In brief

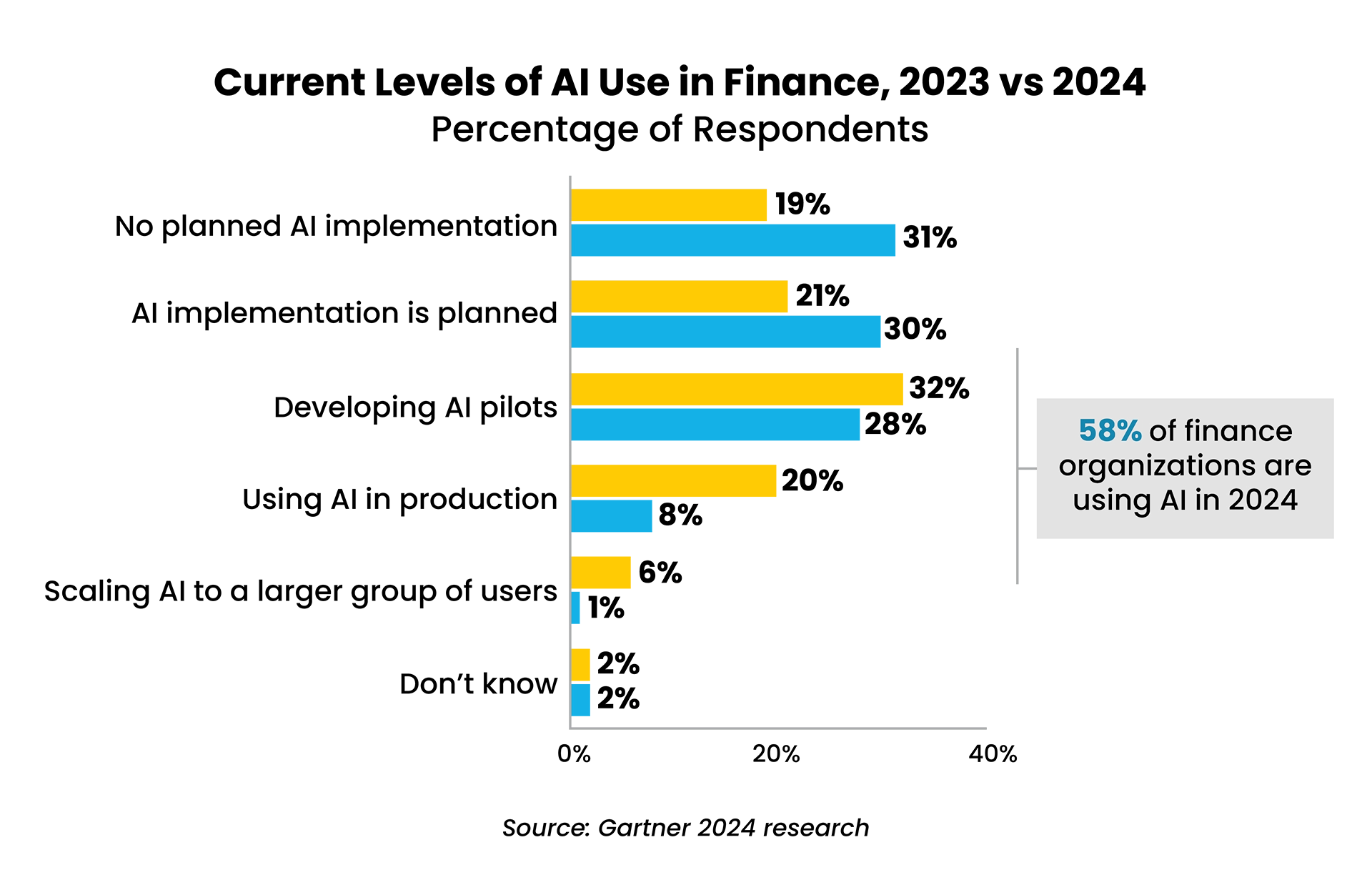

- 58% of finance organizations have adopted AI, up from 37% the previous year, underscoring the urgency of finance digital transformation.

- Elevating traditional RPA finance solutions with emerging technologies like Agentic AI and Generative AI offers the greatest transformative possibilities.

- 86% of finance teams say they’ve seen no significant value from their AI investments, often due to skills shortages.

- 81% of finance functions are adopting or planning to adopt AI through outsourced services to access the talent and tools they need to achieve sustainable success.

Finance leaders are under mounting pressure to deliver more value with fewer resources. At the same time, the nature of finance is changing – with finance teams being called upon to not only report on the past but to be more forward-looking and steer their business through uncertainty and volatility.

As demands for speed, accuracy, and strategic decision-making increase, CFOs require a smarter, more agile approach to scale operations and improve performance. While cost savings matter, finance digital transformation is ultimately about empowering finance teams to work with more speed, precision, and confidence.

CFOs are also prioritizing digital transformation in finance and accounting due to the current economic climate, Grant Thornton’s 2025 Q1 CFO survey found – with new tools for financial operations and data analytics expected to help deal with uncertainty and provide a reliable return on investment. Automation further helps CFOs confront ongoing finance talent shortages, increasing productivity while decreasing turnover by taking over tedious tasks that impact job satisfaction.

The urgency behind finance digital transformation is apparent. Some 58% of finance organizations have adopted artificial intelligence (AI), compared to the 37% that embraced AI the previous year, Gartner research found. In 2026, “leading transformation efforts” continues to rank among the top priorities for CFOs.

What is finance digital transformation?

Digital transformation in finance involves the strategic use of technology to automate repetitive tasks such as data entry, invoice processing, and reconciliations. These changes allow finance departments to shift their focus from manual work to higher-value functions like forecasting, analysis, and strategy.

The benefits of AI and automation in finance solutions are clear: faster cycle times, fewer human errors, better decision making, and long-term cost efficiency. Yet, many organizations fall short of realizing these gains due to limited in-house expertise, poor data quality, budget constraints, and business needs that constantly evolve.

To navigate these challenges, a growing number of CFOs are turning to tech-enabled outsourcing as a catalyst for finance transformation. By partnering with providers who bring built-in digital capabilities and specialized finance talent, organizations can accelerate automation efforts and drive impact faster.

According to Deloitte’s 2024 Global Outsourcing Survey, over 80% of finance leaders are already integrating AI into their outsourced services to achieve sustainable results.

The top 5 technologies driving AI & automation in finance

Modern transformation requires strategic investment in the right talent and technologies. While maximizing ERP automation and deploying Robotic Process Automation in finance are foundational, forward-thinking CFOs are moving beyond traditional tools to leverage digital technologies like Agentic AI, Generative AI, and Intelligent Document Processing (IDP).

Agentic AI

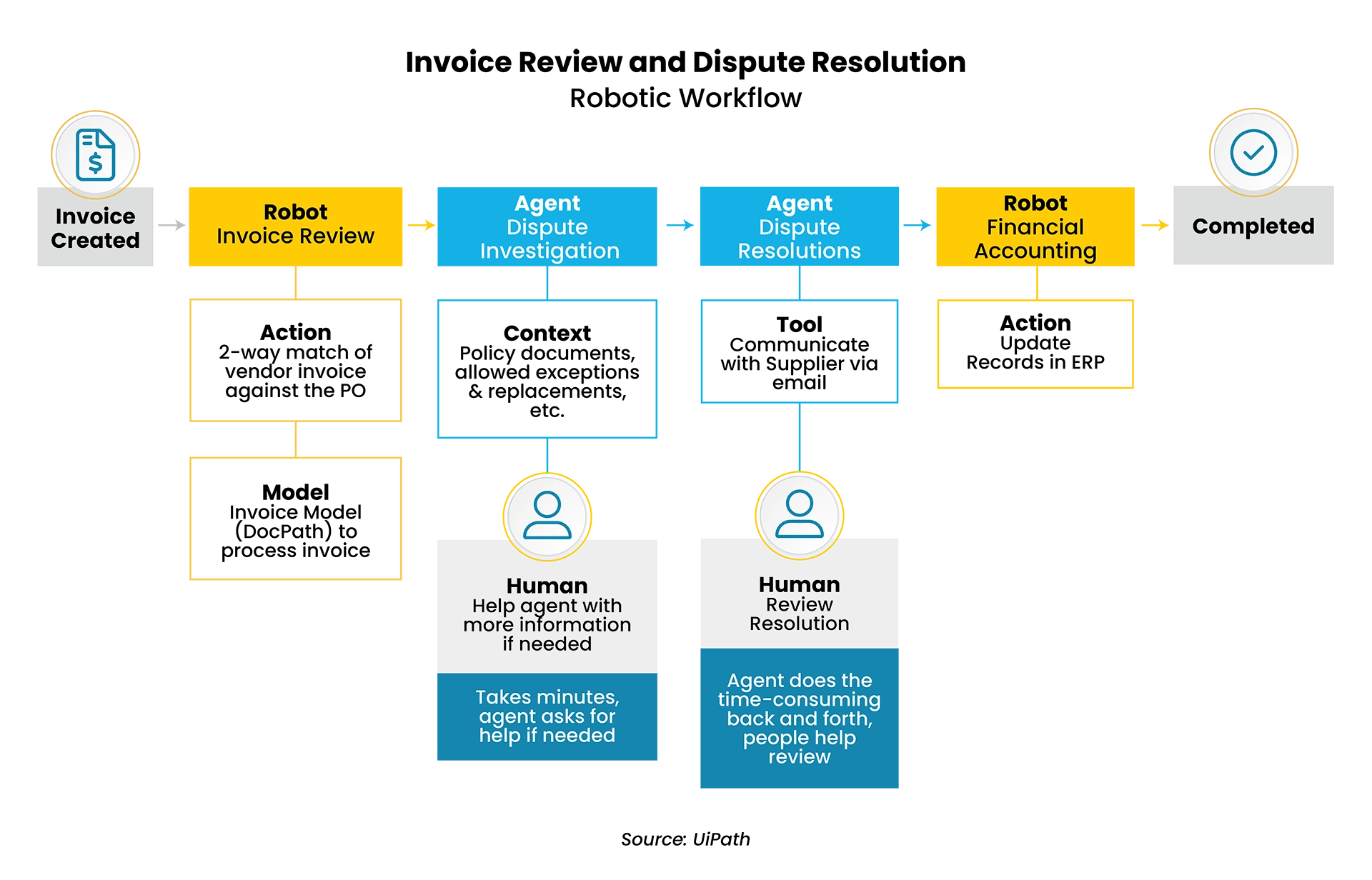

Agentic AI represents the next evolution of automation, empowering intelligent agents to independently manage tasks, tools, and decision-making processes without constant human input. Unlike traditional bots or Generative AI, these agents can autonomously execute complex, judgment-driven workflows such as real-time forecasting, budget monitoring, month-end financial close orchestration, and vendor validation.

For finance teams, the benefits are game-changing: faster execution, higher accuracy, and the ability of cross-functional teams to focus on higher-value work. It’s no surprise that 90% of executives believe agentic automation has the potential to enhance their business processes, according to the UiPath 2025 Agentic AI report.

Generative AI

Generative AI (GenAI) is accelerating the shift from manual finance processes to more efficient, automated finance workflows. With natural language capabilities, GenAI simplifies tasks like reporting, inquiry management, and decision-making, making complex insights more accessible.

While adoption is still ramping up, with 21% of finance teams still in the planning phase by the start of 2025, according to Gartner, AI usage is expected to keep growing rapidly.

When paired with Robotic Process Automation for finance, GenAI serves as the “brain” behind end-to-end workflows, enhancing functions like vendor communication, fraud detection, forecasting, and even compliance checks. GenAI can analyze information and formulate an intelligent response to vendor inquiries, for example – while RPA serves as the “muscle,” gathering relevant current and historical data to create the context GenAI needs to create the most accurate content and then delivering the response.

As improving customer experience becomes a top priority in transformation plans this year, 64% of CFOs have already deployed GenAI to strengthen customer interactions, marking a 19-point increase within 15 months (Grant Thornton survey).

Intelligent Document Processing

Intelligent Document Processing (IDP) tackles a major challenge in finance: the manual extraction of financial data from high volumes of documents such as invoices and spreadsheets — a task where 52% of accounts payable (AP) teams still spend over 10 hours weekly (IFOL Accounts Payable Automation Trends 2024). Unlike traditional optical character recognition (OCR) tools, advanced IDP solutions like UiPath’s Document Understanding leverage AI, machine learning, and natural language processing (NLP) to handle even complex, unstructured documents with precision.

For accounts payable, AI-powered IDP enables high levels of touchless processing, accelerating invoice approvals, reducing errors, and enhancing vendor relationships. It also transforms areas like accounts receivable (AR), regulatory reporting, and financial analysis.

Communications Mining

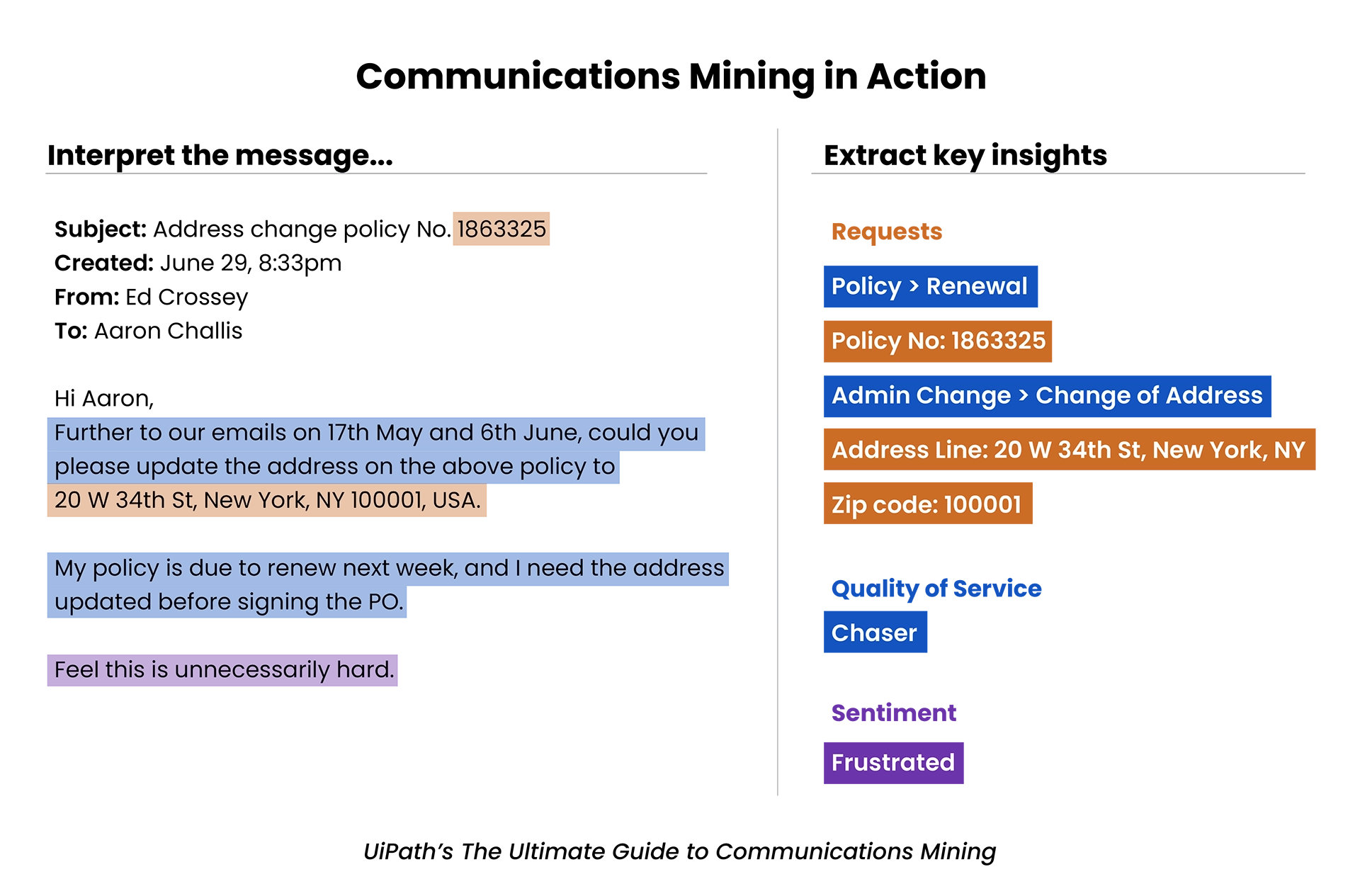

Finance teams handle hundreds of unstructured communications each week, ranging from vendor emails to customer inquiries, which makes manual review time-consuming and inefficient. Communications Mining leverages AI and NLP to convert these messages into structured, actionable data by identifying intent, categorizing requests, and triggering automation to streamline workflows.

This AI technology automates repetitive inquiries and uncovers patterns such as process bottlenecks and common dispute drivers, leading to faster response times, improved productivity, and more consistent service delivery. By surfacing key insights, Communications Mining empowers finance leaders to make proactive, data-driven decisions and build stronger relationships with vendors and customers alike.

Robotic Process Automation (RPA)

RPA in finance is no longer a nice-to-have, it’s a necessity — streamlining tedious, rules-based tasks like journal entries, approvals, and data integration. UiPath reports that over 60% of finance activities are ripe for automation.

Though RPA isn’t adaptive like AI, it delivers even more powerful results when paired with Intelligent Document Processing and GenAI, handling end-to-end workflows like invoice processing with speed and precision. MineralTree’s 2024 State of AP report states that RPA not only cuts costs and inefficiencies but also enhances decision-making, scalability, and work-life balance for finance teams.

Why internal teams struggle with digital transformation in finance and accounting

Many finance leaders agree on the need to digitize, yet 86% of finance teams saw no significant value from AI in 2024, according to Gartner. What’s holding them back? Everest Group points to persistent challenges like poor data quality, talent shortages, and complex budgeting cycles in its 2025 mapping priorities report.

Eduardo Diquez, Auxis’ Intelligent Automation Practice Lead, says the key is rethinking transformation. That means partnering with quality finance and accounting outsourcing (FAO) providers to bypass internal roadblocks and accelerate results.

A tech-enabled FAO partner like Auxis provides the talent, digital tools, and structure needed to deliver transformation at scale without the headache and overhead of building those capabilities in-house. Beyond labor savings, outsourcing to a quality provider delivers proven business strategies, greater visibility, and measurable financial performance improvements.

Get the full 2026 Roadmap to Digital Finance Transformation report

Finance digital transformation is no longer a question of if, but how. As CFOs navigate rising complexity, talent shortages, and increasing demands to deliver strategic value, the path forward hinges on execution.

Download our 2026 Roadmap to Finance Digital Transformation report for an in-depth look at the technologies, use cases, and strategies you need to achieve transformational success.

You’ll discover:

- Actionable steps to modernize your finance function for the future

- How AI and automation are redefining finance workflows

- Practical use cases for Agentic AI, Generative AI, IDP, RPA finance, and more

- Why automation in finance is critical to scale in 2025

- Top challenges that stop finance teams from achieving success

- Why nearshoring is a top strategy for bridging tech and talent gaps

With nearly 30 years of finance transformation experience and recognition as a top FAO and automation provider from leading industry analysts and partners, including Everest Group, ISG, and UiPath, Auxis helps organizations modernize with confidence, whether starting your digital journey or scaling existing efforts.

Ready to lead the future of finance? Schedule a consultation with our experts or explore our resource center for FAO insights and success stories.

Frequently Asked Questions

Which finance functions gain the most from automation and AI?

What are the key steps to successfully implement finance digital transformation?

What’s the difference between traditional finance outsourcing and tech-enabled outsourcing?

Why do most finance digital transformation efforts fail to meet expectations?

How can I measure ROI for my digital transformation finance initiatives?