In brief:

- Agentic AI brings an unprecedented ability to automate judgment-heavy, end-to-end finance processes – creating the first real opportunity to autonomously orchestrate siloed tech like GenAI, APIs, RPA, and IDP into cohesive operations.

- Early adopters of Agentic AI in finance and accounting processes have slashed close times by up to 50%, transformed AR collections, and enabled real-time forecasting.

- 72% of finance leaders cite operational efficiency and enhanced productivity as the top benefits of Agentic AI (UiPath Agentic AI Report 2025).

- Despite 58% of finance functions using AI, 86% reported no significant ROI in 2024, highlighting the need for a clear strategy and targeted use cases (Gartner 2024).

Agentic AI in finance and accounting helps finance leaders overcome the limitations of traditional automation — offering the first real opportunity to autonomously orchestrate siloed technologies like Generative AI, APIs, Robotic Process Automation (RPA), and Intelligent Document Processing (IDP) into fully integrated, end-to-end business operations.

Organizations are taking note: 72% of executives cite increased operational efficiency and productivity as top benefits of implementation, according to UiPath’s 2025 Agentic AI Report. Gartner predicts at least 15% of day-to-day work decisions will be made autonomously through Agentic AI by 2028.

Yet despite its transformative potential, only 15% of enterprise CFOs are actively piloting or exploring Agentic AI today, leaving most organizations at the starting line (PYMNTS 2025).

To help put some perspective into this topic, let’s break down six Agentic AI use cases reshaping finance — plus smart, practical tips to help finance leaders move confidently into the Agentic AI era.

What is Agentic AI?

The latest breakthrough in AI technology, Agentic AI empowers software agents with an unprecedented ability to reason, decide, respond, and pivot in real-time when unexpected events arise. When deployed through an orchestration engine like UiPath Maestro, AI agents act like virtual project managers – intelligently coordinating actions across systems, teams, and technologies for judgment-intensive workflows in month-end close, accounts payable, accounts receivable, and more.

AI agents can act as the “brain” that analyzes and plans, for example, while directing Generative AI to create needed content and leveraging RPA as the “muscle” that executes actions.

Agentic systems are designed with built-in safeguards: while agents can operate autonomously across most tasks, their authority is limited on high-impact decisions that require human judgment. For example, an agent would escalate an invoice higher than the purchase order amount to a human approver.

Agentic AI’s ability to learn from historical data and guided inputs also minimizes the potential for “AI hallucinations,” injecting structure, oversight, and business context to maximize real-world performance.

6 ways early adopters are using Agentic AI in finance and accounting

CFOs’ hesitation to pull the trigger on Agentic AI often reflects a lack of awareness about the practical, high-impact use cases already transforming finance operations today.

Here are six ways early finance adopters are leveraging Agentic AI to unlock real value and modernize their finance operations:

1. Real-time financial forecasting for smarter decisions

Agentic AI empowers finance teams to move beyond static, outdated forecasts by continuously gathering real-time data from enterprise resource planning (ERP), banking systems, and external sources like market trends and supply chain shifts. AI agents in finance can autonomously analyze data and run scenario models to produce forecasts that update daily, helping CFOs make faster, more confident decisions about cash flow and working capital.

By detecting subtle patterns and emerging risks that traditional methods often miss, teams can dramatically improve accuracy, strengthen their competitive edge, and better manage finances. Some 65% of executives surveyed by UiPath cite improved decision-making as a top benefit of AI, and 90% agree that Agentic AI will improve key business processes (UiPath Agentic AI Report 2025).

2. Accelerated financial close with smarter reconciliation and consolidation

Closing the books has long been a time-consuming, error-prone part of transaction processing, bogged down by manual reconciliations, approvals, and endless data entry. Engaging Agentic AI for finance and accounting can transform this cycle with the ability to automate and orchestrate financial close activities end-to-end, while keeping humans in the loop for key reviews and approvals.

That includes reconciling accounts, chasing down missing approvals, preparing journal entries, and generating compliance-ready reports.

AI agents can scan ledgers, flag human errors, and spot unusual transactions that might otherwise go unnoticed – accelerating close times by 30-50% and turning the month-end close into a faster, more value-driven activity. Accounting AI agents can also handle complex tasks such as intercompany eliminations, multi-entity consolidations, and currency conversions, continuously learning from historical data and working alongside APIs and bots to reduce risk and improve accuracy.

3. Intelligent accounts receivable transformation

Agentic AI can change AR operations by orchestrating end-to-end, judgment-heavy processes such as cash application, collections, and dispute resolution. Surpassing the capabilities of scripted automation bots, which focus on automating isolated, rules-based tasks, Agentic AI can analyze customer payment behavior, adapt follow-up strategies in real time, and utilize autonomous decision making to prioritize accounts — all in one flow.

AI agents learn from historical remittance patterns to match payments faster (up to 90%) and more accurately (as high as 99%), according to Everest Group. This agentic finance approach can significantly improve cash visibility and reduce manual tasks.

On the invoicing side, AI agents work to generate and deliver compliant e-invoices automatically across vendor portals and email channels, embed payment links, and track real-time delivery and acceptance.

Instead of relying on collectors to manually chase every unpaid invoice, AI agents can further handle routine follow-ups and send automated reminders to keep payments moving, freeing AR teams to focus on high-priority accounts and complex cases. With 43% of finance executives prioritizing cash flow management and seeking greater visibility into collections execution (2024 APQC Finance Priorities and Challenges), Agentic AI provides a powerful solution to meet this critical need.

In collections, AI agents can analyze customer payment behaviors to identify high-risk accounts, design targeted follow-up strategies, and automate outreach timing for higher success rates. For deductions and disputes, agents can proactively detect root causes, gather supporting documents, and route cases to the right teams, minimizing revenue leakage and speeding up resolution.

More than half of executives surveyed in the UiPath Agentic AI report note the value of automating such complex workflows, which can result in direct improvements in day sales outstanding (DSO) and cash flow.

4. Streamlined accounts payable

Leveraging Agentic AI for accounts payable can transform the payment process in multiple ways: autonomously verifying invoices against contracts and purchase orders, detecting duplicates or anomalies, routing exceptions for approval, and more. AI agents can extract and validate invoice data and push transactions through approval workflows without manual touchpoints.

An Agentic AI finance function also uncovers subtle risk patterns, such as duplicate invoice submissions, mismatched vendor details, and unusual payment amounts that might escape human review.

Once invoices are cleared, AI agents can execute payment runs on schedule, strengthening supplier trust and operational efficiency.

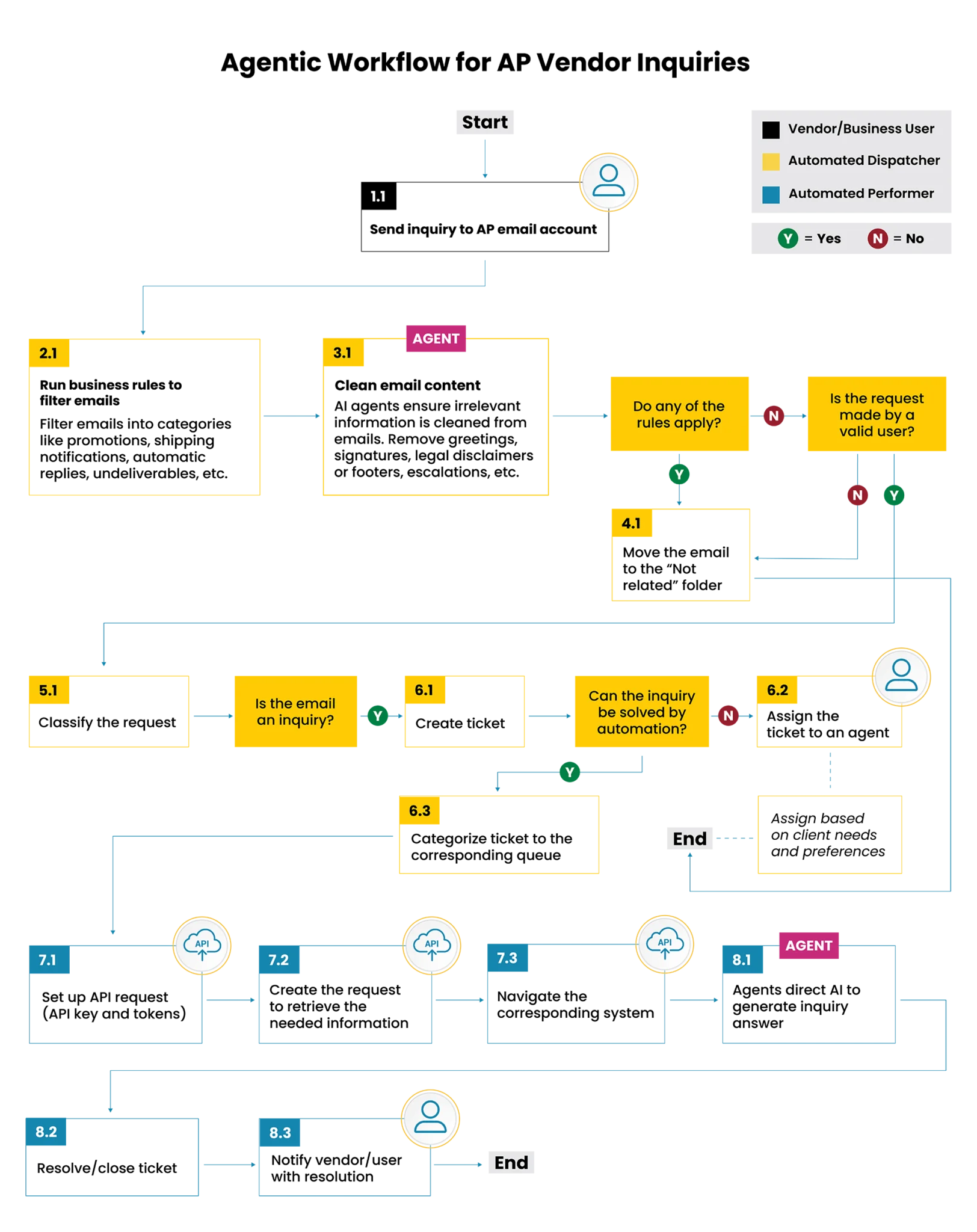

Agentic AI also reduces the burden of vendor inquiries, a major source of friction in AP. For example, Auxis implemented an intelligent, end-to-end workflow leveraging AI agents at critical junctures for a leading retailer that classifies and validates incoming emails, triggers dynamic response logic, and retrieves real-time payment information from source systems.

By eliminating manual bottlenecks and enabling instant, accurate responses, the solution significantly accelerated resolution times and boosted vendor satisfaction. Here’s what the process looks like:

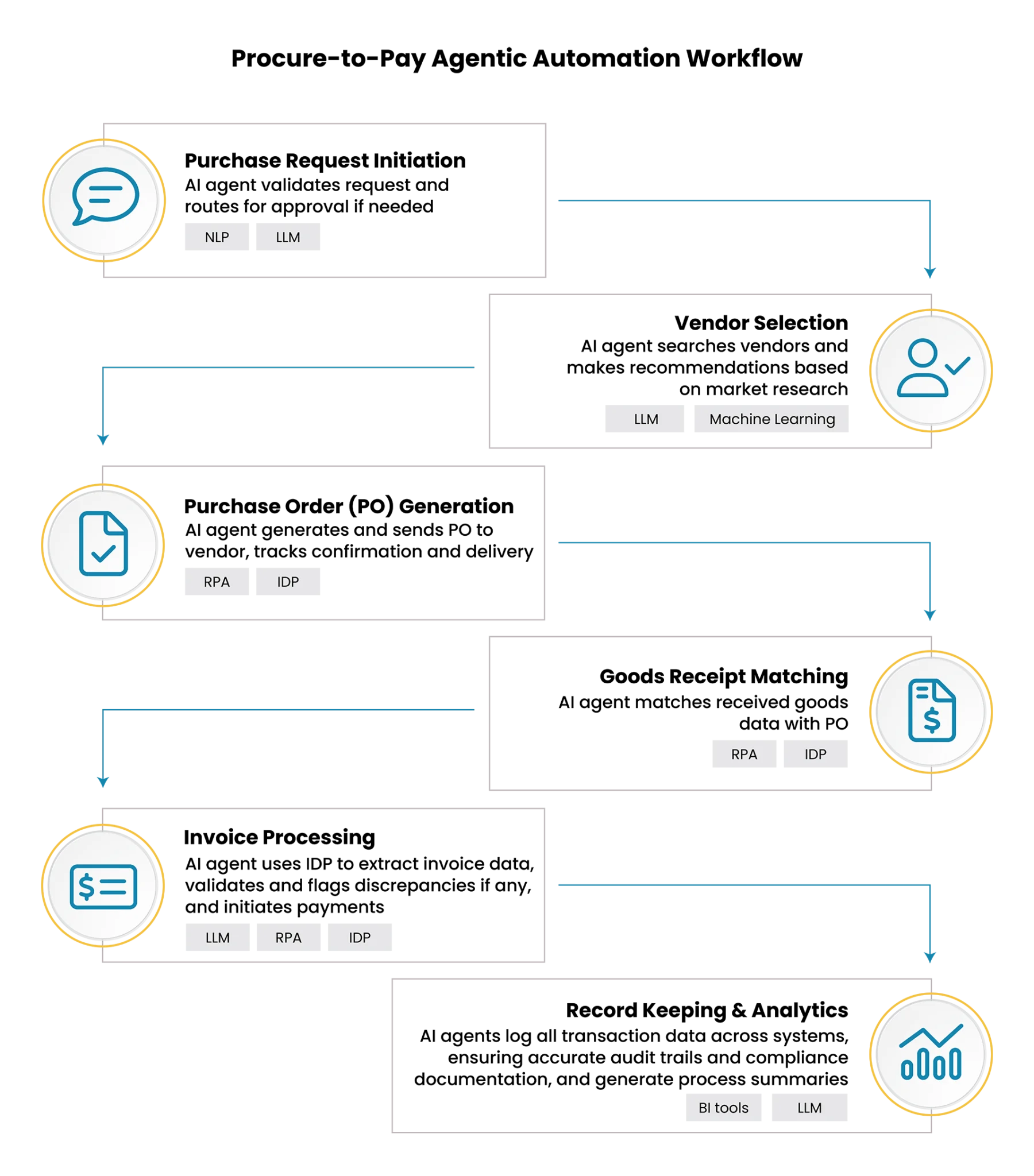

Here’s another example showing how agents could orchestrate an end-to-end workflow across Procure-to-Pay:

5. Proactive budget management with accounting AI agents

Traditional budget tracking is typically reactive, with overruns only discovered after month-end reports. Agentic AI addresses this issue by continuously monitoring departmental spending in real time, comparing it against budgets, and flagging anomalies before they escalate.

When potential overruns surface, Agentic AI agents can recommend reallocations or adjust budgets once approvals are granted. This proactive approach gives financial executives live insights into spending trends, enabling timely interventions that prevent budget surprises.

6. Fraud detection and compliance

Agentic AI can take risk management to the next level by continuously scanning transactions, vendor records, and operational data to detect fraud patterns and compliance breaches in real time. Autonomous AI agents can cross-check vendor tax IDs, sanction lists, and payment data before execution, stopping suspicious activity before losses occur.

Beyond preventing fraud, these agents can maintain live audit trails and monitor control effectiveness, replacing static point-in-time audits with dynamic always-on oversight. This method of monitoring compliance keeps finance teams ahead of evolving regulations, minimizes manual audit preparation, and helps build confidence with boards and regulators.

Smart tips for implementing Agentic AI in finance and accounting

While 58% of finance teams adopted artificial intelligence in 2024, 86% reported seeing no significant returns from their AI investments, according to Gartner. This result underscores the importance of thoughtful planning and a clear strategy to fully realize the benefits of Agentic AI.

Here are key smart tips for successfully leveraging Agentic AI for finance and accounting:

1. Establish robust governance and human oversight

Embed strong governance from the start to maintain compliance, reduce risk, and build trust as automation scales. While agentic automation can largely function autonomously, it is intentionally limited in its ability to take certain actions that would require human intervention, such as approving a home loan. Define clear human-in-the-loop processes, set up review checkpoints, and implement audit trails and exception-handling protocols to ensure Agentic AI decisions align with organizational policies and regulatory standards.

2. Prioritize data quality and security

Agentic AI systems are only as effective as the data they receive. Provide your Agentic AI system with high-quality, accurate, and secure data by standardizing your Chart of Accounts, unifying entity mappings, and ensuring consistent tagging to build a strong foundation.

Also, embed enterprise-grade security measures and strict privacy protocols across your AI architecture to protect sensitive financial information and stay compliant with evolving regulations.

3. Start small and scale strategically

Instead of trying to automate every finance operation at once, begin with focused pilot projects in high-impact but manageable areas such as accounts payable or the cash application process. Pilots help identify process gaps and improvement opportunities, deliver quick wins, and build a prioritized backlog for future, larger-scale improvements.

4. Equip your finance teams for Agentic AI

Equip finance professionals with the skills and guidelines needed to use Agentic AI responsibly and understand its purpose and impact. Provide training across functions and experience levels to strengthen alignment between people and systems. Emphasizing skill development and communication fosters a culture of trust and ensures people remain at the center of the transformation.

5. Conduct comprehensive risk assessments and plan proactively

Perform an AI risk maturity assessment and gap analysis to evaluate readiness, identify vulnerabilities, and determine training needs for finance and accounting teams. Then, develop a detailed roadmap with clear scope, timelines, stakeholders, and contingency plans. This proactive approach mitigates risks and sets the foundation for secure, scalable agentic automation adoption.

6. Prevent Agentic AI sprawl with centralized orchestration

Implement orchestration platforms like UiPath Maestro to manage and coordinate AI agents across functions and systems. Centralized oversight ensures alignment with business objectives, prevents siloed deployments, and supports consistent policy enforcement. By maintaining clear accountability and uniform standards, organizations reduce potential loopholes in financial workflows and enhance integration with other financial tools and teams.

7. Design processes with a customer-centric mindset

When planning automation, take a holistic view that considers customer journeys, risk controls, systems, and KPIs. Address legacy data issues and incorporate compliance from the start to improve both efficiency and customer experience. Automated, customer-facing processes increase resolution speed, boost satisfaction, and strengthen loyalty by delivering seamless, reliable interactions and proactively managing risks.

Why Auxis: Leading the future with Agentic AI for finance and accounting

Agentic AI has the power to transform finance and accounting far beyond task automation, enabling self-directed, judgment-based decision-making at scale. Yet, with only a handful of CFOs actively piloting Agentic AI today, it’s clear that most organizations remain uncertain about how to move from potential to practical impact.

More than 80% of finance organizations are turning to tech-enabled outsourcing to drive AI adoption, gaining access to the skills, talent, and technology they lack in-house (Deloitte 2024 Global Outsourcing Survey). That’s where Auxis comes in.

As a trusted finance transformation partner with nearly 30 years of experience, Auxis blends deep operational expertise with hands-on execution to help financial leaders bridge the gap between AI exploration and tangible business outcomes.

Auxis has a proven record of delivering finance shared services and intelligent automation, recognized as a top finance and accounting outsourcing company globally by top research firms like Everest Group and ISG. Auxis’ turnkey finance AI solutions are backed by an award-winning intelligent automation practice. Named a UiPath Partner of the Year and recognized among a select group of UiPath Agentic Automation Fast Track Partners, Auxis stands out for putting transformative technology at the heart of business innovation and measurable success.

Ready to transform your finance function with Agentic AI? Schedule a consultation with our finance transformation experts today, or visit our resource center for more best practices and success stories on AI business solutions and finance transformation.

Frequently Asked Questions

What’s the difference between Agentic AI and Generative AI?

How does Agentic AI work?

What makes Agentic AI different from traditional automation?

Can Agentic AI work with existing finance systems?