In brief:

- The much-publicized layoffs of 2023 did not change the tech talent shortage issue in the United States, with nearly 4 million tech jobs available.

- 90% of tech managers say finding top talent remains a concern as several hiring challenges continue to persist.

- In-demand technology positions include cyber security, cloud computing, and software development; strong demand for mid to senior talent as well as those with project management experience.

- The ability to work remotely continues to be attractive to tech candidates; employers are offering hybrid or remote jobs as incentive to attract top talent.

Despite the massive layoffs by major tech firms in 2023, driven by economic uncertainty and fears of a recession, the tech job market remains strong going into 2024. The tech economy has proven far more resilient than what was predicted, with tech unemployment rates trending well below the national average.

However, because of the unease in the market, average annual salaries saw a very modest increase of 2% on average in 2023, versus the nearly exponential growth trends over the past decade, according to Motion Recruitment’s 2024 Tech Salary Guide. Revenue growth and a continued emphasis on cost optimization have replaced talent acquisition as a top concern for enterprises, the Everest Group 2024 Key Issues Study found.

But while neither employers nor tech workers seem to have the upper hand in today’s marketplace, most of the challenges faced by hiring managers in the last couple of years continue to persist in 2024.

Understanding the labor statistics and tech salary trends shaping today’s IT market helps CIOs think strategically about the future of their departments. Here are tech talent trends to watch in 2024 – and the best solution for recruiting and retaining the high-quality resources you need to drive innovation, digital transformation, and growth for your business.

1. Tech talent shortage continues despite layoffs, but average salary growth slows

2023 was an unusually bumpy year for the tech talent market, with mass layoffs led by FAANG companies (Meta, Apple, Amazon, Netflix, Alphabet). These companies, along with Microsoft, had been on a steady hiring spree since 2019, and accounted for 42% of all tech layoffs last year.

However, contrary to expectations, this did not flood the candidate pool and make hiring easier. There continues to be a tech talent shortage across the United States, with nearly 4 million tech jobs available, according to Motion Recruitment.

This can be attributed to a few factors:

- Talent reabsorption continues at an all-time high. 79% of people laid off last year found a new job within three months.

- Many non-tech companies were less affected by the conditions of early 2023 that led to layoffs, continuing to grow and hire tech resources.

- 63% of tech workers who were laid off started their own company within 12 months of losing their job. This wasn’t due to a lack of other options but to grow their skills, make more money, or create something new. This is emerging as a new contributor to the tech talent gap.

- Internal recruitment teams as well as HR and marketing teams at tech companies were hit harder, as opposed to tech positions, by layoffs last year.

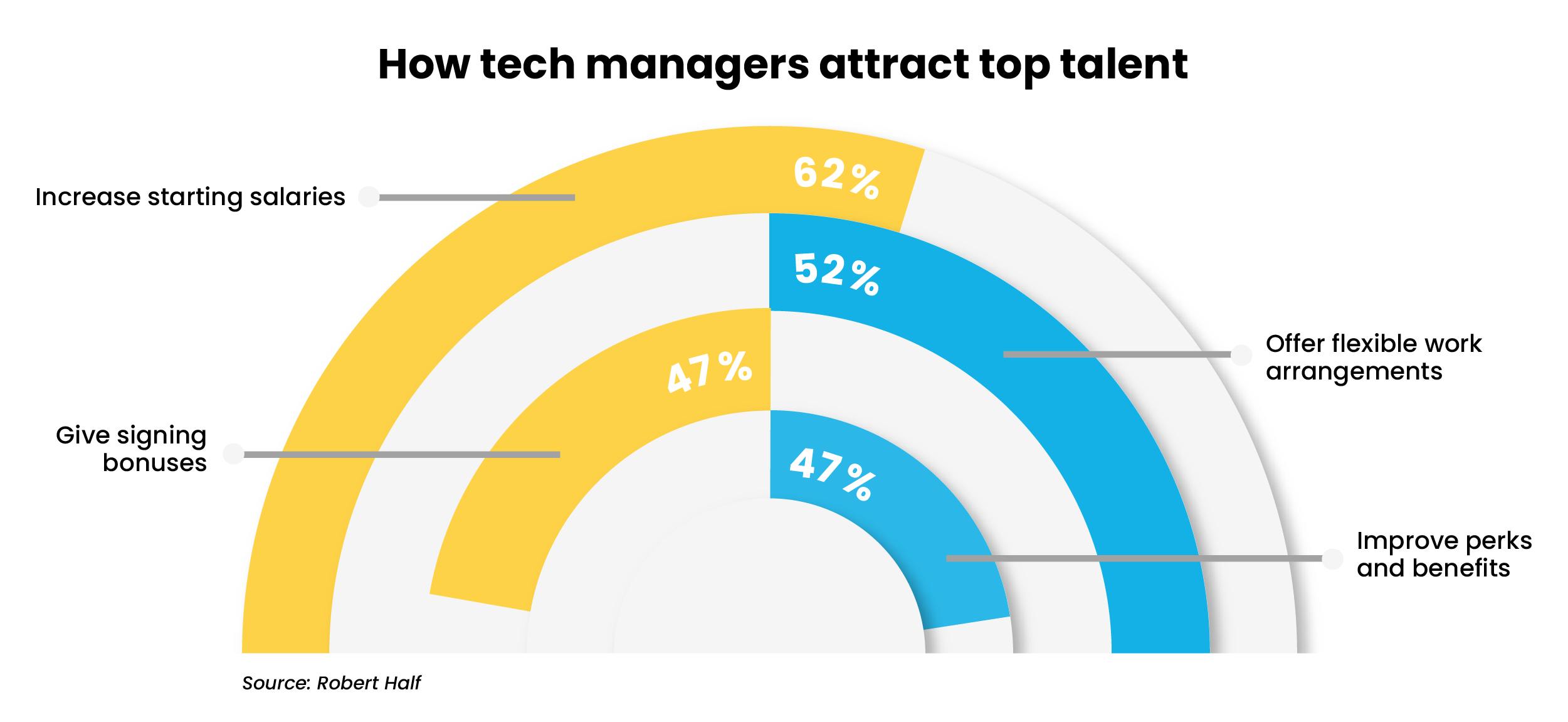

Given this, it is no surprise that finding top talent remains a challenge for 90% of tech managers, according to Robert Half’s 2024 Salary Guide.

IT salary growth, on the other hand, has overall normalized after 2022’s hyperactive growth. Despite fears of hyperinflation having proven unfounded, most organizations in 2024 will be looking to ‘do more with less,’ prioritizing revenue growth and cost optimization over talent acquisition, Everest Group found.

All this means that, breaking from the trend of the past few years, it is no longer a job candidate’s market with an abundance of opportunities and competing salaries on offer. But demand for critical technology skills remains as high as in previous years, with top-level talent still able to pick and choose from multiple offers.

2. Demand, and salaries, for strategic and emerging technology skills remain high

Even as enterprises look to optimize costs in 2024, they are continuing to accelerate adoption of technologies which are strategic and fundamental to growth. As a result, technology profiles including cyber security, cloud, software development, and data science and database management remain in demand and command top dollar.

Everest found that the majority of enterprise executives are also optimistic about the evolution and adoption of new technologies in generating cost savings and growth. Foremost among these is Artificial Intelligence (AI). AI and Big Data will be the biggest reskilling focus for companies inside the U.S., the World Economic Forum’s Future of Jobs Report 2023 said, and AI and Machine Learning jobs will be critical for business transformation in the next five years.

45% of tech leaders said AI spending is a top priority for their company in 2024, Motion Recruitment found, with companies spending top dollar for IT workers who can create AI and ML tools that help computing and processing powers take giant leaps forward. This is also reflecting in salaries, with software engineers that are AI-focused seeing an 8-12% compensation bump compared to their non-AI counterparts.

Experienced IT project managers are expected to be in demand through 2024, according to Randstad’s 2024 salary guide, given that “project management” now ranks as the number one most in-demand specialization sought by employers.

There has also been a surge in demand for relatively senior or experienced candidates. More than 55% of all tech job opportunities today are tailored for mid-level employees, indicating a strong demand for individuals with a few years of experience, according to hackajob’s Emerging Tech Talent Trends in 2024 and Beyond report. 31% of job openings specifically target senior technology professionals.

Senior resources bring deep knowledge of complex systems, problem-solving skills, and a proven track record of successful projects, as well as provide mentorship and guidance to junior team members, ensuring knowledge transfer and skill development within the organization.

3. Remote work: a bone of contention

With the pandemic-induced remote working spike petering out, several enterprises are now asking (and struggling, in several cases) for employees to be back in the office, emphasizing creativity, collaboration, and a stronger company culture fostered by in-person work. Job listings that advertise fully remote positions dropped over 2023, with companies and hiring managers no longer wanting to do a nationwide search for most roles.

However, many tech employees advocate for continued remote work, citing the flexibility it offers, reduced commuting stress, and the positive impact on work-life balance. Motion Recruitment found that only 28% of workers said their company is making it worthwhile to come into the office, while over 50% of frontline workers believe that being fully in office is ideal for career advancement. In this situation, hybrid working has emerged as an ideal middle ground, with flexible working arrangements being offered by recruiters to attract top talent.

Employees with over seven years of experience favor remote work more, Randstad found. Software developers at this experience level, particularly, have demonstrated a preference to work from home full-time. Companies with hybrid models, then, should prepare to offer higher salaries to offset the fully remote incentives being offered by their lesser-known peers, and may have to brace for a longer time to fill positions.

4. Nearshore outsourcing: the solution for high-quality, affordable IT talent

Going into 2024, several challenges faced by hiring managers in the last few years persist: a tightening technology job market, long timelines to fill critical IT roles, as well as high attrition rates. 64% of tech employees are looking or planning to look for a new job, requiring managers to place a renewed focus on retention.

All this means that companies will need to improve their employee experience, re-think hiring strategies, and more importantly, find alternative approaches to alleviate the talent gap.

Nearshoring provides a strategic opportunity to address this. Top nearshore locations like Costa Rica and Colombia have invested heavily into becoming technology hubs and developing tech talent. The high literacy rate, large talent pool, and strong investment and innovation ecosystem have made both countries strong contenders for the title of Silicon Valley of Latin America. Several tech giants and global brands such as Microsoft, Apple, Johnson & Johnson, and Amazon have built a large presence in these countries.

43% of respondents to Everest Group’s Key Issues survey said they are expecting their global services budgets to increase from last year, and plan to leverage IT and business process outsourcing more.

U.S. businesses can realize the value of scalable, nearshore IT teams with up to 50% labor arbitrage and productivity efficiencies of 10-30% compared to onshore teams. Nearshoring to Latin America also resolves many pain points created by offshore models that undercut the speed, synergies, and responsiveness essential to IT. That includes the difficulty of doing business across faraway time zones, language and cultural barriers, and a more competitive labor market with high turnover.

Outsourcing to a reputable nearshore IT provider holds the key to winning the tech talent war – delivering skilled professionals ready to serve customers, support a remote workforce, and enable ever-evolving technology operations.