In brief

- Healthcare revenue cycle management trends for 2026 focus on modernizing operations, alleviating labor shortages, tightening cybersecurity, and improving patient experience.

- Artificial intelligence (AI) and automation in the revenue cycle could generate up to $360 billion in annual savings.

- The outsourced revenue cycle management market is projected to nearly double within four years, with 70% of hospitals and health systems planning to expand their RCM outsourcing engagements.

- Nearshore outsourcing is driving the biggest growth, as organizations look to Latin America for high-touch, time-sensitive, or judgment-intensive processes.

With rising operational costs, complex reimbursement models, and persistent workforce shortages, healthcare providers are under growing pressure to modernize their revenue cycle operations. In 2026, the revenue cycle management (RCM) industry is undergoing rapid transformation driven by AI-powered automation, rising cyberthreats, and a shift toward hybrid operating models that increase efficiency and lower costs.

These evolving trends in revenue cycle management are redefining how providers manage claims, reduce denials, and maintain financial health.

Among the most impactful shifts is the rise of RCM outsourcing, driven by nearshore models that offer real-time collaboration, faster turnaround, and scalable support for high-touch, time-sensitive, or judgment-heavy healthcare processes. But outsourcing is just one part of a much larger evolution.

In this article, we’ll unpack the top RCM trends shaping healthcare in 2026 and how forward-thinking providers are staying ahead of the curve.

4 key revenue cycle management industry trends in 2026

More than half of revenue cycle leaders said they expect their RCM operations to be less effective unless they make changes fast – citing rising denials and appeals volumes, claims processing inefficiencies, aging accounts receivable, and labor and skills shortages as the biggest barriers to improvement (Becker’s Healthcare and Savista 2025 RCM Benchmark Survey Report).

As the RCM market grows more complex, healthcare leaders are prioritizing transformation in 2026 through intelligent automation, strengthened cybersecurity, and strategic outsourcing.

1. AI and automation: Transforming revenue cycle management productivity

Healthcare organizations are integrating artificial intelligence (AI) and automation to streamline billing, reduce human errors, and improve revenue performance. Predictive analytics is being used to identify denial patterns and anticipate claim issues before they impact cash flow. Robotic Process Automation (RPA) is accelerating routine but time-draining tasks like eligibility verification, prior authorization, and payment posting, allowing revenue cycle staff to focus more on strategic and patient-facing work.

By taking over some of the more frustrating and tedious tasks, automation also can help alleviate the high turnover that plagues RCM organizations.

One of the most notable developments is the shift from Computer-Assisted Coding (CAC) to fully autonomous coding. GlobeNewswire in its 2025 Market Report found that over 30% of U.S. healthcare organizations are piloting or planning autonomous coding implementations, enabling end-to-end automation of coding workflows without human intervention.

The momentum doesn’t stop there. According to Deloitte, 92% of healthcare leaders believe Generative AI will significantly improve operational efficiency, with 65% expecting faster decision-making from using it.

Forward-looking organizations are also leveraging Agentic AI, powering intelligent systems that can autonomously execute tasks, learn from feedback, and adapt workflows with human oversight. In a 2025 Salesforce survey, U.S. healthcare workers estimated that AI agents could reduce administrative burdens by up to 30%, with many reporting they would regain the equivalent of one full day per week if routine tasks were handled by intelligent agents.

The National Bureau of Economic Research reports that broad AI adoption in healthcare could deliver up to $360 billion in annual savings by reducing waste, streamlining workflows, and enhancing decision-making.

One in three hospitals report bad debt levels exceeding $10 million, a clear sign that payment collection issues are creating serious revenue leakage across the industry.

2025 Definitive Healthcare report

Automating manual processes improves accuracy and speed, with investments in automation and AI ranking as the biggest RCM priority in 2026, including payer analytics, coding support, and agentic tools for benefits, eligibility, and prior authorization, according to Medical Group Management Association research.

Read our case study to learn how RCM automation led to a 20% reduction in cycle times and better patient experiences for a leading medical device company.

2. Proactive cybersecurity: A rising priority in revenue cycle management

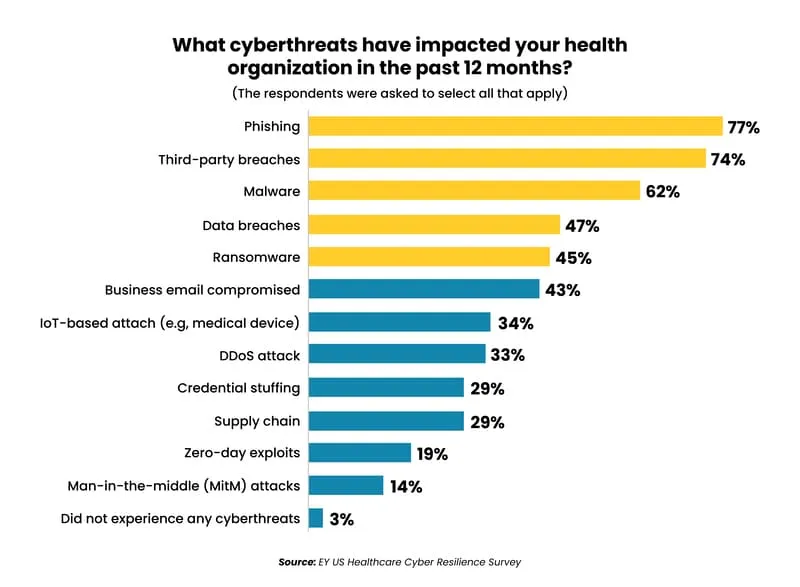

With vast volumes of financial and sensitive patient data flowing through their systems, healthcare organizations remain top targets for cyberattacks. A staggering 93% of healthcare organizations experienced a cyberattack over the past 12 months, with 3 in 4 suffering patient care disruption and 96% experiencing at least two data loss or exfiltration incidents involving sensitive patient data, the 2025 Ponemon Healthcare Cybersecurity Report found.

Third-party risk is especially a growing concern, with 74% of healthcare breaches now caused by vendor vulnerabilities (EY US Healthcare Cyber Resilience Survey).

While regulatory frameworks like the Health Insurance Portability and Accountability Act (HIPAA) and Payment Card Industry Data Security Standard (PCI DSS) remain foundational, compliance alone is no longer sufficient. The increasing scale and sophistication of cyberthreats require providers to adopt more proactive cybersecurity strategies.

Strengthening cybersecurity investments is a top priority in 2026, with leading RCM organizations investing in tactics including data encryption, multi-factor authentication, third-party risk management, personnel training, and continuous security audits to prevent breaches before they occur.

Today’s healthcare leaders are implementing advanced security protocols that not only ensure compliance, but actively protect financial operations and patient trust. By embedding cybersecurity into every layer of the revenue cycle management process, providers can mitigate risk, prevent costly disruptions, and build a more resilient RCM infrastructure.

3. Focus on efficiency: Improving RCM costs, speed, and experience

According to Deloitte’s 2025 Global Healthcare Outlook, 70% of healthcare executives cite improving operational efficiency as their top priority as inflation, reimbursement challenges, and administrative costs continue to rise. Most hospitals are operating on razor-thin margins — averaging just 1% in 2025 (Chief Healthcare Executive 2025 report) — while labor accounts for 56% of hospital spending, making it the largest cost driver and a major barrier to margin recovery (AHA The Cost of Caring 2025).

Cumbersome workflows, disjointed systems, and high turnover are contributing to rising denials, slower reimbursements, and declining patient satisfaction. To address these revenue cycle challenges, forward-thinking hospitals are embracing revenue cycle strategies such as optimized AR billing processes that simplify operations, accelerate collections, and ease administrative burden.

One key example is patient-centric billing, which prioritizes transparency, convenience, and proactive engagement in line with the No Surprises Act. By implementing tools that enable real-time access to billing details, payment scheduling details, personalized payment plans, and flexible payment options, providers can simplify the payment experience, minimize disputes, and accelerate cash flow with fewer administrative touchpoints.

Providers are also investing in AI-driven data analytics, eligibility automation, and centralized support models to consolidate RCM operations and cut costs. The goal is to build a leaner, faster, and more resilient revenue cycle that can adapt to today’s evolving healthcare demands.

4. RCM outsourcing: A strategic response to labor shortages and cost pressures

The ongoing labor shortage in healthcare affects revenue collection. A recent American Academy of Professional Coders (AAPC) report found that 63% of healthcare providers report staffing gaps in their RCM departments, leading to increased errors, slower collections, and compliance risks.

To stay financially viable, more organizations are turning to tech-enabled outsourcing as an essential strategy.

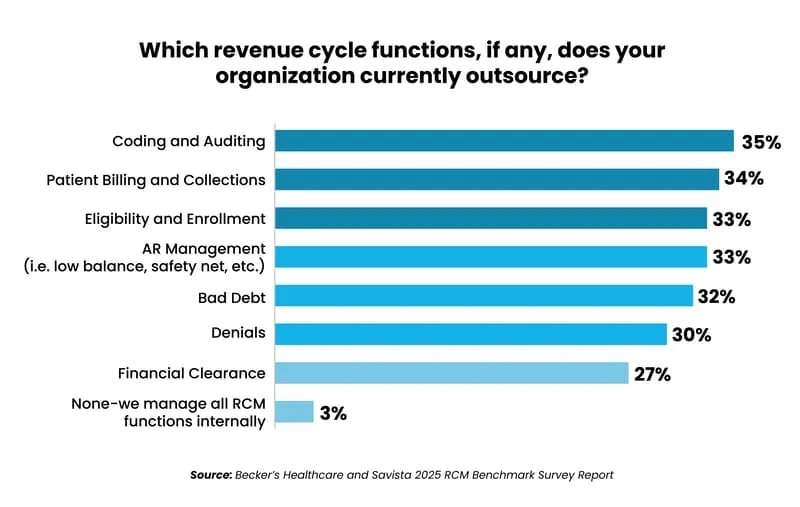

97% of healthcare organizations now outsource at least one RCM function to a third-party provider. And 70% said they plan to expand RCM outsourcing in the coming year.

Becker’s Healthcare and Savista 2025 RCM Benchmark Survey Report

Rising operational costs are also fueling this shift. Becker’s found that healthcare providers are engaging with outsourcing service providers more strategically than they have in the past – looking beyond transactional processing to prioritize partners with the business expertise to optimize RCM strategy, streamline operations, and accelerate AI and automation without heavy upfront costs.

Outsourcing non-core functions like RCM further free healthcare providers to better focus on patient care, while leveraging providers’ expertise to navigate increasingly complex regulations.

The healthcare RCM outsourcing market surpassed $34 billion in 2025 and is expected to nearly double to $67 billion within four years, per Research and Markets – reflecting the growing demand for outsourcing partners that can deliver speed, accuracy, and compliance at scale.

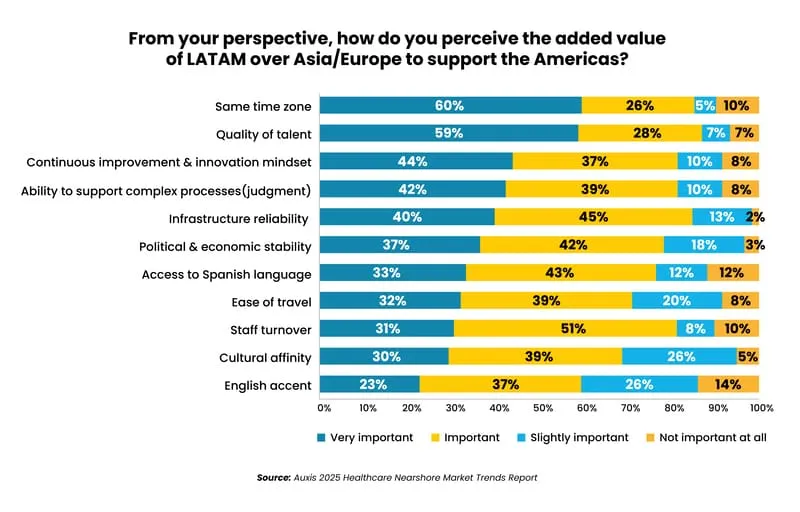

But while offshore operations in Asia represented nearly 60% of healthcare business process outsourcing market revenue in 2024, the market is shifting – with nearshore delivery expected to register the highest 15% CAGR through 2030, according to Mordor Intelligence’s 2025 Healthcare BPO market report.

Nearshore outsourcing is becoming a preferred solution for North American healthcare organizations —offering the real-time collaboration, cultural affinity, high-level talent, and deep U.S. healthcare fluency needed to successfully perform judgment-intensive, high-touch, and time-sensitive RCM processes that have been challenging to deliver in traditional offshore models.

Outsourcing accelerates RCM modernization by freeing up capital due to labor savings that organizations can reinvest into AI, analytics, and automation. In nearshore models, clients typically achieve 30-50% labor cost savings — plus an additional 15-30% efficiency gains from standardized workflows, automation, and scale — allowing many organizations to partially or fully self-fund their digital RCM transformation.

Read our case study to discover how one of the largest health systems in the U.S. turned to nearshore outsourcing to perform complex RCM activities it could not successfully deliver at its Asia operations.

Why Auxis: The nearshore leader in tech-enabled revenue cycle management

As revenue cycle management becomes more complex, modernizing revenue cycle management is no longer optional — it’s a strategic imperative for financial sustainability and patient trust. For many healthcare leaders, RCM outsourcing has become a strategic imperative to strengthen cybersecurity, accelerate technology adoption, scale efficiently, and maintain financial performance.

But not all outsourcing partners deliver the same results. At Auxis, now part of Grant Thornton, we combine decades of healthcare expertise, award-winning RCM AI and automation capabilities, and a proven revenue cycle outsourcing model in Latin America to drive measurable impact: faster collections, lower costs, and stronger compliance.

Our nearshore model further combines with Grant Thornton’s global footprint across Asia, Europe, and the Middle East — enabling you to combine the agility and collaboration of Latin America with the scale and cost efficiencies of the top offshore locations to maximize benefits.

Whether your priority is optimizing operations, tightening cybersecurity, or freeing up internal bandwidth, Auxis helps healthcare RCM leaders stay ahead of industry demands without losing focus on what matters most: your patients.

Want to learn more about RCM outsourcing or automation? Schedule a consultation with our revenue cycle experts, or visit our resource center to explore the latest RCM insights, strategies, and success stories.

Frequently Asked Questions

Why are hospitals and health systems outsourcing more revenue cycle management functions?

What are the biggest trends in revenue cycle management outsourcing for 2026?

What revenue cycle management services are most commonly outsourced?

What is nearshore RCM outsourcing?

Why is nearshore RCM outsourcing growing faster than offshore models?