical or economic uncertainty.

Crucially, this shift is not about adding capacity alone. It reflects a more deliberate approach to location specialization, where work is matched to the regions best equipped to deliver.

This specialization is even increasingly applied across markets within the same region. For example, an integrated Latin American platform may leverage Costa Rica to anchor high-complexity shared services and center-of-expertise functions due to its mature shared services ecosystem and highly educated, multilingual talent — while looking to the lower costs and extensive pipeline of skilled talent in Colombia for more entry-level processes.

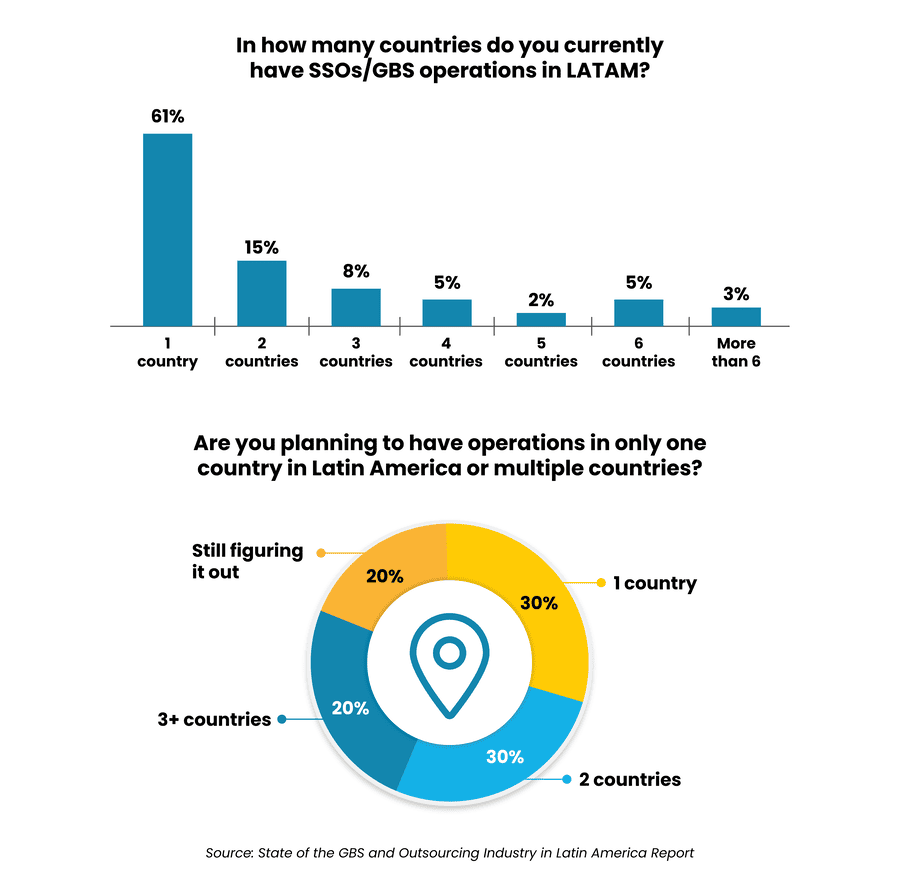

The State of the GBS and Outsourcing Industry in Latin America report conducted by SSON Research & Analytics and Auxis found 39% of organizations already operate in two LATAM countries or more, while 50% of those evaluating the region plan to establish operations across multiple countries.

Together, these differentiated strengths allow GBS leaders to design delivery models around capability, resilience, and performance, rather than relying on a one-size-fits-all footprint. SSON research reinforces that talent, not cost alone, is now the primary driver behind location decisions.

6. Outsourcing demand increases as agility and effectiveness outpace cost as the primary driver

As talent shortages persist and service expectations rise, shared services organizations are increasingly turning to outsourcing to supplement internal delivery models. According to the SSON/Auxis Latin America report, 50% of shared services organizations rely on outsourcing each year to meet their objectives, underscoring how embedded outsourcing has become in day-to-day execution.

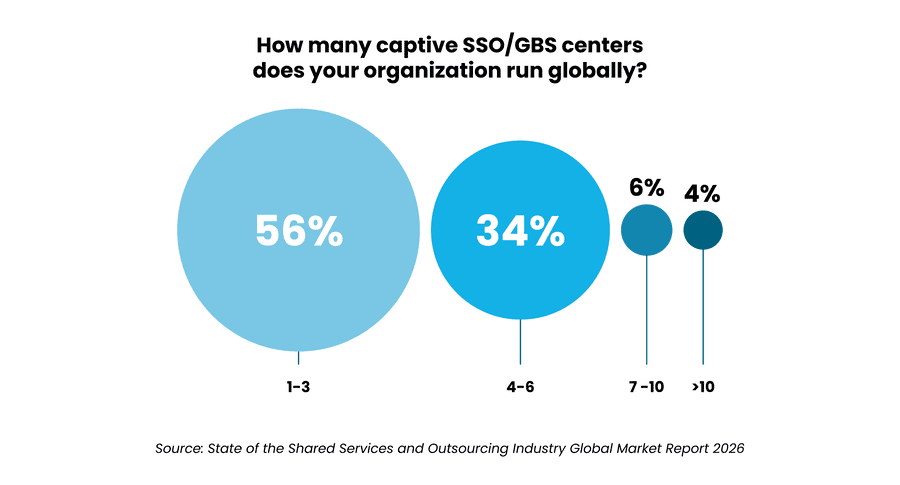

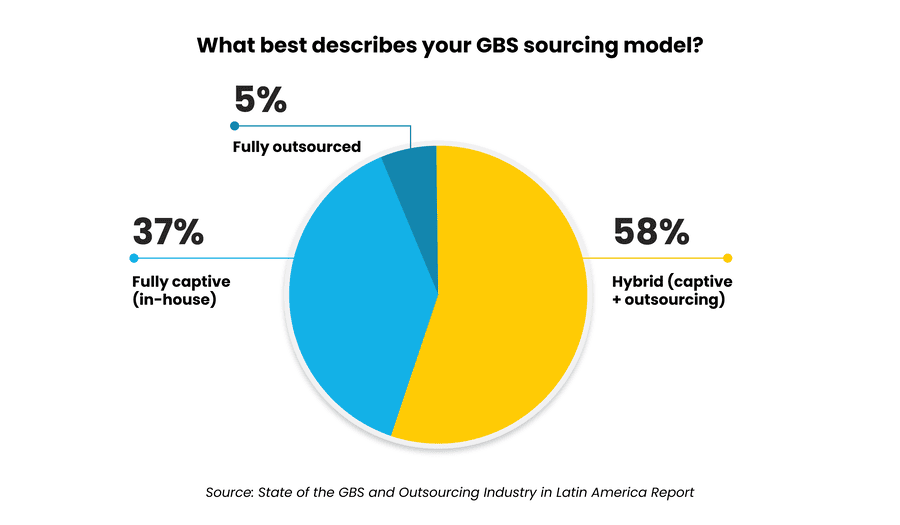

This reliance has reshaped operating models. The SSON/Auxis data shows 58% of organizations globally operate a blended model, combining captive (in-house) teams and outsourced services, while fewer than 40% rely solely on captive shared services, and just 5% are fully outsourced.

This reflects a deliberate shift toward flexibility — using outsourcing to fill capability gaps, manage volatility, and scale specialized skills without permanently increasing headcount. This flexibility is increasingly multi-location by design. Most organizations now work with up to three outsourced centers, while a quarter leverage four or more — taking advantage of the outsourcing industry’s broader geographic footprints to tap into different capabilities.

Commercial models are also evolving. Outcome-based pricing is more common among outsourcing providers (30%) than captive shared services (20%), signaling maturity in defining measurable performance expectations, and highlighting that agility and accountability remain less embedded in many in-house delivery models.

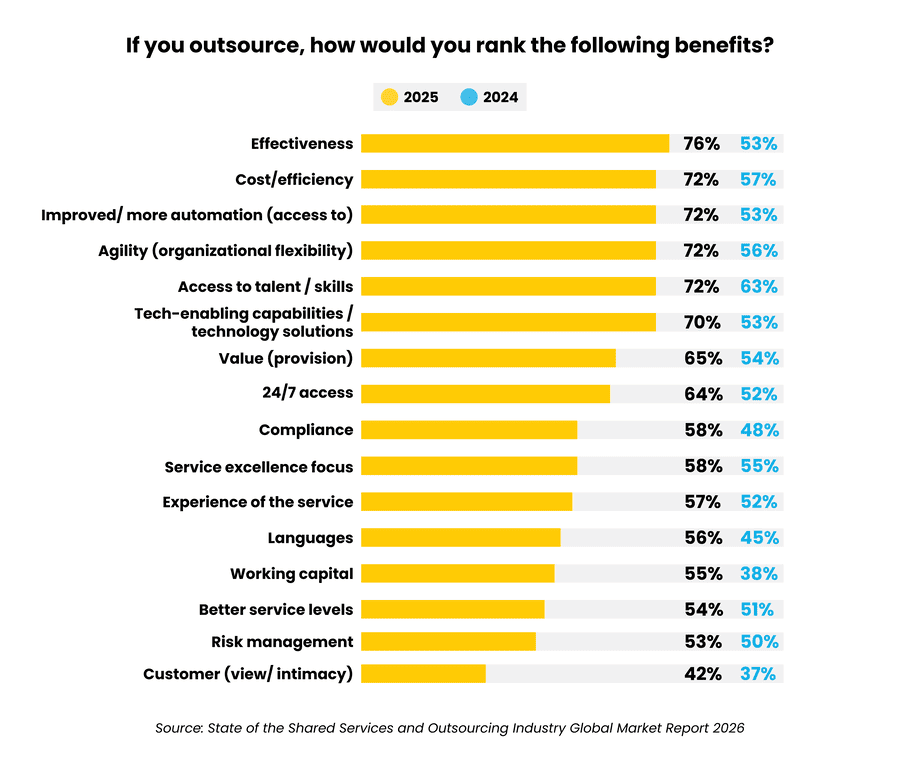

The drivers behind outsourcing are evolving as well. In 2025, access to talent and skills (63%) overtook cost and efficiency as the leading outsourcing driver for the first time since the pandemic, according to SSON. By 2026, the emphasis shifted further, with agility and effectiveness emerging as the biggest reasons organizations move to BPOs.

While cost efficiency remains important, shared services leaders are increasingly focused on responding faster to change, absorbing demand swings, and maintaining consistent performance as scope and expectations expand.

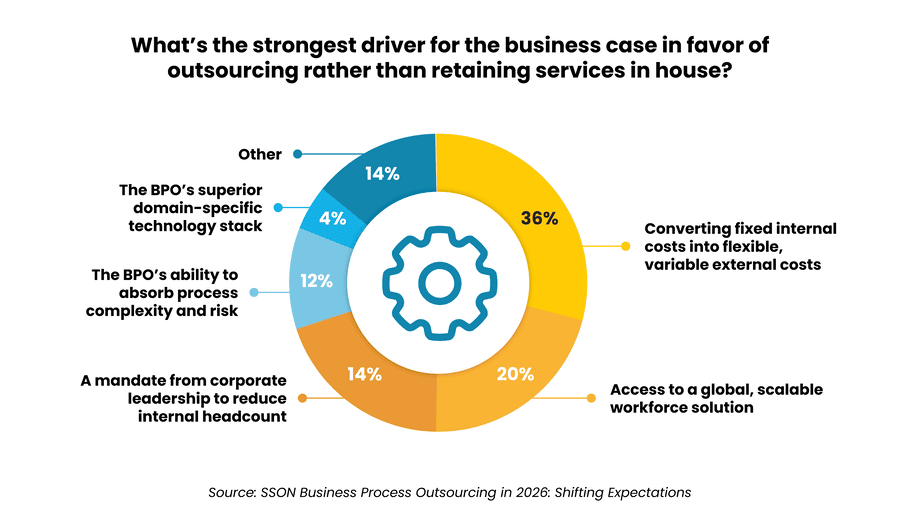

SSON’s 2026 Business Process Outsourcing: Shifting Expectations report reinforces this shift. The strongest business case driver for outsourcing is converting fixed internal costs into flexible, variable external costs (36%), followed by access to a global, scalable workforce solution (20%).

Other drivers including mandates to reduce internal headcount and a provider’s ability to absorb process complexity and risk — further position outsourcing as an execution enabler rather than a pure cost lever.

The benefits organizations report align closely with this framing, with effectiveness the biggest outcome leaders expect to see from outsourcing. Agility, access to talent, and greater automation rank closely behind — tying with cost and efficiency — as other key advantages organizations aim to achieve.

However, persistent challenges, including lack of deep business understanding, quality and consistency issues, talent attrition, and limited value creation beyond cost arbitrage continue to frustrate organizations seeking more value-driven outcomes.

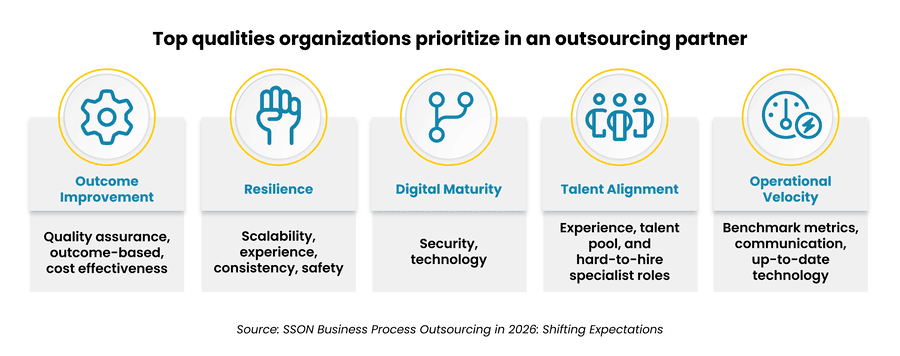

As a result, CFOS, CIOs, HR leaders, and other stakeholders are becoming more selective about who they partner with and how work is delivered. They expect outsourcing partners to act as strategic allies, embedding themselves in operations, driving innovation, and ensuring accountability for outcomes.

This brand of strategic and agility-driven outsourcing increasingly favors nearshore and hybrid models that enable real-time collaboration, tighter governance, and faster decision-making. Fragmented provider ecosystems where advisory, technology enablement, and day-to-day execution are handled by separate vendors are increasingly seen as introducing handoff risk, slowing decisions, and limiting accountability for outcomes.

Buyers are gravitating toward hybrid outsourcing providers that can deliver end-to-end support — from operating model design and digital enablement to ongoing service delivery across captive, nearshore, and offshore teams. Research from ISG and Everest Group shows growing preference for partners that can orchestrate work across locations, deploy AI and automation at scale, and offer strategic support as business needs evolve.

Outsourcing is no longer viewed as an alternative to shared services. It has become a core pillar of modern GBS operating models, working alongside captive delivery and multi-location strategies to address talent constraints and support sustained, outcome-driven growth.

7. Nearshoring surges as organizations prioritize resilience, collaboration, and real-time execution

As shared services and GBS operating models become more distributed, nearshoring is emerging as a preferred delivery strategy, particularly for organizations supporting North American operations. Rather than relying solely on offshore locations optimized for scale and cost, enterprises are blending nearshore delivery into their models to improve collaboration, agility, and operational resilience.

Tholons predicts 50% of organizations will have adopted a hybrid sourcing model by 2026 that includes nearshoring, driven by the need for greater agility and resilience (2025 Top 10 GCC/GBS Trends Report)

According to the SSON–Auxis State of the GBS & Outsourcing Industry in Latin America report, 90% of shared services and GBS leaders already operate in Latin America or plan to by 2027, underscoring the region’s growing role in global delivery strategies. While Asia-based locations remain relevant for high-volume, standardized processes, nearshore models are increasingly used to support more complex, time-sensitive, high-touch, or judgment-intensive activities.

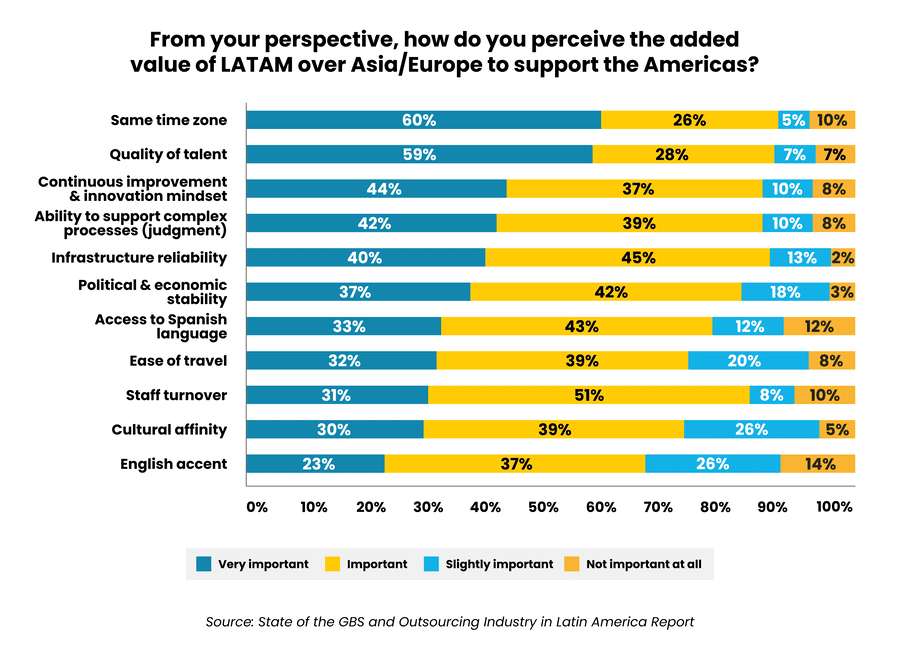

This shift is driven by both structural and operational realities. Nearshoring enables same or similar time-zone collaboration, stronger cultural alignment, and faster turnaround times — capabilities that are critical as shared services take on higher-value activities and closer interaction with the business.

At the same time, rising attrition, wage inflation, and operational rigidity in traditional offshore markets are prompting organizations to rethink overreliance on single-region delivery models.

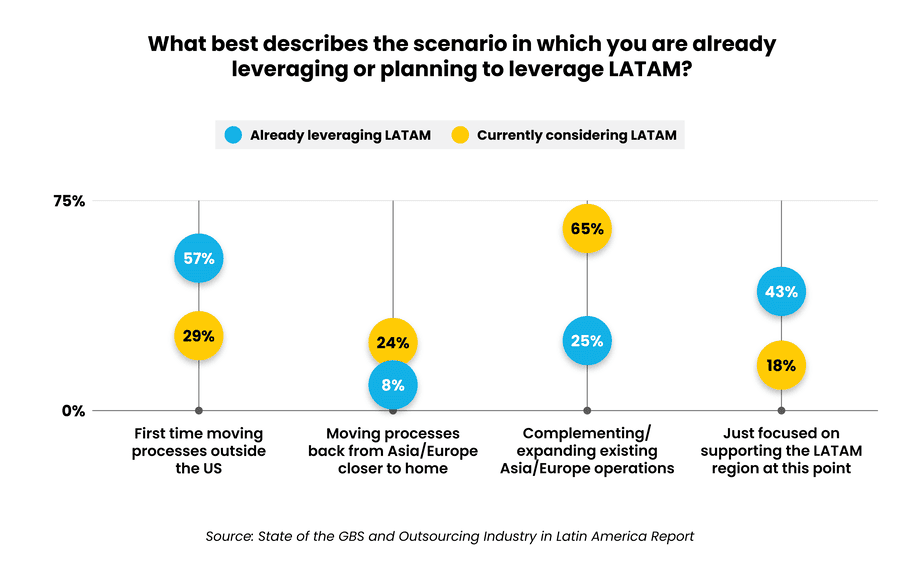

SSON–Auxis research shows that nearshoring is most often used to augment — not replace — existing global delivery models. While 57% of organizations already operating in Latin America entered the region as first-time outsourcers, many organizations evaluating LATAM today are doing so to complement or rebalance established Asia or Europe footprints.

In fact, 65% of organizations considering Latin America are looking to expand or diversify existing delivery models, reinforcing that nearshoring is being adopted as part of a broader hybrid, multi-region strategy rather than a wholesale shift away from offshore operations.

From a cost perspective, nearshoring continues to offer compelling economics. While salaries in Latin America typically fall between Asia and Europe, organizations still achieve average cost savings of 30-50%, while gaining improved collaboration, service quality, and responsiveness. For many leaders, this tradeoff is increasingly viewed as value-accretive rather than cost-dilutive.

Regional specialization further strengthens the nearshore case. Leading markets such as Costa Rica, Colombia, and Mexico have developed deep talent pools capable of supporting judgment-intensive and analytics-driven processes that have proven difficult to sustain at scale in traditional offshore locations.

Talent and operational fundamentals consistently rank as the strongest differentiators. More than 80% of respondents ranked key factors such as talent quality, time-zone alignment, ability to support complex processes, innovation, and infrastructure reliability as “important” or “very important” compared to Asia and Europe.

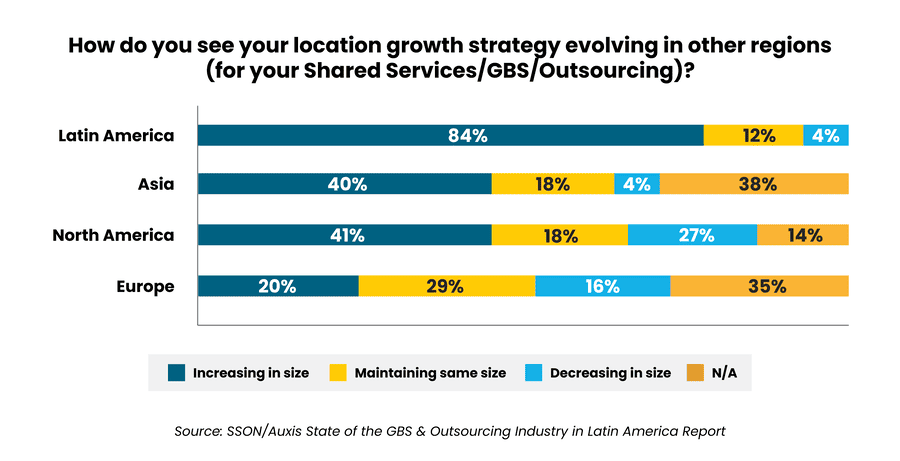

As a result, Latin America’s shared services and outsourcing market is growing faster than other regions. The SSON-Auxis report found that 96% of SSOs operating in LATAM plan to expand or maintain service levels — compared to 58% in Asia, 59% in North America, and 49% in Europe — signaling sustained confidence in nearshoring as a core component of modern GBS delivery strategies.

8. Automation and Agentic AI redefine how shared services execute at scale

SSOs/GBS are playing a significant role in driving digital agendas — not just across their own processes but across the enterprise. Over a quarter lead digitization initiatives, another quarter pilot concepts, and nearly half participate in broader enterprise programs, the SSON research found.

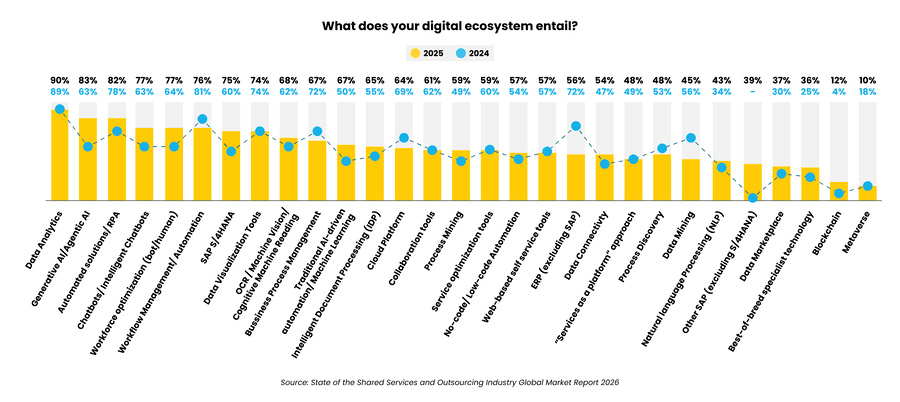

Digital ecosystems are also growing, with SSOs/GBS increasingly relying on advanced technology to improve process performance. Data analytics adoption is nearly universal (90%), followed by robotic process automation (RPA), AI, and workforce optimization.

After being absent from last year’s list, Agentic AI has rapidly emerged as a top investment priority, cited by 65% of respondents — far surpassing traditional automation tools like RPA at 40%.

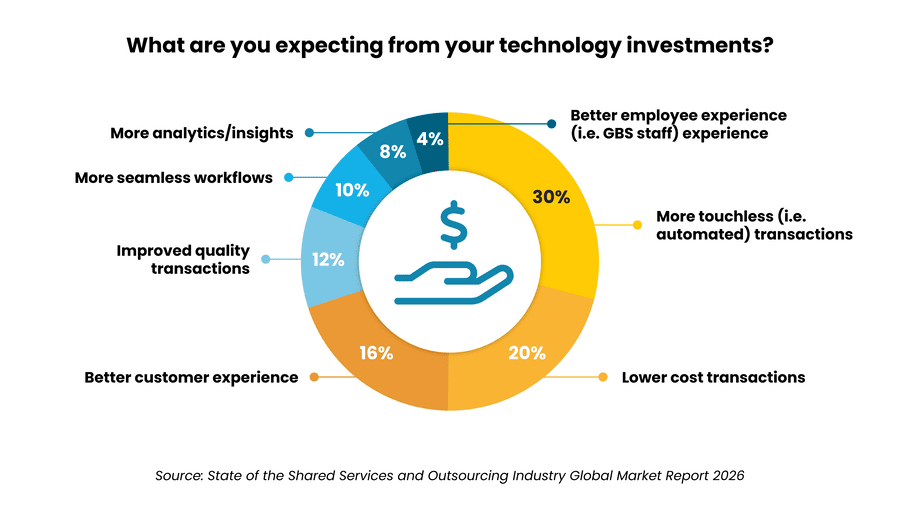

Across all investments, the majority of organizations are targeting the same results: more touchless transactions and lower costs. Interestingly, despite ever-increasing focus on customer experience, less than 20% are using tech to achieve it.

Intelligent automation remains a central lever for shared services performance, but SSON research shows most organizations are still not advanced in their automation maturity. Despite more than a decade of RPA adoption, most SSOs (56%) operate at medium automation levels — defined as 25-50% automated — and nearly 30% report low levels, revealing a persistent execution gap between ambition and reality.

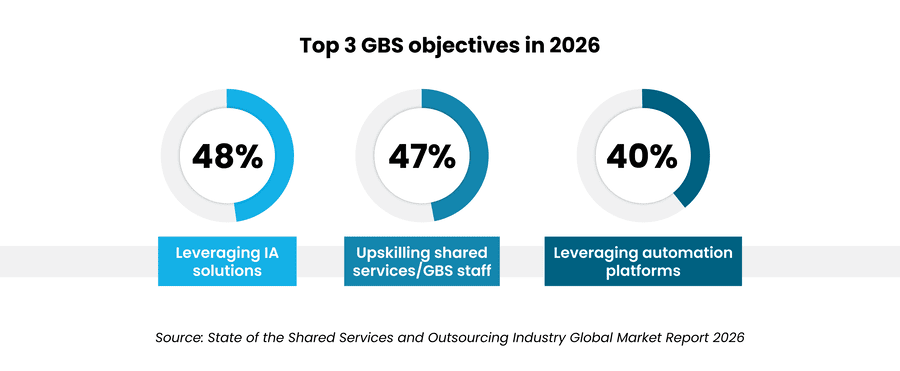

At the same time, optimism around intelligent automation is rising sharply. In the 2026 SSON survey, “leveraging intelligent automation (IA) solutions” ranks as the top SSO objective for 2026, cited by 48% of respondents. Some 40% are focused on improved use of automation platforms, signaling a shift from experimentation toward scalable execution.

Nearly 40% of organizations now manage Generative AI (GenAI) and Agentic AI initiatives directly within SSO/GBS, reflecting growing ownership of AI-enabled delivery rather than isolated pilots. This shift is laying the groundwork for Agentic AI, which extends traditional automation by enabling goal-driven agents to coordinate decisions, trigger actions, and manage workflows across systems.

Expectations are significant. Nearly half of respondents believe Agentic AI will replace some captive activities within three years, while another 40% are actively considering it.

Expectations for replacing outsourced work are far more measured, reinforcing that Agentic AI is reshaping delivery models, not eliminating them.

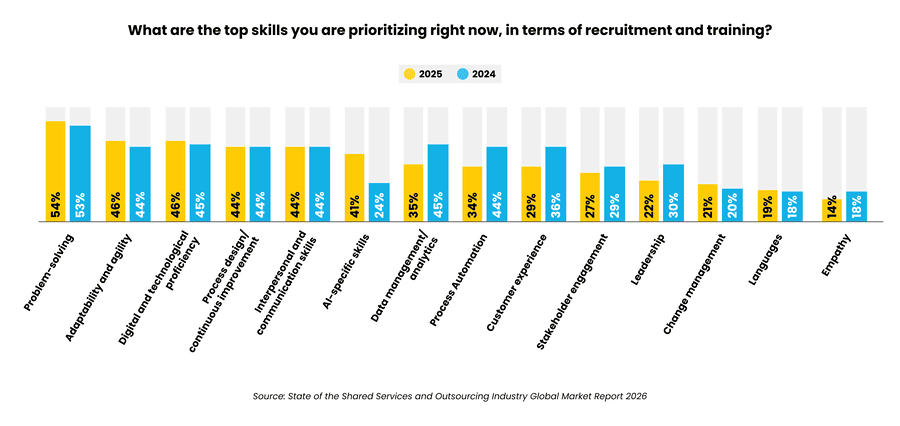

To support this transition, organizations are rethinking both skills and governance. AI and automation skills now rank alongside data and analytics as top workforce priorities, and 53% of respondents say they are introducing AI- or agentic-focused leadership roles to guide adoption and accountability.

Success depends less on deploying individual tools and more on operationalizing automation within scalable, outcome-driven operating models.

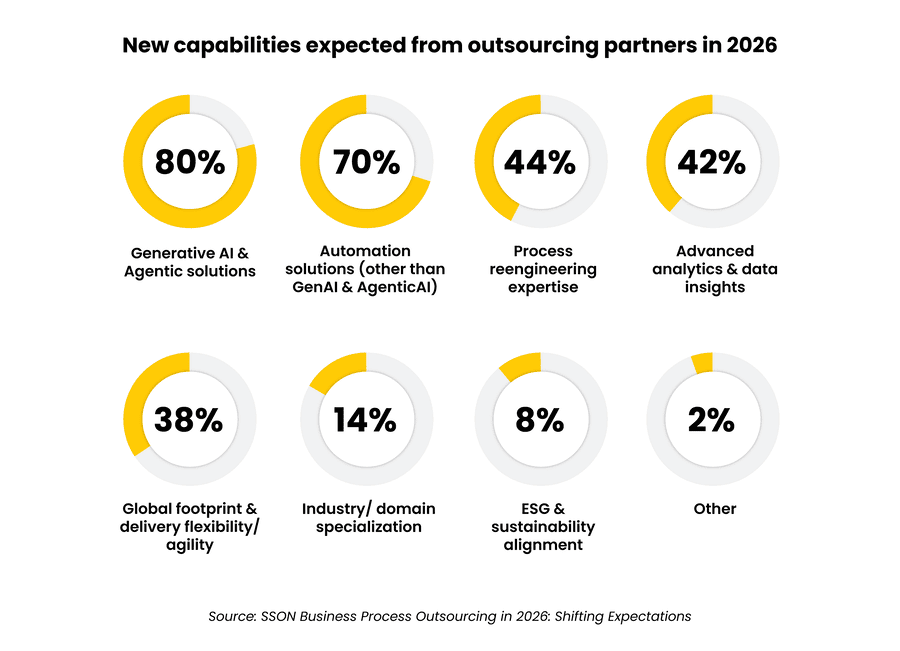

SSON’s Business Process Outsourcing survey reinforces why execution has become the priority. Some 80% of organizations expect Generative and Agentic AI capabilities from their outsourcing partners, while 70% expect broader automation expertise. More than half also rely on outsourcing to close technology capability gaps, underscoring the role of partners in embedding AI into day-to-day delivery.

As a result, outsourcing is evolving from a supplemental labor model into a technology accelerator, providing ready access to AI-enabled workflows, proven use cases, and scalable execution across distributed delivery environments. As shared services expand into higher-discretion and front-facing work, the ability to operationalize AI across people, processes, and platforms has become a defining differentiator.

Alongside emerging technologies such as Intelligent Document Processing, Generative AI, and advanced analytics, Agentic AI signals a pivotal shift — from task-level automation and insight generation toward intelligent, coordinated execution at scale. For organizations navigating talent constraints and rising service expectations, success now hinges less on whether AI is adopted, but more on whether it is operationalized.

That dependence is already evident. A Deloitte survey found that 83% of executives are leveraging AI as part of their outsourced services, while SSON data confirms that outsourcing remains a core execution lever for roughly half of shared services organizations — underscoring the growing role of partners in turning AI ambition into enterprise-scale results.

It is important to note, however, that as automation and Agentic AI mature, their effectiveness increasingly depends on the quality of decisions they are fed — placing analytics at the center of execution.

9. Analytics becomes the foundation for higher-value shared services

As shared services providers expand beyond transactional execution, analytics is becoming foundational to how value is delivered and measured. The 2026 SSON State of the Shared Services & Outsourcing Industry Global Market Report shows that data analytics is now the top technology embedded across SSO/GBS environments, reflecting rising demand for real-time visibility, performance insight, and decision support across enterprise functions.

More than half of shared services organizations now operate beyond basic descriptive reporting, reaching interpretive, predictive, or prescriptive analytics stages. Rather than relying solely on historical reporting, these organizations are using analytics to guide operational decisions, identify performance gaps, and support outcome-based service delivery.

The impact is most pronounced in functions where shared services already manage large volumes of structured data. Core finance processes such as order-to-cash, procure-to-pay, and record-to-report continue to serve as primary use cases, enabling improved cash forecasting, working capital optimization, exception management, and performance benchmarking.

Beyond finance, analytics adoption is expanding into workforce planning, productivity analysis, and service-level optimization, helping leaders allocate resources more effectively across distributed delivery models.

At the same time, analytics maturity remains uneven. While investment is widespread, many organizations still struggle with data standardization, governance, and analytics talent, limiting their ability to scale valuable insights consistently across regions and functions.

As shared services take on broader scopes and more judgment-intensive work, the ability to operationalize analytics, embedding insights directly into workflows and decision processes has become a critical differentiator. This is where analytics increasingly converges with automation and AI. Rather than functioning as a standalone capability, analytics now serves as the decision layer that informs intelligent automation, GenAI, and emerging Agentic AI models — helping organizations move from insight generation to action.

For leading shared services organizations, analytics is no longer a reporting function; it is the foundation for delivering measurable value, supporting strategic decisions, and reinforcing the shift from back-office efficiency to enterprise enablement.

10. Talent constraints force shared services to rethink workforce strategies

As shared services organizations take on broader, more judgment-intensive work, talent availability has emerged as one of the most significant constraints on performance and scalability. The 2026 SSON Global Market Report shows that while digital capabilities are expanding rapidly, workforce readiness has not kept pace — forcing leaders to rethink how talent is sourced, deployed, and sustained.

This pressure is evident in the skills organizations are prioritizing. According to SSON 2026 data, problem-solving remains the top skill focus for recruitment and upskilling, followed closely by adaptability, digital and technological proficiency, process design and continuous improvement, and data and analytics capabilities.

As automation absorbs routine tasks, shared services teams are increasingly expected to manage exceptions, interpret insights, and act as advisors to the business, thereby raising the bar for human capability across all functions.

At the same time, traditional talent models are proving insufficient. Competition for digitally skilled professionals remains intense, while shared services organizations continue to expand across regions, functions, and service lines. This combination is stretching local labor markets and increasing reliance on more flexible workforce strategies.

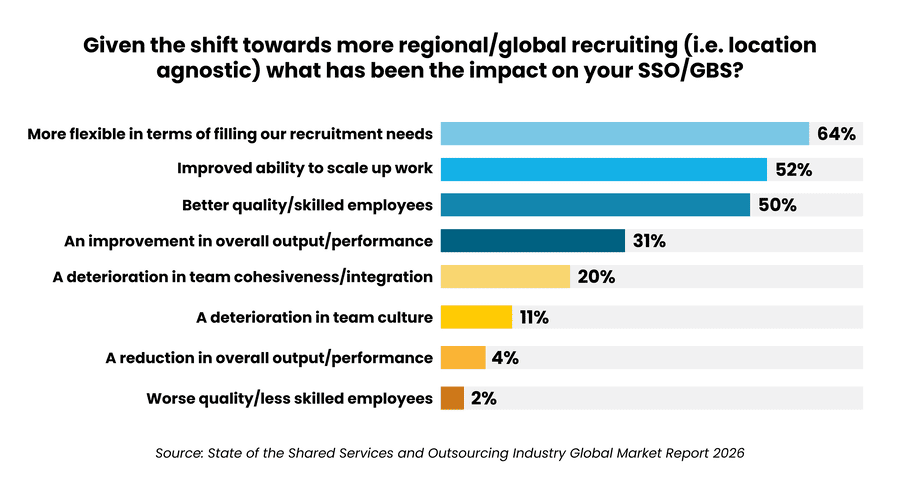

Location-agnostic and hybrid models combining remote and onsite work have become central to this shift. SSON 2026 data shows that hybrid work is the dominant operating model, with the majority of organizations reporting primarily hybrid workforces.

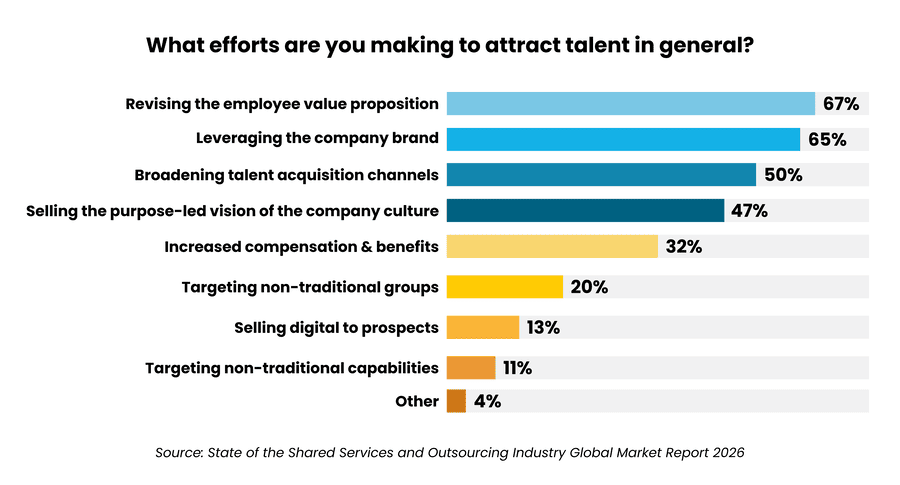

Importantly, SSON findings indicate the regional and global recruiting this enables has delivered tangible benefits. Half of respondents report improved talent quality, while many also cite greater flexibility and improved ability to scale work — challenging earlier assumptions that distributed work would dilute performance or culture.

To compete for scarce skills, shared services organizations are increasingly revisiting their employee value propositions (EVPs). SSON research highlights growing emphasis on career development, digital and innovation exposure, global experience, flexibility, and purpose, often outweighing compensation as differentiators. These shifts reflect a broader recognition that talent attraction and retention are now inseparable from operating model design.

The SSON–Auxis State of the GBS & Outsourcing Industry in Latin America report further reinforces this trend. As organizations expand into multi-location and nearshore models, talent strategy and location strategy are becoming tightly intertwined. Access to scalable, digitally capable talent pools, rather than pure cost advantage, is increasingly driving where work is placed and how delivery models are structured.

Taken together, these dynamics signal a fundamental change in how shared services approach workforce planning. Talent is no longer managed as a static input, but as a strategic variable orchestrated across automation, hybrid work, multi-location delivery, and selective outsourcing.

For shared services organizations seeking to sustain performance and value creation, rethinking workforce strategy is no longer optional; it is foundational to execution at scale.

The future of shared services blends efficiency with enterprise value

Shared services remains a resilient and trusted operating model, even as expectations continue to rise. The 2026 State of the Shared Services & Outsourcing Industry Global Market Report from Shared Services & Outsourcing Network (SSON) shows that organizations are maintaining or expanding shared services scope — signaling confidence not just in efficiency, but in long-term impact.

What has changed is the bar for success. Cost discipline is now assumed; differentiation comes from value creation. Leading shared services organizations are expected to deliver efficiency and measurable business outcomes — improving service quality, enabling better decisions, and supporting enterprise priorities.

Technology and talent sit at the center of this evolution. Automation, advanced analytics, and emerging Agentic AI capabilities are reshaping how work is executed, while skill demands are shifting toward problem-solving, digital fluency, and business partnership. Rather than replacing human roles, these technologies are elevating them, pushing teams toward higher-value, judgment-intensive work.

To support this shift, operating models are evolving. Organizations are expanding functional scope, adopting multi-location and nearshore strategies, and using outsourcing more strategically to access scarce skills and operationalize technology at scale. The result is a continued move away from siloed, transaction-focused delivery toward integrated, enterprise-aligned service models.

As disruption across talent, technology, and delivery accelerates, the shared services organizations that succeed will be those that can consistently turn efficiency into insight, automation into execution, and scale into sustained enterprise value.

Why Auxis: Turning shared services ambition into execution

Shared services and GBS have reached an inflection point. As this year’s trends make clear, organizations are being asked to deliver more value, more insight, and more resilience — often with the same or fewer resources. While cost efficiency remains essential, it is no longer the differentiator. The real challenge lies in execution: operationalizing technology, redesigning operating models, and sustaining performance amid ongoing talent constraints and rising expectations.

This is where many organizations struggle. Fragmented delivery models, siloed technology initiatives, and disconnected advisory and execution partners often slow progress and dilute impact. As shared services take on broader, more judgment-intensive work, enterprises increasingly need partners that can move beyond recommendations and pilots to deliver measurable outcomes at scale.

Auxis – recognized as a global outsourcing and shared services leader by respected industry bodies including IAOP, ISG, and Everest Group — helps organizations close that gap. Through an end-to-end delivery model anchored in Latin America with the ability to expand globally, Auxis combines strategic advisory, technology enablement, and ongoing service delivery across captive and outsourced environments.

Now part of Grant Thornton U.S., and with deep partnerships across platforms such as UiPath and Microsoft, Auxis aligns operating model design, intelligent automation, analytics, and AI within a single execution framework — reducing handoffs, accelerating time to value, and increasing accountability.

Whether organizations are expanding scope, redesigning delivery footprints, scaling automation and Agentic AI, or addressing persistent talent shortages, Auxis brings the integrated capabilities required to move from strategy to sustained results. We don’t just help clients define the future of shared services — we help them build and operate it.

Ready to partner with us? Schedule a consultation with our shared services and GBS leaders to explore how Auxis can help you turn today’s trends into a scalable, future-ready operating model. Or visit our resource center to dive deeper into shared services trends, strategies, and real-world success stories.

Frequently Asked Questions

What are the top shared services trends shaping 2026?

How are Global Business Services (GBS) models different from traditional shared services?

Shared services vs. GCC: What’s the difference?

Why are organizations increasing outsourcing and nearshoring within shared services?

How are automation, analytics, and AI changing the future of shared services?