In brief

- Nearly 90% of businesses report up to 30% of their invoiced sales are overdue – creating a major drain on liquidity.

- As CFOs prioritize cash flow management in 2026, they are leaning into accounts receivable automation benefits to make it happen.

- Top-performing finance organizations that automate, centralize, and standardize processes achieve 3x lower AR costs per $1,000 in revenue than their bottom-performing peers (APQC).

- With nearly 65% of CFOs struggling to realize digital ROI, 81% are turning to finance outsourcing to access the talent, tech, and process expertise needed to modernize and optimize functions like AR.

Cash flow management remains a top priority for CFOs heading into 2026 – and they are leaning into accounts receivable (AR) automation benefits to make it happen.

Overdue invoices are straining AR performance, with nearly 90% of businesses saying some 30% of invoices are paid late. For companies extending payments beyond 30 days, that translates to an average 4.6% of revenue – some $19 million – lost to payment uncertainty (PYMNTS From Friction to Flow: AR Automation in 2025).

To close the gap, top-performing finance teams are embracing automation to accelerate collections, improve visibility, and boost cash flow.

But despite rising investments, challenges remain. Nearly 65% of CFOs don’t feel confident they can realize meaningful value from their AI programs (Gartner 2026 CFO Agenda).

Only 27% say their technology strategy is fully aligned with business goals, underscoring the need for a clearer roadmap and stronger execution (Grant Thornton’s 2025 Shift Your Tech Strategy Report).

To help you overcome these obstacles and maximize accounts receivable automation benefits, we’ve outlined the strategies and best practices used by high-performing AR teams.

What Is AR automation?

Accounts receivable automation refers to the use of technologies like RPA, Generative AI, and agentic to streamline and standardize the AR process. By replacing manual, error-prone activities with intelligent automation, finance teams can improve accuracy, accelerate cash flow, and reduce Day Sales Outstanding (DSO).

Instead of juggling spreadsheets, PDFs, and email threads, AR automation connects directly to your ERP and banking systems, automatically generating and delivering invoices, tracking overdue accounts, and applying payments in real time.

Agentic automation takes these capabilities further with systems that adapt and act autonomously with proper governance — predicting late payments, prioritizing collections, matching payments even with incomplete data, surfacing real-time cash flow insights and more.

Whether you’re building custom automations with platforms like UiPath, extending ERP functionality, or deploying next-gen AR automation software, capabilities often include:

- Automated invoice creation and delivery

- AI-driven cash application with automatic remittance matching

- Rule-based collections and dunning workflows

- Digital payment portals and self-service for customers

- Standardized dispute and deduction resolution

- Real-time dashboards and analytics for better AR visibility

A recent Grant Thornton survey found “AI, automation, and other efficiency measures” are the most-cited tactic (69%) CFOs are using to offset rising costs and protect margins. In Order-to-Cash (O2C), 41% of organizations are actively using AI to improve operations, while 31% are in the early stages of adoption (APQC Trends in 2025: AI Adoption for the Finance Function).

5 key benefits of AR automation

AR automation lays the foundation for a more proactive and efficient finance function, and its impact is clear and measurable. The Hackett Group found that automating AR processes can improve on-time collections, lower costs, and deliver up to $7 million in benefits for mid-sized firms (2024 Customer-to-Cash Receivables Software report).

Below are key benefits of automating accounts receivable:

1. Faster cash flow & lower DSO

Accounts receivable automation speeds up every step of the invoice-to-cash cycle — from invoice delivery to payment application and follow-ups. With real-time visibility, automated reminders, and integrated payment options, companies can reduce DSO, unlock working capital, and boost liquidity for growth.

According to APQC, the median DSO is 38 days, but top performers collect in under 30. AI-powered invoice-to-cash tools close this gap by enabling workflows that prioritize high-risk accounts and embed credit risk assessments early in the cycle — an approach Gartner calls an AR best practice.

The Hackett Group found that this practice can reduce average delinquency by 8.4 days.

2. Enhanced efficiency

AR automation eliminates time-consuming manual tasks like payment matching, deduction processing, and customer follow-ups, freeing AR teams to focus on higher-value work. Amid ongoing finance hiring challenges, automation helps teams stay productive by handling bulk uploads, reassigning deductions, and reducing bottlenecks when staff turnover hits.

For clients where disputes must be manually uploaded into customer portals, automation of this process is key to eliminating delays and reducing team fatigue. Automation also makes it easier to track resolution progress and define metrics like dispute closure rate to improve transparency and performance over time.

APQC points to automation as key driver of AR efficiency, noting top-performing organizations that have automated, centralized teams, and standardized processes achieve 3x lower AR costs per $1,000 in revenue than bottom performers.

High-performing AR teams also process about 80% of invoices electronically and receive 94% of payments automatically, achieving stronger cost control and higher productivity per $1 billion in revenue compared to their peers that handle finance processes manually (APQC).

Consider this example:

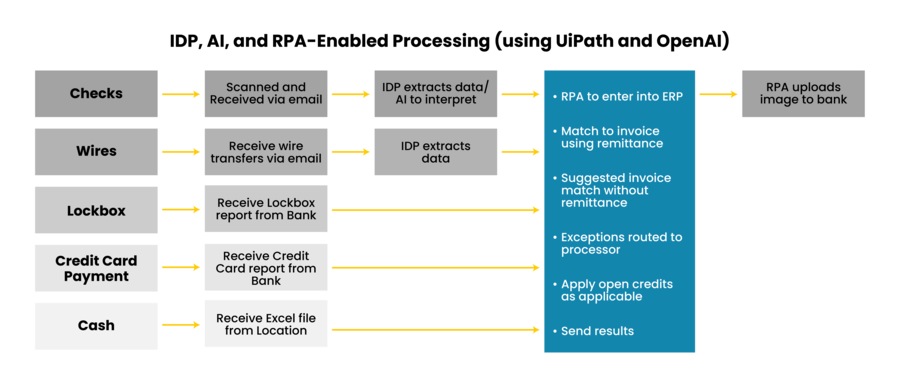

Auxis is helping a client streamline accounts receivable through a tech-enabled BPO solution that pairs optimized operations with customized AI and automation leveraging UiPath and OpenAI.

The solution automates daily payment application across sources such as ACH, wire transfers, checks, credit cards, and more. It also handles remittance extraction, reconciliation, and uploads to banking portals – leading to faster cash application, reduced exceptions, and a scalable, high-efficiency collections process.

Here’s what the process looks like:

3. Higher accuracy and lower risk

Manual AR tasks are prone to costly mistakes, yet issues like missing or incorrect invoice data and fraudulent invoices often derail collections. AR automation reduces these risks by enforcing consistent rules, applying real-time validations, and creating a traceable audit trail.

Automation improves accuracy in payment application, credit checks, and dispute resolution, ensuring AR teams stay compliant while protecting margins. For SaaS and usage-based billing models, automation pulls billing data directly from service logs, minimizing revenue leakage.

Advanced agentic automation adds another layer — predicting late payments, tailoring outreach, and matching payments even when remittance data is incomplete, reducing unapplied cash and manual cleanups.

4. Improved customer experience

Outdated AR processes frustrate customers and delay payments. Accounts receivable automation simplifies the experience with self-service portals, flexible payment options (like ACH or credit card), and personalized reminders that match each customer’s payment habits.

Instead of generic notices, customers receive smart, targeted nudges — turning collections into a more collaborative process. Invoice formats can be tailored by account type, while electronic invoicing linked to payment portals speeds up reconciliation and cash application.

With automation handling routine tasks, finance teams can focus on building stronger client relationships and delivering a smoother, more customer-centric experience.

5. Better decision-making with data

With over 75% of CFOs now responsible for enterprise-wide data and analytics, “metrics, analytics, and reporting” ranked as the top CFO priority this year, Gartner found. Heading into 2026, “improving financial forecast accuracy and quality” is one of the two most-urgent CFO priorities for the next six months, Gartner reports.

AI-powered accounts receivable automation eliminates guesswork and empowers finance teams to make fast, data-driven decisions that strengthen liquidity and support growth. Automated dashboards track DSO, aging invoices, collector performance, and dispute trends, helping teams identify risks and act early.

For subscription-based and high-volume businesses, this visibility is critical to understanding customer payment behaviors and improving cash forecasting. Automation also improves collaboration across finance and sales, creating a single source of truth and keeping collections aligned with business goals.

6 accounts receivable automation best practices that drive success

With most finance organizations struggling to achieve meaningful returns from their automation investments, turning potential into performance takes more than technology — it requires clear strategy, disciplined execution, and process excellence. Here’s how to get it right:

1. Assess your current AR workflows

Too often, teams skip straight to AI and automation tools without first mapping processes or aligning stakeholders.

Here’s how you can do better: Start by identifying bottlenecks, repetitive tasks, and gaps in your current AR workflows. Audit records to catch unreconciled payments and prevent automation misfires, such as sending reminders for invoices that have been paid but not reconciled.

Document each step from invoice creation to reconciliation. Map out each step, note the time required, who’s involved, and where delays or handoffs occur. This documentation not only exposes operational gaps but also serves as your baseline for measuring automation success and refining your future-state strategy — ensuring automation enhances your process, not just digitizes its flaws.

2. Standardize workflows such as invoice & dispute processes

Before rollout, align with teams like sales, IT, and customer service to design automation rules that reflect actual business needs. Use workflow maps to set logic and business rules — like auto-generating invoices when orders ship or escalating overdue accounts based on invoice age and value.

Mapping and standardizing AR processes can improve receivables-related working capital by up to 30% within weeks.

McKinsey 2025 Gain Transformation Momentum by Optimizing Working Capital

Focus on key areas such as consistent invoice formats, clear cash application rules, structured remittance guidance, standardized dispute codes and escalation paths, templated customer communications, and formalized credit policies.

3. Start with high-impact, easy-to-automate areas

Avoid tackling everything at once. Begin with high-ROI, easy-to-automate, low-complexity tasks such as invoice generation, payment reminders or proactive collection emails, then expand to more advanced areas like consolidated billing or dispute resolution after early wins.

Use pilot tests to introduce AI in controlled AR segments. Choose processes that are valuable but manageable, such as invoice processing, expense report management, or basic reconciliations—so you identify issues early, adjust, and build confidence before scaling.

4. Automate deductions management

Deductions management is a critical but often overlooked part of the O2C process. Poorly managed deductions drain resources, create cash flow gaps, frustrate customers, and directly impact profitability.

Automating deduction processes with bots or specialized tools helps reduce backlogs, reclaim lost revenue, and ease team workload, especially with high-volume customers like Walmart or Target.

Standardize reason codes, root-cause tracking, and escalation paths to speed up resolutions and reduce manual errors. Automation within leading ERP systems like SAP, Oracle, or NetSuite can route claims to the right team instantly, cutting time-to-resolution and eliminating email chains.

5. Choose the right accounts receivable automation software

The best AR automation tools align with your goals, budget, and existing systems. While platforms like HighRadius offer end-to-end capabilities, many teams overpay for features they don’t use.

If you already have a strong ERP foundation, layering targeted automation — like UiPath for payment matching or PDF extraction — can be a smarter, lower-cost option.

Whichever path you choose, integration is critical. Your AR automation tool must sync seamlessly with your ERP and banking systems to avoid creating new silos and manual work. Prioritize strong API connectivity, real-time syncing, and enterprise-grade security features like encryption and access controls.

Look for collaboration features that let finance, sales, and customer success teams share dashboards and resolve issues faster. Also, involve your AR team early to ensure the AR solution fits day-to-day operations.

Platforms like UiPath that combine AI and RPA deliver intelligent data extraction, predictive insights, and adaptive processing, offering the scalability and adaptability needed to future-proof your AR process.

It’s also important to fully assess the extended functionality already available in your core platforms before layering new automation tools.

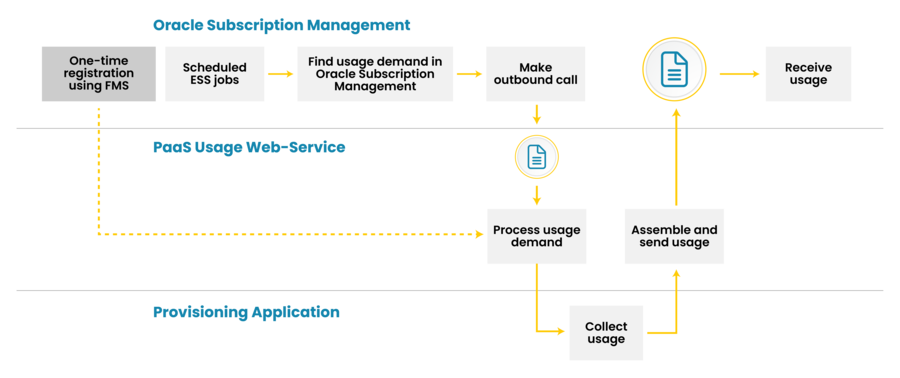

For example, Auxis is helping a transportation client modernize a highly manual billing process built on the Oracle ERP. The company’s invoicing process typically requires multiple spreadsheets and constant back-and-forth with operations to gather usage data and contract details.

Auxis is helping the client explore implementation of Oracle’s subscription management module to automate complex contract rules, usage-based billing, and monthly calculations. Here’s how the new process would work:

6. Regularly track performance metrics

Consistently tracking key AR metrics like DSO, aging buckets, dispute resolution time, collection effectiveness, and the frequency of manual intervention helps spot trends and issues early and refine workflows. Set clear baselines before implementing AI and automation, then evaluate progress monthly to catch gaps in performance.

If DSO remains high or disputes increase, it may be time to recalibrate workflows or automation logic. Redeploy AR resources to focus on reconciliations, verify customer contact details, and clear unapplied cash. Top AR tools can also flag outliers and send alerts when metrics drift, helping you stay ahead of problems before they escalate.

For organizations that outsource AR operations, partners like Auxis enhance this visibility even further by providing monthly performance reviews and connected Power BI dashboards developed at no additional cost, to track KPIs and SLAs in real time. This level of transparency helps CFOs improve accountability while reducing operational cost.

Why Auxis: Maximize the value of your AR automation journey

AR automation transforms finance into a true growth driver — accelerating cash flow, reducing DSO, and freeing teams for higher-value work. But many organizations lack the time or expertise to identify the best use cases and implement AR automation effectively.

Not surprisingly, a remarkable 81% of finance functions are adopting or planning to adopt AI as part of their outsourced accounts receivable services (Deloitte’s latest Global Outsourcing Survey). The reason is clear: achieving real results with AI and automation requires more than technology alone. By partnering with high-quality outsourcing providers, organizations gain access to the talent, tools, and process excellence needed to turn AI investments into lasting performance.

Now powered by Grant Thornton, the fifth-largest accounting and advisory firm worldwide, Auxis brings a century of finance expertise, proven AR best practices, and end-to-end AI and automation capabilities as a UiPath Partner of the Year and Agentic Automation Fast Track Partner. Named a top finance and accounting outsourcing company globally by leading research analysts like Everest Group and ISG, Auxis is consistently recognized for its world-class, tech-enabled nearshore delivery model that combines top-tier finance talent with process optimization and digital transformation — with the ability to expand globally as your business demands.

From assessment and strategy to implementation and nearshore support, Auxis helps clients avoid common pitfalls like tool overload, integration gaps, and lack of in-house skills, ensuring they achieve the full benefits of a modern AR organization.

Ready to transform your collections process with AR automation or outsourcing? Schedule a consultation with our accounts receivable team today, or visit our resource center for more AR tips, insights, and success stories.

Frequently Asked Questions

How does AR automation work?

What are the steps to automate accounts receivable?

How can I improve the Order-to-Cash process with automation?

How does Agentic AI transform accounts receivable?

What are the common challenges of implementing AR automation?