In brief

- Outsourcing has become a top solution as U.S companies face talent shortages, cost pressures, and rising operational demands.

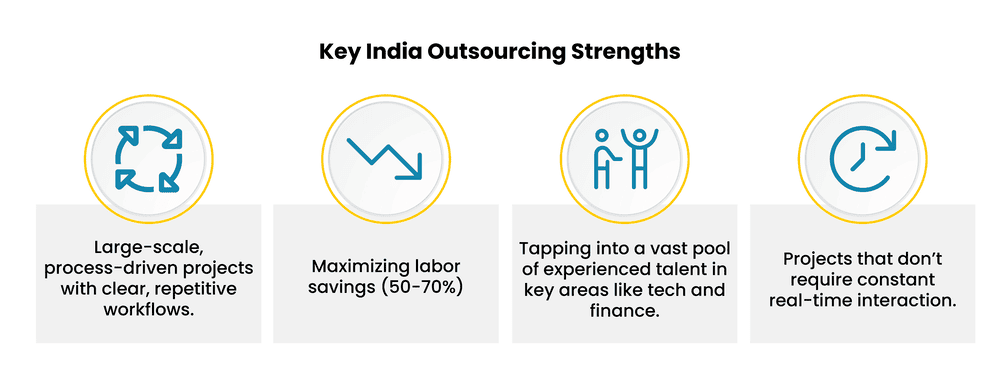

- India remains a top destination, with India outsourcing models delivering 50-70% labor savings and a vast pool of skilled workforce across IT, finance, and other business operations.

- Latin America is rapidly gaining ground, with 90% of enterprise and shared service leaders already operating in LATAM or planning to within the next three years.

- The best countries for outsourcing depend on your goals. While India can be a strong choice for large-scale, transactional work, LATAM is preferred by businesses seeking flexibility or outsourcing high-touch, time-sensitive, or judgment-intensive processes where real-time collaboration and cultural alignment drive success.

With talent shortages intensifying and operational demands on the rise, the question for U.S. businesses isn’t whether to start your outsourcing journey — it’s where. When evaluating top outsourcing countries, two regions often lead the conversation for North American organizations: offshore outsourcing to India and nearshore outsourcing to Latin America. Both are established outsourcing destinations for business processes, but they offer distinct advantages.

India has long been the global outsourcing leader, known for its vast talent pool, low labor costs, and decades of delivery experience. But for many organizations, business priorities are shifting — requiring real-time collaboration, strategic support, and delivery of more complex processes, areas where India outsourcing often falls short.

That’s why more organizations are re-evaluating their outsourcing strategies, considering offshore alternatives in geographically close destinations, or diversifying their portfolios with multiple locations that offer different strengths. India typically wins on cost effectiveness, while Latin America offers more customization, time zone alignment, and cultural affinity that support successful delivery of high-touch, time-sensitive, or judgment-intensive work.

In this article, we’ll explore the strengths and challenges of outsourcing to Latin America vs. India, breaking down key decision factors like cost, talent, cultural alignment, and collaboration to help you choose the right outsourcing model to give you a competitive edge.

Outsourcing to India: Cost efficiency at scale

India stands as an outsourcing powerhouse, with a business process outsourcing (BPO) industry that spans finance & accounting, customer support, information technology, and more. In 2024, the Indian BPO market reached $19.5 billion and is projected to triple by 2035, growing at an 11.5% CAGR (Market Research Future 2025 report).

This broad portfolio is supported by an extensive workforce widely recognized for its strong work ethic, diligence, and reliability. Many professionals are also willing to work U.S. hours through night shifts to help bridge time zone differences. Yet, India’s biggest draw remains its significant cost efficiency.

India is among the most cost-effective outsourcing countries, especially for large-scale, transactional operations. With a favorable dollar-to-rupee exchange rate and significant labor arbitrage compared to in-house teams, India offers a fast, scalable path to cost savings.

Labor costs average about 50-70% lower than U.S. rates, making it a popular choice for cost-conscious companies that seek to work with an outsourced team at a low cost.

But these savings and vast talent pools come with trade-offs. India’s faraway time zones can create friction for teams that require real-time collaboration or rapid issue resolution, slowing down execution and responsiveness. While overnight shifts can help, they are more expensive to staff and struggle to attract and retain top talent, which impacts service quality and cost savings.

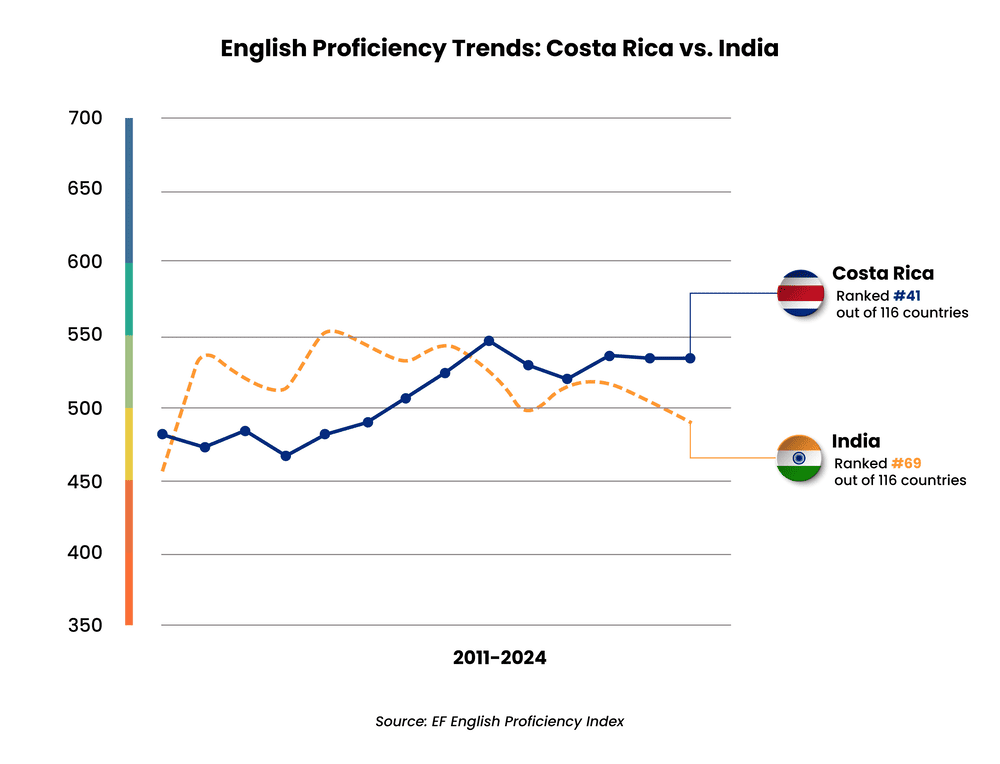

Language and communication can also pose challenges. While English is widely spoken, proficiency and clarity can vary by region and role.

India ranked 69th globally out of 116 countries in EF’s 2024 English Proficiency Index, down from 21st a decade ago and 60th the previous year – the biggest drop of any location. These inconsistencies, combined with cultural differences in communication style, can lead to miscommunication, frustration, and delivery delays.

Outsourcing to Latin America: Top talent in your time zone

Latin America is rapidly emerging as a top alternative to India, especially for U.S. companies that prioritize strategic partnership and real-time collaboration. More than 90% of enterprises already operate in LATAM or plan to within the next three years, according to the 2024 State of the GBS and Outsourcing Industry in Latin America report by the Shared Services & Outsourcing Network (SSON) and Auxis.

Latin America’s support for North America has nearly doubled in eight years, growing from 44% in 2016 to 84% in 2024 – with North America now the #1 region supported.

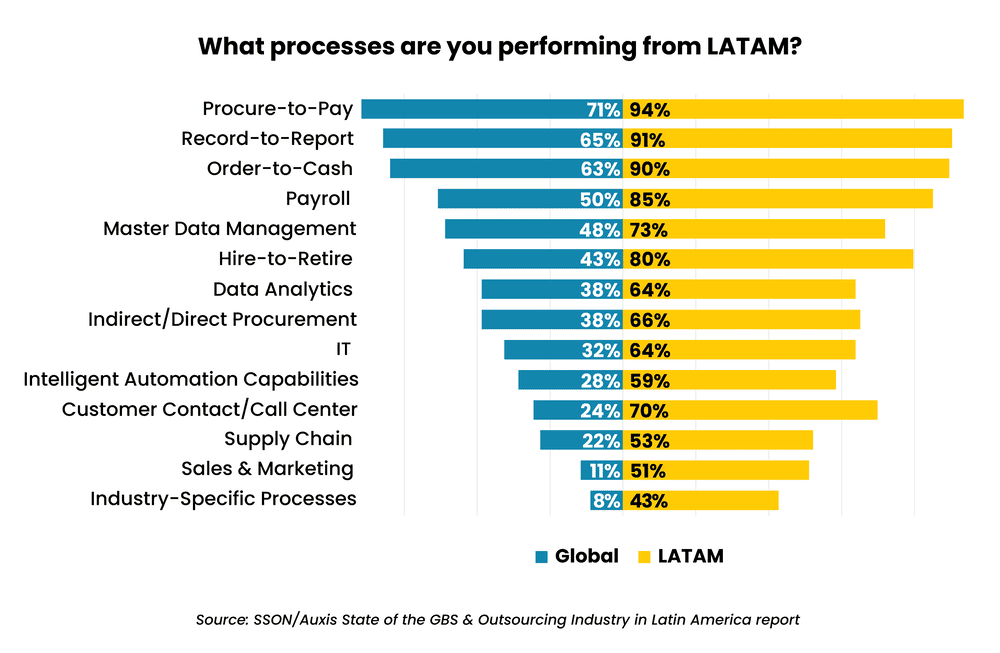

Leading destinations like Colombia, Costa Rica, and Mexico are successfully delivering processes spanning finance, IT, HR, customer support, and more on a greater scale than their global counterparts, the SSON/Auxis report found.

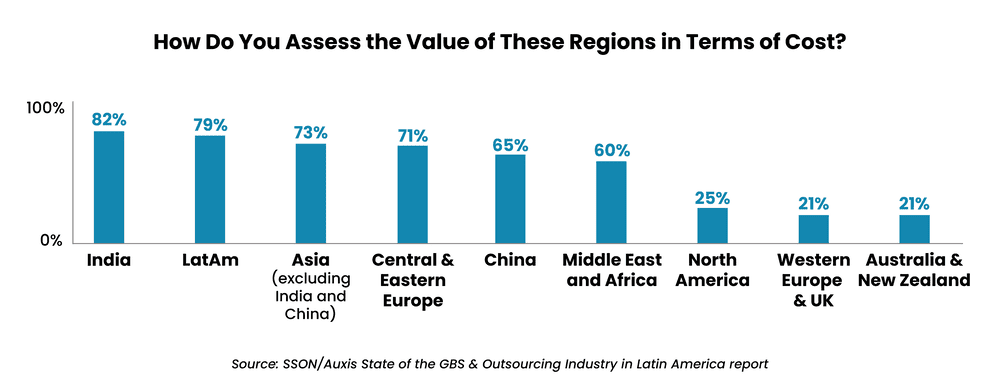

With an average of 30-50% labor cost savings compared to the U.S., Latin America’s labor arbitrage is typically lower than Asia’s, but still offers substantial savings. In fact, shared services leaders rank the value provided by Latin American markets as very similar to India – and ahead of other Asian locations like the Philippines – when you factor in technology enablement and inherent nearshore advantages that support high-quality service delivery, states SSON’s 2023 The Future Location Report.

LATAM’s proximity to the U.S. provides a key advantage. Real-time communication enabled by shared or similar time zones and deep experience with U.S. business practices allow LATAM shared services to function as a seamless extension of client teams. Shared communication styles and more neutral accents further reduce friction and accelerate team integration.

LATAM also boasts strong language skills. Currently, 15 Latin American countries outrank India on the EF EPI — translating to clear communication and strong customer experiences.

But not every LATAM location offers the same strengths, so evaluating the right market for your needs is important. Top destinations such as Costa Rica, Colombia, and Mexico — aka the “Big Three” — offer top-tier talent pools across business functions. But some destinations, such as Jamaica, are more heavily focused on Tier 1 customer care and may lack the technical depth needed for more advanced work in finance and IT.

While Brazil’s shared services market is growing, it primarily supports Brazilian customers due to higher labor costs, its Portuguese language, and complex regulations that limit scalability for U.S. businesses.

Latin America vs. India: 6 key factors to consider when evaluating the best countries for outsourcing

Outsourcing isn’t one-size-fits-all. Whether you choose nearshoring to Latin America or offshoring to India, your decision will influence collaboration, speed, and long-term value.

Both outsourcing regions bring unique strengths to the table, and the right fit depends on your specific goals and operational priorities. Here’s how India and LATAM compare across key outsourcing criteria:

1. Cost savings (getting the most value from your budget)

If low cost is your top priority, both India and Latin America deliver — but in different ways.

India remains one of the most affordable outsourcing destinations, offering labor savings averaging 50-70%. It excels at handling large volumes of standardized, transactional work — translating into substantial economies of scale.

But upfront savings aren’t the whole story. India’s cost advantage is often offset by hidden expenses, including quality issues on exception-heavy processes, delayed issue resolution, and saturated labor markets driving high turnover. A single plane ticket to visit your outsourced team in India can cost over $10,000 if you choose business class for the long flight, which is enough to fly an entire U.S. team to Costa Rica or Colombia for training or onboarding.

India’s BPO industry has also been chipping away at its greater labor arbitrage. The median salary increase in India is forecast to rise by 9.5% in 2025, on top of the previous 9.5% increase in 2024, to combat alarmingly high turnover, states WTW’s latest Salary Budget Planning Report.

With average savings of 30-50%, labor costs in Latin America are higher, with currency fluctuation and wage inflation ranking as the biggest nearshoring concerns on the SSON/Auxis report.

But here’s the thing: When it comes to wages, U.S. executives evaluating Latin America must consider the historical dollarized inflation rates of their target countries to accurately assess the true impact on costs. In general, wage inflation in the U.S. has surpassed dollarized inflation in Latin America.

That means that while salaries may be increasing labor costs in Latin America, the same is happening in North America – maintaining a healthy and attractive labor arbitrage for U.S. companies. When you factor in lower travel costs, fewer communication barriers and delays, and faster tech adoption, the value is even higher.

It’s also important to remember that savings vary by country, and choosing a reliable outsourcing partner with a multi-location platform can help you balance operational costs. For instance, tapping into highly educated talent in more expensive markets like Costa Rica for advanced work, while leveraging skilled talent for transactional roles in Colombia, ranked by Kearney as LATAM’s most financially attractive destination.

In fact, Colombia’s financial attractiveness score on the Kearney report was only a tenth of a point different from the Philippines.

The bottom line: If your goal is to scale transactional work at a low cost, India delivers. But if you’re looking for more strategic value, Latin America offers advantages.

2. Real-time communication (for collaboration and responsiveness)

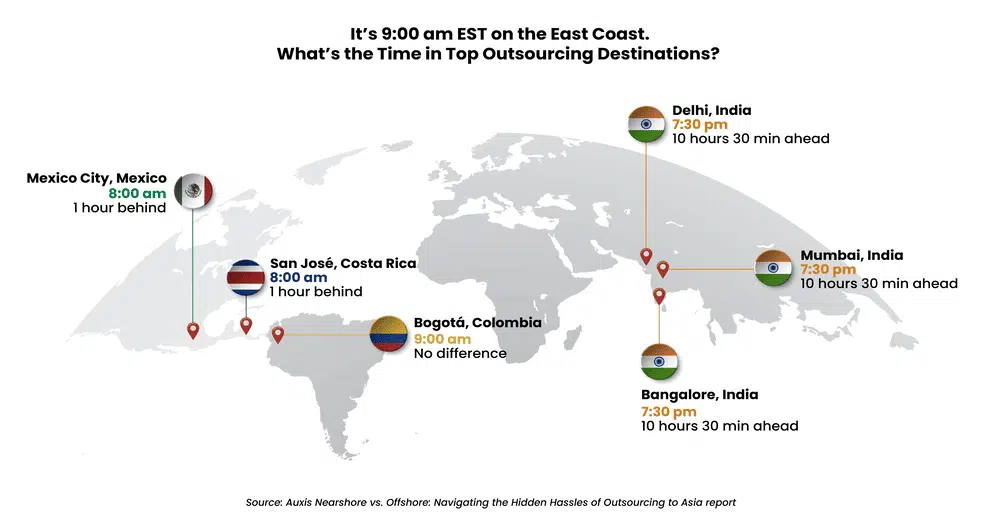

When speed and responsiveness matter, time zone alignment matters. Nearshore teams in outsourcing countries like Costa Rica, Colombia, and Mexico work during U.S. business hours, enabling faster decisions, quicker escalations, and smoother collaboration with internal teams.

For high-touch, time-sensitive, or judgment-intensive processes in areas like finance, IT, healthcare revenue cycle management, HR, and cybersecurity, this alignment is a game-changer. In fact, 86% of U.S. leaders ranked time zone compatibility as the biggest advantage of LATAM over Asia and Europe on the SSON/Auxis report.

India, on the other hand, sits 9.5-12.5 hours ahead of the U.S. This significant time difference presents a hurdle for real-time communication and collaboration.

Overnight shifts, while helpful for alignment with U.S. business hours, drive higher turnover and make it harder to attract top talent in India’s competitive labor market – impacting consistency and performance.

These offshoring problems often result in slower responses, longer project timelines, and increased delivery risk, especially for time-sensitive functions or urgent issues.

Infrastructure challenges in India compound the issue. India dropped from 49th to 64th in NordLayer’s latest Global Remote Work Index, with recurring issues like unstable internet and power disruptions outside corporate parks impacting day-to-day productivity in an outsourcing industry where workers increasingly demand work-from-home options. For teams that need to stay in sync, these risks are hard to ignore.

3. Talent (competing beyond cost)

Amid ongoing talent shortages, rising labor costs, and skills gaps in the U.S., “access to talent” surpassed cost savings as the #1 outsourcing driver on Deloitte’s 2024 Global Outsourcing Survey for the first time since the pandemic. Only 34% of enterprise leaders prioritized cost reduction, down from 70% in 2020.

India has long been recognized for the depth of its skilled workforce, particularly in IT and transactional finance roles. Strong government investment in higher education fuels millions of graduates entering the workforce each year — predominantly spanning engineering, technology, and business — building a deep, long-term talent pipeline that makes it easy to support high volumes of work.

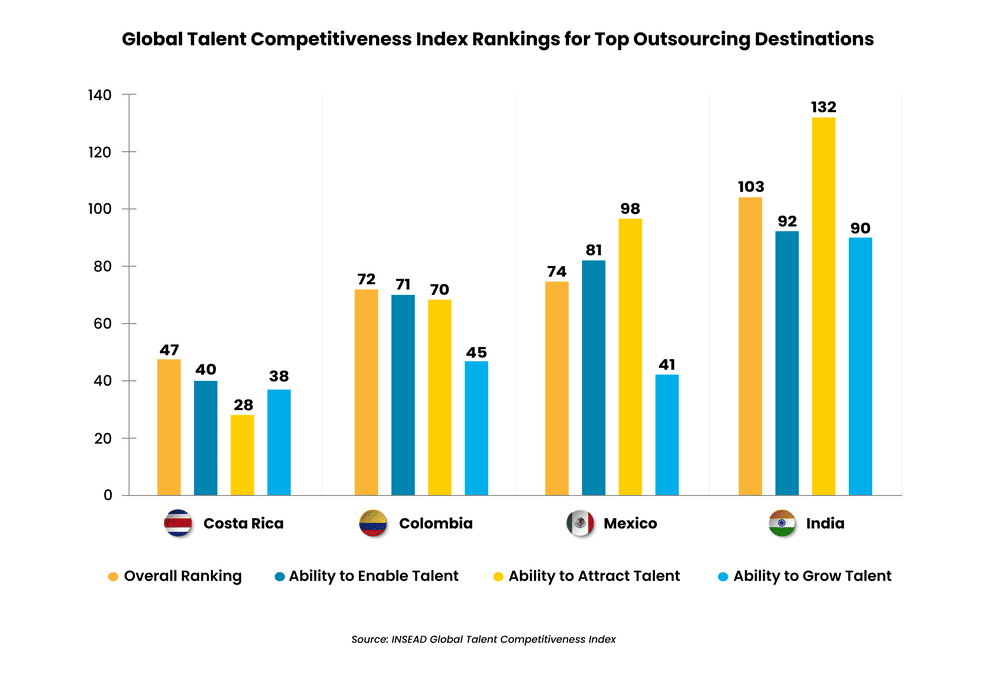

But India’s position on the INSEAD Global Talent Competitiveness Index has slid every year since 2020 — from 72nd to 103rd out of 134 countries — as the overheated job market causes hires with mismatched skills.

Latin America offers a different equation to alleviate these challenges of outsourcing in India. Many LATAM destinations rank higher than India on the Talent Competitiveness Index and are increasingly seen as a strategic source of skilled, agile talent for more complex work — including Costa Rica (47th), Colombia (72nd), and Mexico (74th).

While country talent pools in LATAM are smaller compared to India, they are still deep — and a top outsourcing company offsets the difference with integrated delivery platforms that tap into the unique strengths of multiple nearshore destinations, ensuring both scale and specialized expertise.

The 2024 SSON/Auxis Outsourcing Report reinforces the market shift: talent availability was flagged as a top concern for 71% of business leaders operating shared services outside LATAM, compared to just 45% in the region. The same report found that 87% of executives rank LATAM’s talent quality as its greatest value proposition over Asia and Europe.

Nearshore hubs such as Costa Rica, Colombia, and Mexico provide deep pools of highly educated talent with the strong English proficiency, advanced certifications, and critical-thinking capabilities to deliver processes across the value chain. Continuous government investment in key educational areas like IT, accounting, and engineering ensures a steady pipeline, while lower market saturation keeps attrition in check.

The region is also emerging as a hub for intelligent automation, software development, and data analytics. Latin America has become the #1 HR outsourcing destination for North American firms as well, offering the same caliber of experienced HR talent found in the U.S., unlike in India, where U.S. HR experience is less common.

Learn how a leading Fortune 50 retailer recently shifted HR functions to Auxis’ Costa Rica delivery center after struggling to find talent in India with the nuanced knowledge required for complex U.S. HR practices.

4. Cultural alignment (for better performance)

Cultural fit is critical to outsourcing success. More than 70% of international ventures fail due to cultural misalignment — a risk many U.S. companies underestimate.

India’s business culture emphasizes professionalism, strong process discipline, and respect for hierarchy — traits that can be valuable for consistency, quality control, and risk management. However, this same formality, hierarchy, and risk aversion can frustrate U.S. business leaders with expectations for agility, ownership, and direct communication — creating potential for miscommunication and execution delays.

Latin America offers a more natural cultural alignment with the U.S. Professionals across the region follow western culture and practices, mirroring U.S. business norms and bringing a more collaborative, autonomous approach to execution that can make it easier to build integrated teams and deliver high-touch, judgment-intensive processes.

5. Innovation (driving better results)

Some 60% of organizations are turning to existing outsourcing partners to accelerate AI adoption — while another 57% are forming new partnerships focused on AI — seeking the talent, tools, and proven success they lack in-house (Deloitte Global Outsourcing Survey 2024).

For years, India stood as the clear innovation leader in outsourcing — offering deep technical talent, scale, and cost efficiency that power large-scale transformation programs. But today, Latin America is rapidly emerging as a strong alternative, combining robust capabilities in AI, automation, and analytics with nearshore advantages that prompted CBRE’s 2024 Scoring Tech Talent report to rank it among the world’s top up-and-coming tech markets.

The right solution often comes down to the value proposition:

- India’s innovation ecosystem, built primarily on labor arbitrage, is often oriented toward large-scale execution and cost-driven delivery.

- Latin America offers agility, shared business schedules, and a culture of continuous improvement that resonates with companies that want cross-functional teams working together in real-time to build, test, and scale new solutions.

Some 80% of enterprise leaders now cite “innovation and continuous improvement mindset” as LATAM’s greatest advantage over Asia and Europe (SSON/Auxis Report). India’s saturated labor markets are also a factor: While availability of AI and automation skills is a top 2 concern for 60% of shared service leaders in Asia, Europe, and North America, it ranks as the lowest concern in LATAM — flagged by only 29% of survey respondents on the SSON/Auxis report.

6. Project complexity (supporting processes across the value chain)

As service delivery evolves, more companies are moving beyond traditional outsourcing to offload complex, judgment-intensive processes that require critical thinking and end-to-end ownership. While 32% of business leaders are boosting budgets for transactional solutions, nearly 67% are investing in next-gen partnerships that deliver not just cost savings, but also digital strategy, actionable insights, and measurable outcomes (Deloitte).

India remains a strong choice for traditional outsourcing solutions. Decades of outsourcing leadership have created a mature services environment, with established training infrastructure, process maturity, and proven global delivery models that excel at delivering defined protocols at scale.

But Latin America is fast becoming the go-to for advanced process tiers where agility, customization, and immediate collaboration matter more. LATAM’s business culture and geographic proximity enable teams to adapt quickly, communicate seamlessly, and take on greater decision-making responsibility, reducing reliance on U.S. staff.

More than 80% of enterprise leaders say LATAM is better suited than Asia and Europe for supporting complex processes (SSON/Auxis Report). Learn why a leading healthcare provider with existing operations in Asia turned to LATAM for successful delivery of more complex revenue cycle management processes.

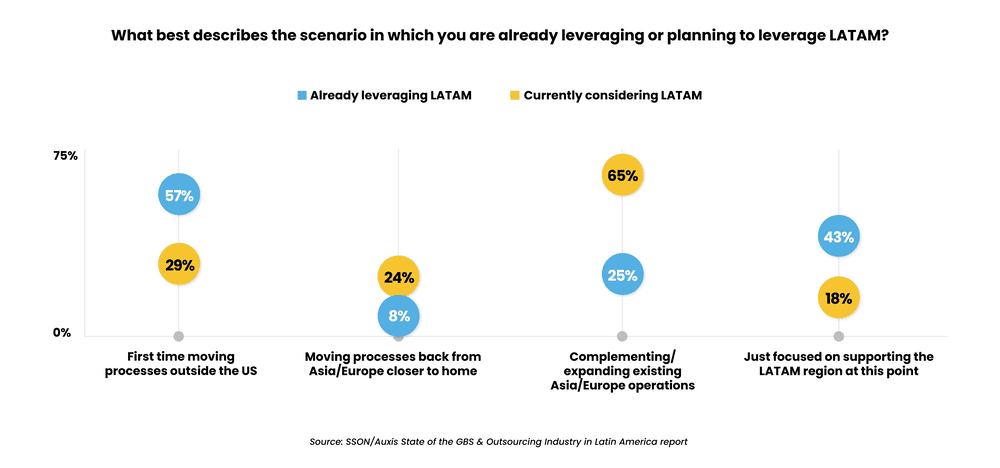

Increasingly, hybrid models are becoming the norm, keeping Asia for transactional delivery while leveraging LATAM for high-touch, strategic functions. Nearly 70% of enterprises exploring LATAM shared services are doing so to complement, not replace, existing operations in Asia or Europe, the SSON/Auxis report found.

Why Auxis: Pioneering LATAM nearshoring for North America

India will always be a major player in the global outsourcing landscape — offering significant savings for transactional, large-scale work. But in 2025, shared services and outsourcing priorities are evolving. It’s no longer just about labor arbitrage — enterprises want partners who can optimize processes, deliver more complex work, accelerate digital transformation, and provide strategic value alongside cost savings.

Latin America is rapidly emerging as the preferred destination for North America, with satisfaction levels at LATAM shared services (87%) outpacing Asia (53%), Europe (64%), and even North America (69%).

Auxis is a nearshore outsourcing pioneer and recognized leader in Latin America outsourcing, with main delivery hubs in Costa Rica, Colombia, and Mexico, and nearly three decades of experience helping clients modernize and scale operations across finance, IT, HR, customer service, and industry-specific business operations.

Auxis is consistently ranked among the world’s top outsourcing providers on IAOP’s Global Outsourcing 100 list and by leading research firms including Everest Group and ISG. Its status as a Partner of the Year for UiPath, the world’s leading AI and automation platform, further reflects its strength in intelligent automation and tech-enabled service delivery.

By joining forces with Grant Thornton, Auxis also can now offer a true global delivery model — helping clients leverage the strengths of shared services across Latin America, Asia, Europe, and the Middle East to build the best solution for their business.

Whether you’re scaling AI-powered automation, building a shared services model, or outsourcing business operations, Auxis delivers the strategic insight and regional expertise to make transformation a reality.

Ready to learn more about the benefits of outsourcing to Latin America? Schedule a consultation with our nearshore experts today! You can also download our reports, Nearshore vs. Offshore: Navigating the Hidden Hassles of Outsourcing to Asia and 2024 State of the GBS and Outsourcing Industry in Latin America, to explore the data behind the shift to nearshore outsourcing. For more insights, visit our resource center.

Frequently Asked Questions

Is India a good country to outsource to?

Are companies outsourcing to India still?

Why is Latin America becoming a top outsourcing destination?

What factors should I consider when choosing between nearshore and offshore outsourcing?